Imperial Brands

This page was last edited on at

Imperial Brands (previously known as Imperial Tobacco, and often referred to simply as Imperial) is a transnational tobacco company (TTC), headquartered in Bristol, United Kingdom (UK).

Background

The Imperial Tobacco Company was formed in 1901, when a consortium of British tobacco manufacturers – the Wills, Player and Lambert and Butler companies – came together to resist an attempt by James Buchanan Duke of the American Tobacco Company to dominate the British market.12 It has produced several products other than tobacco, including beer, prepared foods and packaging.2 In 2016 it changed its name from Imperial Tobacco to Imperial Brands, which in the company’s own words reflects its “expansion into potentially less harmful alternatives to traditional tobacco products.”1

The company has no relationship to Imperial Tobacco Canada, which is a subsidiary of British American Tobacco (BAT).

Major Divisions & Subsidiaries

Imperial Brands has many subsidiaries and its internal structure is complex.3 Some of its major subsidiaries include:

- The tobacco companies Imperial Tobacco Limited (UK), ITG Brands LLC (US), Altadis S.A.U. (Spain), Reemtsma Cigarettenfabriken GmbH (Germany) and Imperial Tobacco Australia Limited.4

- Logista, a Spain-listed “distributor of tobacco and other convenience products”, which also provides “freight, parcel and pharmaceutical logistics”.4

- Fontem Ventures, a Netherlands-listed company focused on “developing innovative vape-based Next Generation Products”.5

- Nerudia Limited, a research facility based in Liverpool, UK, focused on the development of e-vapour products.4

In 2020, Imperial Brands sold its cigar business Worldwide Premium Cigar (including Tabacalera and Premium Cigar RoW) to reduce the company’s growing debt.6

Imperial’s corporate structure is illustrated in the appendix to this report.

- For details of Imperial holding companies and subsidiaries see the Imperial Brands section of the Tobacco Supply Chain database.

Products

The page Tobacco Industry Product Terminology lists product types and the terms used on Tobacco Tactics.

Conventional tobacco products

Imperial’s main cigarette brands include John Player Special (JPS), Davidoff, Gauloises, West, Winston, Kool, Lambert & Butler (L&B), Fortuna, Nobel and News.7

It also manufactures the roll-your-own (RYO) tobacco Golden Virginia and Champion and the Rizla cigarette papers and filters, as well as skruf, a brand of Swedish-style snus.7

More information can be found on the Imperial Brands corporate website (see link at end of this article).

Production and key markets

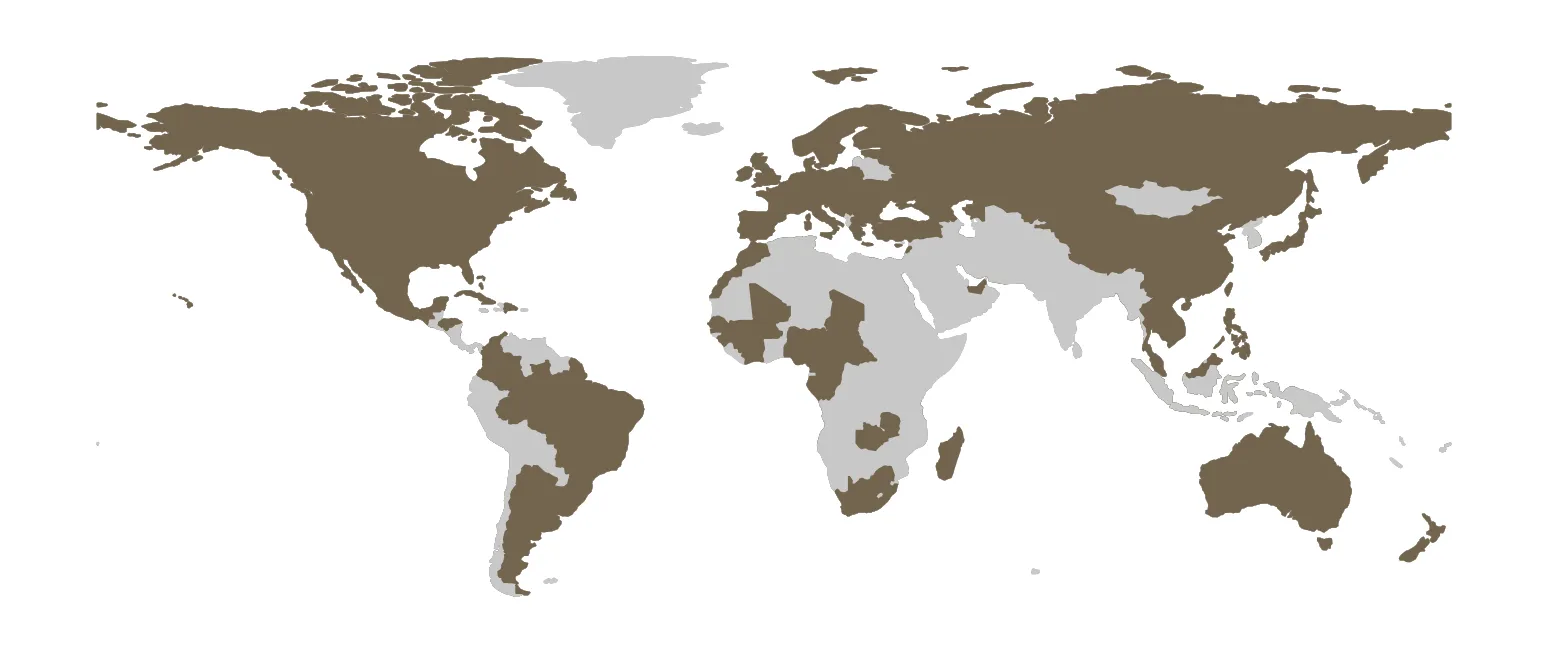

The map below (Figure 1) shows the countries in which Imperial operates. The Tobacco Supply Chain database shows that Imperial is directly involved in tobacco leaf agriculture and processing in eight countries, manufactures its products in 30 countries, and has distribution operations in 53 countries.

Figure 1: Map showing the global subsidiaries of Imperial Brands. Source: Tobacco Control Research Group, University of Bath

According to Euromonitor International, in 2023 Imperial had a share of around 6% of the global cigarette market outside China (by retail volume, figure rounded).8

Asia Pacific is by far the largest regional market for cigarettes, making up over one third of the total global market excluding China (regions as defined by Euromonitor). Imperial has a market share of around 10% in this region. However, the vast size of this market means that it accounts for 36% of all Imperial’s cigarette sales. At around 33%, Imperial’s largest market share is in Western Europe; however, this region only represents 16% of total sales.8

Research published in 2023 showed that in 2020 Imperial Brands had the highest cigarette market share in six of the markets in which it operated (out of 90 for which data was available).9

For more information on the global and regional market shares of the ‘Big 4’ transnational companies, see Tobacco Companies.

See the Tobacco Supply Chain database for country specific information.

Newer nicotine and tobacco products

As the harms from smoking conventional products have become better understood, and tobacco control measures have been put in place, the cigarette market – from which tobacco companies make most of their profits – has started to shrink. To secure the industry’s longer-term future, TTCs have invested in, developed and marketed newer nicotine and tobacco products.10

Imperial’s newer nicotine and tobacco brands include:7

- Blu e-cigarettes

- Pulze heated tobacco products

- Zone X and skruf nicotine pouches

In its corporate materials, Imperial refers to these products as ‘next generation products‘ or NGPs.7

- For an overview, see Newer Nicotine & Tobacco Products: Imperial Brands

Market Strategy

Focus on conventional products

The vast majority of Imperial’s net revenue – around 97% in 2023 – comes from the sale of cigarettes and other conventional combustible tobacco products.11

In 2021, Imperial announced a new five-year strategy, a year after appointing Stefan Bomhard as CEO. The first of the three “pillars” of this strategy is a “Focus on priority combustible markets”.12 In a presentation to investors, Bomhard stated that Imperial’s combustibles business would “be the biggest contributor to value creation over the next five years.”13

The second pillar is “Driving value from our broader market portfolio”. In 2022-23 Imperial created a new “AAACE region” to include Africa, Asia, Australasia and Central & Eastern Europe, and highlighted the potential for future growth in these markets.4 In its 2023 annual report it stated that Africa has “the potential to make a significant contribution” to its overall success.4

Imperial’s third strategic pillar is to “Build a targeted NGP business”,14 concentrating on markets where newer nicotine products are already “a big proportion of overall nicotine consumption” and where it has “strong existing routes to market.”15 Even so, in Europe, where Imperial has focused its investment in newer products, they still accounted for just 7% of its overall net revenue in 2022.4

Imperial’s five “priority markets” are the US, Germany, Australia, Spain and the UK. As of 2023, these accounted for around 70% of Imperial’s operating profit in cigarettes and other conventional tobacco products,4 with the US and Germany accounting for around half.16 In 2023, Imperial stated that declines in market share in the UK and Germany had been offset by increases in its other three priority markets.417

Africa accounts for 8% Imperial’s operating profit, while Central and Eastern Europe account for 4%.16

In 2022, Imperial withdrew from both Japan and Russia. It stated that its Japanese business “remained small and unprofitable” even after a decade of investment.4 It sold its Russian operations to local investors in April 2022 following the Russian invasion of Ukraine.418 This also resulted in the company closing its operations in several Central Asian markets which depended on its Russian supply chain.4

Imperial had by far the smallest market share in Russia of the Big 4 – and so had less to lose than some of its competitors who have remained in the country.1920 Imperial acknowledged the “limited profit contribution” of the Russian and Ukrainian markets.21

Share buybacks

A key goal remains delivering financial returns to shareholders, including via share buybacks.22 In 2022, Imperial announced the start of a share buyback programme, in line with its “five-year strategy to deliver sustainable growth and enhanced shareholder returns.”23 The first GB£1 billion buyback was completed in September 2023. The following month, Imperial announced its intention to repurchase another GB£1.1 billion in shares by the end of September 2024.24 The buybacks reflect operating profit growth, driven by tobacco prices high enough to offset falling sales.25

- Imperial Brands’ annual reports, presentations and information for investors can be found on its corporate website (link at end of this article).

TACTICS TO UNDERMINE TOBACCO CONTROL

Tobacco industry interference is widely understood to be the greatest barrier to progress in reducing the deadly health impact of tobacco.26 Article 5.3 of the World Health Organization Framework Convention on Tobacco Control (WHO FCTC) obliges countries to protect their health policies from the “commercial and other vested interests of the tobacco industry”.27

TCRG has identified a range of tactics used by tobacco companies to interfere with and undermine tobacco control, in order to further their commercial goals.2829

Undermining national or international laws

Imperial has been accused of violating tobacco control laws in multiple countries.

Circumvention of EU menthol ban with new products

The 2014 EU Tobacco Products Directive Revision, passed into UK law in 2016, banned the sale of menthol cigarettes and rolling tobacco.30 Though a four year “phase-out” period was granted following industry lobbying, the regulation came into force in May 2020, and included a ban on “characterising” flavour in tobacco and all components, including filters, capsules, packaging and rolling papers.3132

Imperial has launched several products designed to circumvent the ban, including rebranded JPS Green cigarettes;33 new variants of Lambert & Butler, JPS Players and Embassy cigarettes, with filters designed to deliver “a cooling sensation during smoking”;343536 and a new Rizla flavoured insert to be put into a packet of cigarettes or rolling tobacco, which Imperial argued was an “accessory” and therefore exempt from the menthol ban and other regulations such as the display ban.3738

- For more information see: Menthol Cigarettes: Industry Interference in the EU and UK.

Provision of smoking shelters at UK airports

To make it easier for people to smoke whilst travelling, yet be seen to comply with smoking bans, Imperial Tobacco launched its Smoking Allowed campaign in 2011, which provided smoking shelters at UK airports.3940

Legal threats and actions

Imperial Tobacco has filed legal challenges against tobacco control regulations in the UK, EU, US and Australia, including:

- 2020: Tobacco Products; Required Warnings for Cigarette Packages and Advertisements (US). Imperial’s legal challenges have helped to delay implementation of graphic health warnings (GHWs) on tobacco products in the United States.41

- 2014: EU Tobacco Products Directive (TPD). Imperial Tobacco formally supported a legal challenge brought by Philip Morris International (PMI) and British American Tobacco (BAT) to invalidate the TPD. For more information see TPD: Legal Challenges.

- 2010: Tobacco and Primary Medical Services (Scotland) ACT. Imperial’s legal challenge delayed the introduction of the retail display ban by two years.4243

See the case study below on legal tactics used against plain packaging in Australia and the UK.

The website Tobacco Control Laws publishes detailed and up to date information about regulation at country level.44

For countries that are parties to the WHO FCTC, progress is detailed in the Implementation Database for the WHO FCTC.

Intimidation

In addition to threatening legal action, tobacco companies often threaten to close down operations – with resulting job losses – in order to exert pressure on policy makers, particularly in LMICs.2829 These threats are often in reaction to proposed tobacco control regulations, such as plain packaging and increases in tobacco taxes.

In 2016, Imperial wrote to the Minister of Health in Burkina Faso, warning the government against the introduction of plain packaging and large graphic health warnings. The letter stated:

“If these measures are brought into effect, the economic and social impact will be extremely negative. They could even threaten the continuation of our factory which has operated in Bobo Dioulasso for more than fifty years with more than 210 salaried employees.”45

However, companies frequently move operations and close factories for business reasons. In 2014, for example, Imperial closed factories in Nottingham, UK and Nantes, France, and shifted production to Poland and Germany, with the aim of saving GB£300 million in costs.46

See also TCRG research on this topic.47

Lobbying and influencing policy

Endgame policies in New Zealand and the UK

In 2021, the New Zealand Ministry of Health ran a consultation on its “Smokefree Aotearoa 2025 Action Plan”, a set of measures designed to reduce smoking prevalence to under 5%.48 Such measures are sometimes referred to as ‘endgame’ policies, in that they involve going beyond tobacco control, towards a goal of eliminating tobacco use entirely.49

In its submission to the consultation, Imperial outlined its opposition to all the principal endgame policies. One such measure was the ‘smokefree generation’ policy, which would have introduced an annually rising smoking age, ensuring that tobacco products could not be legally sold to anyone born on or after 1 January 2009.50 In its response, Imperial Brands Australasia wrote the following:

“We support sensible, evidence-based regulation of tobacco products. The proposal to introduce a smokefree generation is neither of these things. It represents an ideological objective to restrict the free choice of New Zealanders that is unnecessary, impractical and potentially even counterproductive.”51

In the UK, following the announcement of plans to introduce a similar smokefree generation policy in October 2023, lobbyists representing Imperial reportedly engaged MPs from the All-Party Parliamentary Group for Smoking and Health.52 Like in New Zealand, the UK government opened a consultation on the new legislation, to which Imperial submitted a highly critical response.53

- For more information, see Tobacco Industry Interference with Endgame Policies.

EU Tobacco Products Directive

In the financial year 2014-2015, when the EU Tobacco Products Directive (TPD) was undergoing its first revision, Imperial Tobacco reportedly spent EU€400,000 – €499,000 lobbying EU institutions, employing five full-time equivalent staff in its Brussels office.54 Imperial Tobacco met with the European Commission’s Health Directorate, DG SANCO, and Health Commissioner John Dalli,55 as well as five Conservative UK MEPs.565758 For more on the controversies that lead to the resignation of then commissioner Dalli, see TPD: Dalligate.

Imperial Tobacco also lobbied other directorates on the TPD. In 2011, the PR firm Bell Pottinger tried to broker access to officials in DG Trade and the Secretariat General on its behalf.

In 2012, Imperial Tobacco attended meetings with DG ENTR (Enterprise and Industry) as part of a delegation with Tobacco Europe (known as CECCM at the time),5960 and directly with DG Trade.61 With the exception of DG SANCO, EU officials were not systematically transparent about their contact with Imperial Tobacco and other tobacco companies at the time of the 2014 EU TPD Review.62 Some meetings only became public knowledge due to freedom of information (FOI) requests.

Similar concerns have re-emerged in light of the third revision of the TPD, with tobacco control advocates raising concerns about tobacco industry access to EU institutions.

Documents released by the UK Department of Health revealed that Imperial Tobacco had access to confidential information from the European Council concerning the 2014 TPD review.63 Despite being asked to explain how it obtained this confidential information, Imperial refused to disclose its source. For more information, see Imperial Receives Inside Information from the European Council.

- For more information see EU Tobacco Products Directive Revision.

Hospitality for politicians

One common tobacco industry tactic is to provide gifts to those who might influence the regulation with which it has to comply.28 Members of both Houses of Parliament in the UK continue to accept tobacco industry hospitality, in contravention of the WHO FCTC. In recent years, Imperial has provided tickets to the tennis at Wimbledon for several MPs and Lords. For more information, see Tobacco Industry Hospitality for UK Politicians.

Political donations

Tobacco companies also make donations to political parties and campaigns.28 Between 2016 and 2024, the political action committee (PAC) of Imperial’s US subsidiary donated nearly US$400,000 to federal candidates from both the Democratic and Republican parties. These include candidates to both the House of Representatives and the Senate.64

Claiming a public health role

Like all three of its main competitors – PMI, BAT and Japan Tobacco International (JTI) – Imperial has attempted to claim a public health role, based largely on its development of newer nicotine and tobacco products. As Imperial Brands Science states on its website:

“As a responsible business, Imperial Brands is committed to making a meaningful contribution to the public health concept of tobacco harm reduction (THR) to address consumer needs and contribute to positive health outcomes.

We therefore offer consumers a broad portfolio of innovative, satisfying and potentially harm reduced Next Generation Products (NGP), manufactured to a high quality and in accordance with recognised safety standards.”65

However, conventional tobacco products remain fundamental to Imperial’s business model. The five-year plan launched in 2021 renewed the company’s focus on cigarettes and limited its investment in newer products to countries where a market for such products already existed (see above section Market Strategy).

- See harm reduction for details of how tobacco companies use this concept as a tactic to further their commercial goals.

CSR relating to health

In 2020, during the COVID-19 pandemic, tobacco companies made extensive use of corporate social responsibility (CSR) campaigns, as a strategy to gain legitimacy, increase public trust and advance their business interests. Imperial Brands was no exception, providing COVID-19 relief in Ukraine and Germany.66

Imperial also contributed US$136,000 to a programme led by the tobacco leaf merchant Universal Leaf in the Philippines, which provided kits with “materials for music, reading, writing, drawing, and sport” to children during the pandemic.4

- For more on tobacco industry activity during the pandemic, see the COVID-19 Tobacco Tactics page and the COVID-19 monitoring database.

Support through allies

Like other TTCs, Imperial has long used the third party technique to achieve its goals.

Front groups

Imperial has a history of using front groups to oppose tobacco control legislation:

- It is a member of the International Tobacco Growers Association (ITGA) and the Eliminating Child Labour in Tobacco-Growing Foundation (ECLT, see “Exploitative practices” below).

- It financed the Alliance of Australian Retailers, along with PMI and BAT, to oppose plain packaging regulation in Australia (see case study below for details).

- In 2013, to promote the tobacco industry’s tracking and tracing system, Codentify, Imperial Tobacco, BAT, PMI and JTI jointly set up the Digital Coding & Tracking Association (DCTA), which often failed to disclose its relationship to the tobacco industry in its statements.

Think tanks and lobby groups

Imperial has supported various UK and International think tanks, although its financial contribution is not always clear:

- In response to a query made in 2014 with regard to Imperial’s engagement with the Institute of Economic Affairs (IEA), a UK free market think tank with a history of collaboration with the tobacco industry, Imperial’s Head of Regulatory Science replied: “We have been supporters of the IEA for many years, stretching back well over a decade”.67

- Imperial has also been a donor to the Adam Smith Institute (ASI), another UK free market think tank which has repeatedly opposed tobacco control regulations. In 2013 an Imperial spokesman defended the company’s donations to both the IEA and the ASI: “We believe the contributions of organisations like the ASI and the IEA are very valuable in an open and free society. We respect their work and share their views on many issues.”68

- Imperial also funded the International Tax and Investment Center (ITIC), “an independent, nonprofit research and education organization” based in the US.69 ITIC has advised high-level government officials worldwide on tobacco taxation. However, following criticism from the WHO and civil society organisations, ITIC cut ties with the tobacco industry in 2017.70

- It also has historical links with the Democracy Institute, a think tank based in the UK and US. In 2006 the company funded a book published by the Democracy Institute, which argued there was no evidence that graphic health warnings on tobacco, food, and alcohol packaging would work.71 For more information see Countering Industry Arguments Against Plain Packaging: No Evidence Plain Packaging Will Work.

In May 2012, the Tobacco Control Research Group (TCRG) at the University of Bath asked Imperial Tobacco to disclose which think tanks the company was funding or had funded over the previous few years. The company replied that it did “not wish to participate in your research”.72

See the lists of front groups, think tanks, lobby groups and other organisations linked to Imperial in the Affiliations section below.

See also the list and map of tobacco industry allies on the STOP website.

Astroturfing

The term ‘‘astroturfing’ refers to the faking of a grassroots movement in order to influence public opinion. Typically, a third-party runs a campaign on behalf of a tobacco company while hiding industry involvement and funding. This is a well-known tactic used to interfere with tobacco control legislation.28

In August 2023, Imperial, along with BAT New Zealand, supported an apparently grassroots initiative led by convenience store owners called “Save Our Stores”. This campaign claimed that the new tobacco control measures proposed in the Smokefree Aotearoa 2025 plan would force small businesses to close.73 The campaign website included the claim that more than 6,000 shops in New Zealand relied on tobacco sales for up to 55% of their revenue – a figure based on a survey carried out by Imperial.74 For more information see Tobacco Industry Interference with Endgame Policies.

A similar campaign called “Save Our Shops” was run in the UK in 2008 against the ban on displaying tobacco products in retail outlets. It was led by the Tobacco Retailers’ Alliance, an offshoot of the Tobacco Manufacturers’ Association, of which Imperial is a member.75

In February 2019, Imperial made use of the European Commission’s “Citizens’ Initiative”, funding a campaign called “Let’s demand smarter vaping regulation!”.7677 One of the campaign organisers was Imperial’s head of EU corporate affairs and a registered lobbyist, while others were representatives of e-cigarette trade associations of which Imperial was a member.76 Yet it was portrayed as a “grassroots” campaign.78 For more information see E-cigarettes: Imperial Brands.

Case study: plain packaging

The introduction of plain packaging legislation in Australia and the UK provides several examples of Imperial using a range of tactics to oppose the policy and protect its commercial interests.

Legal threats and actions

In 2009, Imperial threatened the UK government with legal action over an amendment to the health bill aiming at banning branded cigarette packets. For details see Plain Packaging in the UK.

In 2011, Imperial challenged Australia’s plain packaging legislation in the High Court, arguing that it would only benefit criminals and have negative impacts on revenue for both retailers and government. For details see Australia: Challenging Legislation.

Lobbying and influencing policy

In June 2012, Imperial Tobacco attempted to influence UK Members of Parliaments’ (MPs) views on the plain packaging debate by running an anti-plain packaging advertising campaign in The House, a magazine delivered directly to MPs, peers and civil servants.79 The company did not reveal itself as the funder anywhere on the front-page advertisement. For more information on Imperial Tobacco’s advertorial, and the debate it sparked, see Imperial Tobacco Promotes Opposition to Plain Packaging.

Front groups and astroturfing

In 2010, Imperial Tobacco Australia (in collaboration with PMI and BAT) financed the Alliance of Australian Retailers (AAR) to oppose the introduction of plain packaging.80 The AAR claimed to represent the owners of local corner stores, milk bars, newsagents and service stations, but did not reveal that it was financed by tobacco companies and run by tobacco company executives and a PR company.81 The purpose of the AAR was to argue that plain packaging would cause economic damage to small Australian retailers. For more information on this front group, and Imperial Tobacco Australia’s involvement, visit the Alliance of Australian Retailers page.

Undermining legislation

In September 2012, a few months before plain packaging legislation was introduced in Australia, Imperial Tobacco Australia changed the packaging of its Peter Stuyvesant cigarette pack to show a ripped pack exposing plain packaging underneath. The accompanying slogan said “it’s what’s on the inside that counts”.8283 The Australian Health Minister criticised Imperial’s marketing campaign, saying that “diseased lungs, hearts, and arteries are the reality of what is happening on the inside to a smoker”.82 For more detail on Imperial’s “it’s what’s on the inside that counts” campaign, go to Plain Packaging: Imperial Tobacco Australia Pre-empts Legislation.

Discrediting science and scientists

As part of their legal challenges against plain packaging legislation in the UK, tobacco companies including Imperial attempted to dismiss the evidence of researchers advising the government as unreliable because they were members of the public health community. Ultimately, this argument was dismissed by the high court.84

- For more information on tobacco industry opposition to plain packaging, see the following pages:

Controversial marketing

Targeting youth

In its response to the UK government consultation on creating a smokefree generation and tackling youth vaping, Imperial stated:

“Without exception, IMB supports legislation – and enforcement of that legislation – preventing sales to minors. Our International Marketing Standard is unequivocal and prohibits the sales of tobacco products to those under 18 years of age in the UK.”53

However, Imperial has been accused of targeting youth in its marketing activities around the world.85

Imperial Brands has also used social media – with its mostly young audience – to market cigarettes. For example, a campaign launched to promote Davidoff in Bosnia, Malaysia and Egypt is reported to have been viewed more than 24 million times.8687

- For more on this topic see Tobacco Industry Targeting Young People.

Targeting women and girls

Women smoke less than men globally, although the gap is narrowing.88 They remain a key demographic for tobacco companies, who have identified packaging and brand design as important ways to appeal to women. TTCs have therefore launched brands specifically aimed at women, often using the terms “light” or “slim”, reinforcing an association of smoking with beauty, glamour and weight loss.89

In 2011, Imperial launched a new Richmond product in the UK called SuperSlims, promoted as “the first superslim brand in the value-price cigarette sector”.90 At the time, The Grocer retail magazine reported that the pack was embossed with a “stylish pink design”, and that it was “clearly designed to appeal to female smokers”.90 Tobacco companies use similar tactics to target women and girls in low and middle-income countries.919293

- For more information on tobacco industry marketing to female consumers, see Targeting Women and Girls.

Targeting minority groups

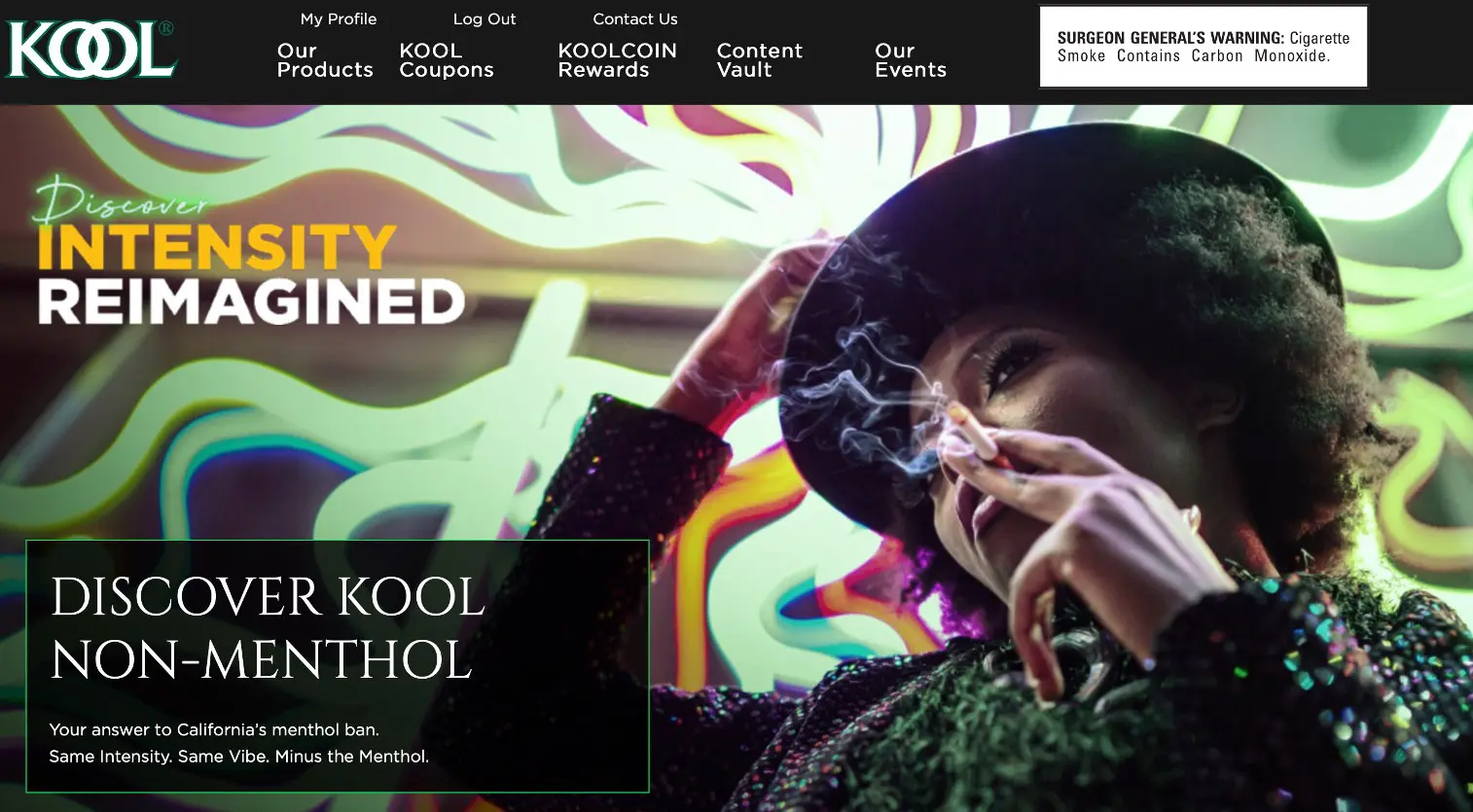

Imperial’s US subsidiary ITG Brands was formed in 2015 when Imperial acquired the cigarette brands Winston, Salem, Kool and Maverick, as well as the blu e-cigarette brand. Kool, a brand of menthol cigarettes, has long been targeted at Black people in the US. Studies from the US have shown that 80% of Black people who smoke prefer menthol cigarettes, and Kool was the only significant menthol brand in the US for over two decades.9495

ITG has stated that it “does not target any individual demographic group as part of its marketing and advertising practices”.96 However, as the corporate website of its parent company states:

“It [Kool] maintained a dominant position in the [menthol] category throughout much of the 20th Century and was synonymous with the US jazz scene of the 1970s and 80s. Even today, Kool is particularly popular among the menthol smokers of Louisiana, the birthplace of jazz.

By building on this unrivalled heritage, we’re working hard to unlock Kool’s full potential and to restore its market position.”7

Recent Kool marketing for its ‘non-menthol’ variant, sold to consumers as “Your answer to California’s menthol ban”, also suggests that Imperial continues to target African Americans.97

Image: ITG marketing for Kool non-menthol variant. Source: Stanford University Research into the Impact of Tobacco Advertising, 2024.

These non-menthol variants in the US, which contain a chemical additive with a similar cooling effect to menthol, also recall tactics used by Imperial to circumvent the menthol ban in the UK and EU.9899

- For more information see the page on Flavoured and Menthol Tobacco in the US and the long read on Racism and the Tobacco Industry.

Corporate social responsibility

In the 2023 financial year, Imperial funded CSR projects in 11 countries, across areas such as childcare, education, water, sanitation and hygiene.4

Environment & greenwashing

CSR activities relating to the environment are a way for companies to greenwash their reputations.

Some of Imperial’s CSR programmes in LMICs are centred around farming. In Malawi, for example, it has run initiatives on alternative crops to tobacco,100 soil erosion,101 forestry,102 water stewardship103 and solar boreholes.104

Other CSR activities relate to the waste that the industry creates. In 2011, Imperial Tobacco co-founded the Love Where You Live campaign in the UK, on which it partnered with the Department of Environment, Food and Rural Affairs (DEFRA).105

- For more information see CSR Strategy and Greenwashing.

Awards

In its 2023 Annual Report, Imperial stated that it had been recognised as a “Climate Leader” by the Financial Times for the third successive year. Similarly, it received an A rating from the Carbon Disclosure Project (CDP) for a fourth successive year.4

However, these schemes are voluntary, and there is no globally agreed protocol for assessing companies’ performance on Environmental, Social and Governance (ESG) issues. Companies may therefore cherry pick the schemes likely to provide them with a positive rating. For example, when Imperial received a poor rating from CDP Forests in 2017, it simply opted out.106

- For more information see Tobacco and the Environment and the long read Unsustainable: Big Tobacco’s use of the UN SDGs.

Exploitative practices

Despite being a member and funder of the Eliminating Child Labour in Tobacco-Growing Foundation (ECLT) since 2001, alongside the other TTCs and major leaf merchants,107108 Imperial has been accused of complicity in child labour and the exploitation of farmers in its supply chain.

In 2020, a legal case was brought against Imperial and BAT by over 7,000 Malawian farmers – including over 3,000 children – who were represented by the UK legal firm Leigh Day.109

The farmers allege that Imperial and BAT “facilitate unlawful and dangerous conditions, in which they, having been trafficked from their villages, have to build their own homes, live on a daily small portion of maize, work 6am to midnight seven days a week, and have to borrow money to be able to feed their families throughout the season.”109 They also allege that the tobacco companies “know, or ought to know, that the conditions they are faced with leave them no choice but to rely on their children to work as child labourers in extremely hazardous conditions”.109

Imperial and BAT attempted to have the case dismissed, but this was rejected by the UK High Court in June 2021.109110111 Though Imperial and BAT had stated that they could trace the tobacco to the farms where it was grown, in fact those records were only held by the leaf-buying companies which supplied the two TTCs.110

The case is ongoing. Both companies deny the allegations.

- For more information see Tobacco Farming and watch the Tobacco Slave film.

Influencing science

Tobacco companies have a long history of attempting to influence science, in order to cast doubt on evidence demonstrating the harmful effects of their products and to argue against regulation.112 This has encompassed both funding their own science, as well as attacking research which is perceived as damaging to tobacco industry interests.

Discrediting science and scientists

In 2011, Imperial Tobacco strongly criticised a study commissioned by the UK Department of Health,113 which concluded that England’s 2007 smoking ban had had positive benefits for public health. The study also concluded that the legislation had had no obvious negative impacts on the hospitality industry, contrary to claims made by the tobacco industry.114

Imperial Tobacco criticised the three-year review as being “lazy and deliberately selective”, and accused the study’s author, Professor Linda Bauld, of having a conflict of interest due to her links to the charity Action on Smoking and Health (ASH).115 Imperial’s attacks on Professor Bauld are part of a pattern of tobacco industry attempts to discredit public health researchers, depicting them as misguided “fundamentalists” producing work which is biased, careless and of poor quality.84

Using FOI requests to counter health campaigns/acquire research data

In February and March 2011, acting on behalf of Imperial Tobacco, the PR firm Bell Pottinger persistently requested access to research data that supported an anti-RYO tobacco health campaign run by regional charity SmokeFree South West.116117 This is an example of the tobacco industry using freedom of information requests to obstruct the progress of tobacco control campaigning and research.

Commissioning research and funding scientists

Imperial has commissioned a number of research papers in recent years, much of which is focused on newer nicotine and tobacco products. Some examples include:

- An 2024 study on nicotine pouches published in the medical science journal Cureus.118

- A 2023 study on whether Imperial’s myblu e-cigarettes might serve as a “gateway” into cigarette smoking, published in the journal Drug Testing and Analysis. It was funded by Fontem US LLC, an Imperial subsidiary and the manufacturer of the myblu products analysed.119

- Also in 2023, a paper published in Toxicology in Vitro compared levels of harmful and potentially harmful constituents in heated tobacco product (HTP) aerosols and cigarette smoke.120

Imperial has also funded research companies. Between 2017 and 2019, Imperial (via its subsidiary Fontem Ventures) funded the Centre for Substance Use Research (CSUR), a research consultancy based in Glasgow, Scotland.10 CSUR has also received funding from BAT, PMI, JUUL Labs and the PMI-funded Foundation for a Smoke-Free World.

Imperial also funded the German laboratory Analytisch-biologisches Forschungslabor (ABF Lab) to publish a paper in 2017, while in 2019 ABF Lab listed Imperial as a funder of an ongoing project.10

- For more information see Influencing Science.

Involvement in the illicit tobacco trade

Imperial has repeatedly argued that tobacco control measures lead to an increase in the illicit tobacco trade. The company made these claims in its 2012 and 2014 submissions to the UK Consultations on standardised packaging, and reproduced similar arguments in its response to the proposed tobacco endgame measures in New Zealand and the UK (see section “Endgame policies in New Zealand and UK”). For more information see Industry Arguments Against Plain Packaging and Tobacco Industry Interference with Endgame Policies.

However, while Imperial presents itself as a victim of illicit trade, there is strong historical evidence of its complicity in smuggling its own cigarettes.

In 2021, Imperial (alongside BAT) was reportedly found to be oversupplying its products in Mali through a local subsidiary and accused of supporting conflict in the area by fuelling the illicit trade. In response, Imperial stated that it is committed to opposing tobacco smuggling, which “benefits no-one but the criminals involved”.121

In 2003, a senior Imperial director was charged by German authorities following a raid on Imperial’s German subsidiary Reemtsma by police and customs officials. The raid was part of an investigation into the smuggling of illicit cigarettes to various countries, reportedly including Iraq, though it was under international trade sanctions at the time.122123 Imperial said that the suspected offences took place before its acquisition of Reemtsma in 2002.123

In 2002, genuine Imperial Tobacco brands accounted for more than half of the 17 billion cigarettes smuggled into the UK.124 When questioned about oversupplying countries notorious for smuggling at the Commons Public Accounts Committee, Imperial claimed ignorance, to which one MP responded: “One comes to the conclusion that you are either crooks or you are stupid, and you do not look very stupid.”125

Internal documents from Gallaher (now part of JTI) also refer to Imperial Tobacco’s “highly aggressive” smuggling activities in the 1990s, blaming Imperial’s smuggling for Gallaher’s weakening position in the UK market.126

- For more information on Imperial’s involvement in smuggling, see Imperial and Gallaher Involvement in Tobacco Smuggling or read our article Tobacco industry rallies against illicit trade – but have we forgotten its complicity? published in The Conversation.

Price and tax

Tax avoidance

In an investigation published by the Investigative Desk in 2020, the authors stated that “IB’s [Imperial Brands’] annual reports are so untransparent that their actual UK tax burden is virtually impossible to determine.”3 The same report found that Imperial had used group relief, based partly on internal loans, as a means of reducing its corporation tax bill. The authors estimated that Imperial had managed to reduce its payments by an estimated GB£1.8 billion between 2010 and 2020.3

Another study suggested that Imperial only paid an effective corporation tax rate of 20.45% between 2012 and 2019 – and generally much lower – though the rate due during this period was usually significantly higher.127

As of 2023, Imperial was the subject of a legal challenge from French tax authorities, which could lead to additional liabilities to the company of GB£254 million including tax, interest and penalties.34

- For more on this topic see The Tobacco Industry and Tax.

Pricing strategies

In October 2023, Imperial said it was on track with financial targets, with higher prices helping to offset lower sales of conventional tobacco products.17

One of Imperial’s “operational levers” to drive sales across its five priority markets is to “Optimise the value segment”.4 In the UK, this has involved launching new products like the Embassy Signature roll-your-own (RYO) tobacco. RYO tobacco now accounts for nearly 46% of tobacco sales in the UK according to the retail press, indicating a significant shift in consumer preference.128129 This shift is partly attributed to the lower taxation on RYO tobacco compared to factory-made cigarettes, as highlighted by a 2018 study. The study recommended increasing RYO tobacco taxes to reduce price differentials and curb its attractiveness to consumers.130

Other strategies targeting the value segment in the UK include launching packs of 21 cigarettes (instead of the standard 20) and 32g pouches of RYO tobacco (instead of the standard 30g), as well as Players Max, a new brand of cigarettes 12% longer than standard kingsize.131132 These strategies aim to offer more perceived value to consumers while maintaining competitive pricing.

- For more information on this topic see Price and Tax and Tobacco Industry Pricing Strategies.

Non-Nicotine Subsidiaries & Investments

In 2018, Imperial invested in Oxford Cannabinoid Technologies, a UK medical cannabis research company. It did not disclose the value of the investment, though it has been reported that Imperial holds nearly 11% of the company.133134 The following year, it announced a partnership with the Canadian cannabis company Auxly Cannabis Group, which saw Imperial take a 20% stake of the company over three years.135

Key Employees and Board Members

During 2019, Imperial Tobacco underwent significant changes in leadership and strategy. On 3 October 2019, it was announced that Alison Cooper, Imperial Tobacco’s Chief Executive since May 2010, would step down.136 The announcement came after the company issued a profit warning that reduced the company’s anticipated revenue growth.137

In July 2020, Stefan Bomhard was appointed as the Chief Executive Officer on a five-year contract. Bomhard had previously held leadership roles at various multinational companies including Bacardi Europe, Cadbury and car dealership Inchape.138139

The following work, or have worked, for Imperial Brands:

Roberto Ascoli | Drago Azinovic | Arthur van Benthem | Ken Burnett | Sue Clark | Helen Clatworthy | Fernando Domínguez | Robert Dyrbus | Gareth Davis | Louise Day | Kevin Freudenthal | Roberto Funari | David Haines | Michael Herlihy | Nikos Mertzanidis | Peter Middleton | Almos Molnar | Susan Murray | Iain Napier | Matthew Phillips | Walter Prinz | Michiel Reerink | Richard Ross | Berge Setrakian | Alessandro Tschirkov | Mark Williamson | Titus Wouda Kuipers | Colin Wragg | Malcolm Wyman | Waldemar Zegar

A full list of the company’s leadership team can be accessed on Imperial Brands’ website.

Affiliations

Imperial Brands is a member of various national and international organisations and networks. It also works with think tanks and other lobbying organisations, and employs a wide range of consultants.

Memberships

Imperial Brands is or has been a member of the following organisations (including those listed as affiliations with Fontem Ventures):140141

The American Chamber of Commerce in Moldova142 | The American Chamber of Commerce Ukraine143 | The Anti-Counterfeiting Group (ACG)144 | Asia Pacific Travel Retail Association (APTRA)145 | Associate Parliamentary Corporate Responsibility Group | Association of Business Service Leaders146 | Association of Convenience Stores (ACS) | Australian Association of Convenience Stores147 | Australian Lotteries and Newsagents Association147 | British Chamber of Commerce in Belgium | British Chamber of Commerce Czech Republic148 | BusinessEurope | Confederation of Industry of the Czech Republic149 | Cooperation Centre for Scientific Research Relative to Tobacco (CORESTA) | Eliminating Child Labour in Tobacco-Growing Foundation (ECLT) | Euraffex/European Affairs Expertise140 | European Rolling Papers Association (ERPA)140 | European Cigar Manufacturers Association (ECMA) | European Smoking Tobacco Association (ESTA) | European Smokeless Tobacco Council | European Travel Retail Confederation (ETRC) | Irish Tobacco Manufacturers Advisory Committee (Itmac)150 | Industry and Parliament Trust (see Rosemary Brook)151 | Institute of Business Ethics152 | Institute of Economic Affairs (IEA) | Kangaroo Group | MARQUES | Public Affairs Council140 | Scottish Grocers’ Federation (SGF) | Slave-Free Alliance153 | Society of European Affairs Professionals (SEAP)154 | Tobacco and Nicotine Products Chemicals Group (previously Tobacco Industry Platform)155 | Tobacco Europe (formerly CECCM) | Tobacco Manufacturers’ Association | UK Vaping Industry Association (UKVIA) | Vereninging Sigaretten en Kerf (VSK)156 | Wirtschaftsrat140

Other funded organisations

Imperial Brands is known to have funded, directly or indirectly, the following:

- Adam Smith Institute

- Institute of Economic Affairs

- International Tobacco Growers’ Association

- Eliminating Child Labour in Tobacco-Growing Foundation

- Tobacco Manufacturers’ Association

See also the STOP database and map of industry allies, available on exposetobacco.org

Consultancies

Imperial Brands is known to have used the following companies and consultancies for public relations, lobbying, marketing, research or other consultancy services:140157158159160161

Aspect Consulting | Burson Cohn & Wolfe (BCW) | Bell Pottinger | FTI Consulting | Instinctif Partners | Nudge Factory Ltd | Calacus

Relevant Link

- Imperial Brands corporate website

Tobacco Tactics Resources

- Tobacco Companies

- Fontem Ventures

- Newer Nicotine & Tobacco Products: Imperial Brands

- Plain Packaging: Imperial Tobacco Australia Pre-empts Legislation

- Imperial and Gallaher Involvement in Tobacco Smuggling

- Imperial Brands Use of the EU Citizens’ Initiative

- Tobacco Supply Chain database: Imperial Brands

- All pages in the Imperial Brands category

TCRG Research

- Developing more detailed taxonomies of tobacco industry political activity in low-income and middle-income countries: qualitative evidence from eight countries, B.K. Matthes, K. Lauber, M. Zatoński, L. Robertson, A.B. Gilmore, BMJ Global Health, 2021;6:e004096, doi: 10.1136/bmjgh-2020-004096

- The Policy Dystopia Model: An Interpretive Analysis of Tobacco Industry Political Activity, S. Ulucanlar, G.J. Fooks, A.B. Gilmore, PLoS Medicine, 2016, 13(9): e1002125, doi:10.1371/journal.pmed.1002125

- The revision of the 2014 European tobacco products directive: an analysis of the tobacco industry’s attempts to ‘break the health silo’, S. Peeters, H. Costa, D Stuckler, M. McKee, A. Gilmore, Tobacco Control, 2016,25(1):108-117

- ‘It will harm business and increase illicit trade’: an evaluation of the relevance, quality and transparency of evidence submitted by transnational tobacco companies to the UK consultation on standardised packaging 2012, K. Evans-Reeves, J. Hatchard, A. Gilmore, Tobacco Control, 2015,24(e2):e168-e177

- Transnational tobacco company interests in smokeless tobacco in Europe: Analysis of internal industry documents and contemporary industry materials, S. Peeters, A. Gilmore, PLoS Medicine, 2013,10(9):1001506

- UK: imperial tobacco wrap house of commons magazine in ‘plain packaging’, in Worldwide news and comment, D. Clifford, K. Evans, Tobacco Control 2012;21:524-528

For a comprehensive list of all TCRG publications, including TCRG research that evaluates the impact of public health policy, go to the Bath TCRG’s list of publications.

References

Categories

- Advertising Strategy

- Australia

- Burkina Faso

- Cannabis

- Challenging Legislation

- Consultancies

- Countering Critics

- COVID-19

- CSR Strategy

- Display Ban

- E-cigarettes

- Endgame

- EU

- Flavour and menthol

- Freedom of Information Requests

- Front Groups

- Germany

- Harm Reduction

- Hospitality

- Illicit Tobacco Trade

- Imperial Brands (Tobacco)

- Influencing Science

- Labelling and Packaging

- Legal Strategy

- Lobbying Decision Makers

- Lobbyists and PR People

- Mali

- Newer Nicotine and Tobacco Products

- Plain Packaging

- Price and Tax

- Think Tanks

- Third Party Techniques

- Tobacco Products Directive

- UK

- USA