Menthol Cigarettes: Industry Interference in the EU and UK

This page was last edited on at

Key points

- The EU menthol ban came into force in May 2020. Tobacco companies exploited weaknesses in the ban: the focus on characterising flavours rather than flavour ingredients; product exemptions; and a long phase-in period.

- Prior to the ban menthol use was highest in England and Poland. Menthol had an estimated 20% of the UK cigarette market, in which Imperial Brands and JTI dominate.

- Unlike other EU countries, menthol’s share of the market grew in Poland and the UK after the ban was announced in 2016.

- Tobacco companies, led by JTI and Imperial, were able to exploit the challenges of determining ‘characterising’ flavour, and the omission of cigarillos and accessories from the ban. There are early indications that this has prolonged menthol use post-ban.

- Menthol ban websites promoted newer products, mainly heated tobacco and e-cigarettes.

- In its submissions to the EU, the tobacco industry is minimising the harm caused by flavoured additives by focusing on toxicity rather than addiction.

Regulation of flavours that make smoking more palatable is recommended by the WHO Framework Convention of Tobacco Control (FCTC).12 This page details regulation and interference in the EU in the pre and post the 2020 menthol ban.

For information on the global menthol market, and regulation and interference in other countries see Flavoured and Menthol Tobacco.

Background

Regulation and Interference on Flavour in the EU and UK

An EU-wide ban on the sale of flavoured cigarettes was introduced in May 2016, including menthol, under the 2014 revised European Tobacco Products Directive (TPD), with a May 2016 deadline for EU countries to transpose the TPD into national law.3 While retailers were allowed a year to sell existing stocks of other flavours, the phase-out period for menthol was extended for a further three years, and came into force across the EU in May 2020.4

Weaknesses of the EU menthol ban which could be exploited by industry included:567

- not banning menthol as an ingredient

- exemption for most products (as the ban was only applicable to cigarettes – factory made and roll your own) and accessories

- and a four year phase-in period.

Menthol market share in Europe

Prior to the 2020 ban, Euromonitor analysis estimated the whole European menthol market to be worth around EU€9.7 billion (US$11 billion, nearly UK£8.5 billion).8 The relative shares of menthol flavoured cigarettes versus those with capsules (menthol and other flavours) varied; while the market share for capsules exceeded the share for menthol flavoured tobacco in half of EU countries, in others the capsule share was very low or non-existent.9 Menthol and capsule market share has tended to be higher for European countries outside the EU.9

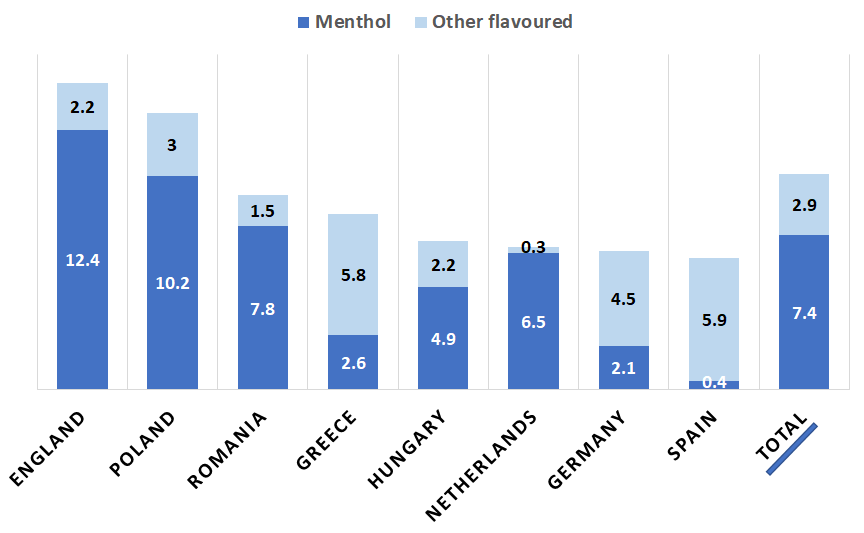

The International Tobacco Control (ITC) survey in 2016 (n=10,000 adult smokers, in 8 European countries) found that the countries with the highest menthol use were England (over 12% of smokers) and Poland (10%); the lowest levels were observed in Germany and Spain (Figure 1).10

Figure 1: Prevalence of flavour of cigarettes smoked (usual brand of choice) in 2016 (%).(Source: EUREST-PLUS ITC Europe Surveys)10

The ITC figures are supported by 2018 Euromonitor data, which show that the combined market share of menthol and capsules was generally higher in northern European countries, with the highest in Poland, at over 25%, followed by the UK, at over 20% .11

The UK market

The UK was part of the EU until 31 January 2020. The 2016 TPD, which included the menthol and flavours ban, was transposed into UK law and remains in place in the UK. Any future amendments to UK legislation will be made by the UK government.

The UK cigarette market, is dominated by two tobacco companies, Imperial Tobacco (Imperial Brands) and Japan Tobacco International (JTI).12 According to Euromonitor, in 2019, Imperial had a 44% share of the total cigarette market and JTI 37%, by retail volume. Although it is also based in the UK, British American Tobacco (BAT)’s share was much smaller, at just over 9%. Philip Morris International (PMI) had under 8%, mainly due to its Marlboro brand.13

Prior to the ban, menthol cigarettes formed an estimated 21% of the UK market.9 2018 figures from the Office for National Statistics (ONS) indicate that there were 7.2 million smokers in the UK; based on the 2016 ITC survey data (detailed above) that would equate to nearly 900,000 smokers who usually smoke menthol cigarettes. According to market research survey based data, the figure was much higher in 2019, nearly 1.6 million in Great Britain,14

Six billion menthol cigarettes were sold in the UK in 2018.15 According to the ITC survey, 17.5% of UK smokers said that they intended to quit after the ban (an average of 16% of smokers in the EU said the same).10 As this could reduce annual sales by around 1 billion sticks (3% of the total UK cigarette market), tobacco companies had a clear interest in circumventing the ban and maintaining market share, particularly Imperial and Japan Tobacco International (JTI) (having over 80% of the total cigarette market between them).

See below for a description of the range of tactics used by tobacco companies to exploit loopholes in the legislation and circumvent the EU menthol ban.

- For information on the global market for menthol cigarettes see Flavoured and Menthol Tobacco.

Tobacco Companies Activities to Circumvent and Undermine the Menthol Ban

Lobbying and delay: four year phase-out for menthol

After protests against the TPD from the tobacco industry, and an (ultimately unsuccessful) legal challenge by Poland at the European Court of Justice, supported by Romania, implementation of the ban on menthol cigarettes was postponed to 2020.1617 This was agreed as a four-year transitional “phase-out” period for all flavoured products with more than a 3% market share in the EU, such as menthol.18 (There was a similar ‘sell-through period’, a period when soon to be non-compliant stock can be sold off, when plain, or standardised, packaging was introduced into the UK in 2016, although only for one year).19 Romania asked for the ban to be repealed shortly after the TPD was agreed, using evidence from PMI as justification. JTI officials in Romania were making the same arguments at the time.20

The relevant wording of the EU TPD menthol ban is as follows:

“Member States shall prohibit the placing on the market of… cigarettes and roll your own tobacco… products with a characterising flavour… including… menthol [or those] containing flavourings in any of their components such as filters, papers, packages, capsules or any technical features allowing modification of the smell or taste of the tobacco products concerned… However, products with characterising flavour with a higher sales volume should be phased out over an extended time period to allow consumers adequate time to switch to other products… In the case of tobacco products with a characterising flavour whose Union-wide sales volumes represent 3 % or more in a particular product category, the provisions of this Article shall apply from 20 May 2020… The Member States and the Commission may charge proportionate fees to manufacturers and importers of tobacco products for assessing [compliance].” 3

Some member states, such as Germany and Finland, have gone beyond these requirements and prohibit menthol as an additive.7 Hungary has also announced it has plans to ban cigarettes that contain any amount of menthol.21

In early May 2020, tobacco companies were reported to be lobbying for further postponement of the ban in the EU.2223 Tobacco industry front group Forest EU were also reported to be lobbying against the ban.23 In January 2019 it had described the ban as “unwarranted attack on consumer choice that will do little to deter children from smoking”.24 These attempts were not successful. Romania delayed implementing the ban for six weeks in 2020, without informing the EU.20

Promotion of menthol products through the derogation period

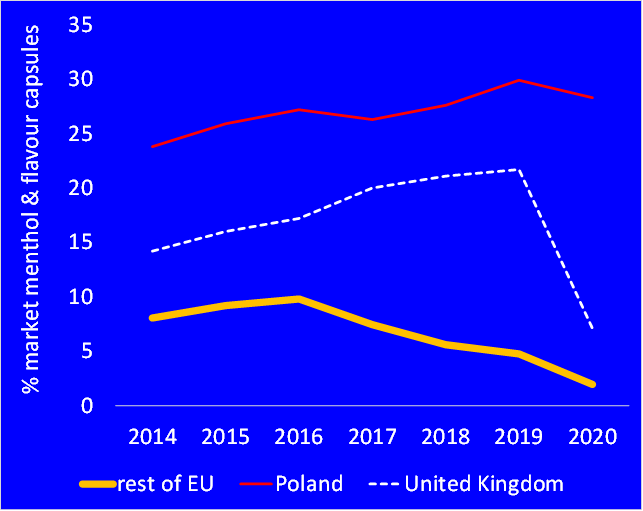

Menthol/capsule cigarettes’ market share began to decline after the EU TPD legislation was announced in EU countries, whereas there was some growth in in countries in the WHO Europe Region which were not EU members. Two exceptions were the UK and Poland, two markets with high proportions of menthol sales. In these countries there was marked growth in the market share of menthol/capsule cigarettes despite the incoming ban (figure 2).

Figure 2: Tobacco companies increased their sales of menthol in the run up to flavour bans in the UK and Poland (source: TCRG, June 2021)

During this period the tobacco industry promoted new menthol products to UK retailers through the retail trade press. It appears that the tobacco industry was prolonging sales in the ‘phase out’ period in these countries rather than using the period for a phase out of flavours, thus calling into question the necessity of a long derogation (delay to implementation).252627

Tobacco company buy-back schemes to maximise pre-ban sales

Despite being given four extra years by the EUTPD to get ready for the menthol ban, UK retailer group the Association of Convenience Stores stated, in advice to its members, that there was “no sell-through period”.2826 Tobacco companies stated that they had, or were planning, ‘buy-back’ schemes, to encourage retailers to sell menthol cigarettes right up to the ban.26 However, tobacco companies were slow to inform UK retailers of their plans.

PMI’s UK affiliate Philip Morris Ltd (PML) supplied details of its scheme via a dedicated website, where it promoted PMI’s heated tobacco product (HTP) IQOS as an alternative product, and which required retailer registration (see below).2930 Further details were provided as late as the end of April 2020.263031 BAT said in November 2019 that it would swap small amounts of menthol stock after the ban came into force. However, when approached by trade publication Better Retailing in April, less than a month before the ban, BAT refused to give further details.31

Imperial Tobacco also gave no indication whether or how it would take back excess menthol products, other than that it would “be dealt with on an individual basis”.31 It was reported that some retailers had advised others to remove from their product lists those products supplied by companies which would not disclose their plans. Otherwise, they risked being left holding stock which they would not be able to legally sell after 20 May.31

In August 2021, fourteen months after the ban, some retailers were still waiting for the buyback and complaining of a lack of response from attempts to contact tobacco companies. 3233

Tobacco companies issued warnings of the risks of the ban leading to illicit trade. JTI, which said it would be buying back excess menthol stock, warned retailers that there was a risk of illicit trade in menthol cigarettes, claiming that “counterfeit menthol products [had been] seized in the UK already”.3134 However, Better Retailing stated that this was contrary to information from other tobacco companies earlier in the year.34 JTI’s anti illicit trade operations manager said that retailers should warn their customers not to buy fake products, using common tobacco industry arguments around product quality and safety.34

For more information see Illicit Tobacco Trade.

Product innovation & promotion of newer products

While the ban applied to cigarettes and roll your own tobacco, other tobacco products were exempt. Menthol accessories were only included in the ban if they were sold within the packaging of cigarettes or roll your own tobacco.2528

Tobacco companies used product innovation as a way to circumvent the menthol ban and maintain a market for their menthol products, claiming that they were doing so to meet the needs of consumers.83536

Tobacco companies used several tactics, including launching product alternatives, in order to circumvent the ban:

- new menthol accessories

- new brands of cigarettes containing some menthol, exploiting the term ‘characterising flavour’

- new cigarette-like cigarillos, other tobacco products (pipe or shisha tobacco)

- menthol and flavour launches for newer products (heated tobacco products, e-cigarettes and nicotine pouches) promoted through ‘menthol ban’ websites

CNTC identified Germany, France, Belgium, Spain and the UK as offering the largest variety of these alternatives in the EU.11 Methods varied by company: Imperial and JTI developed new products; PMI used it as an opportunity to promote its own alternatives. All created ‘menthol ban’ websites or web pages (see below).

New menthol accessories

Tobacco accessories sold separately are not covered by the current TPD regulations, although they can still impart a menthol flavour. The tobacco industry has launched various new accessories since the TPD implementation in 2016, many relating to filters.2537 Imperial launched menthol roll your own (RYO) filter tips in mid-2017.38 In January 2019, it launched a filter tip with a capsule, called “Polar Blast”.39

It originally appeared that new filter tips might be an attempt to encourage menthol cigarette smokers to switch to RYO rather than quit. However, IMB introduced a product which enabled it to circumvent the EU ban on pre-inserted flavour capsules in factory made cigarettes. In January 2019, Imperial launched the L&B Blue Bright Air Filter with a recess in the filter and a firm filter structure.40 Although the launch announcement did not mention it, this filter structure allows a menthol filter tip – designed for RYO – to be inserted.41

Independent company Republic Technologies, which specialises in RYO accessories, also introduced a new menthol filter tip under its Swan brand.42 (Republic Technologies bought Swedish Match UK in 2008, but does not sell tobacco).43 These have been advertised with Imperial’s L&B Blue Bright Air Filter cigarettes.41

Packets of flavour capsules are now being advertised to buy separately to be poked into the cigarette filter before combustion in websites targeted at Poland.44

Figure 3: Imperial’s Rizla menthol “infusion” cards (source: conveniencestore.co.uk)45

Strips of cardboard, known as flavour cards, add flavour to cigarettes when they are added to a pack. A Finnish firm ‘Frizc’ sells menthol, lime, liquorice and raspberry flavoured cards in Estonia.46 The company website states that the packs (which appeared on the market in May 2020) can be used to flavour tea, coffee and oatflakes but do not mention tobacco. However, they are sized exactly for a cigarette pack and retailers can recommend them to smokers.46

In January 2020, the launch of Imperial’s “Flavour Infusion cards” in two flavours: “menthol chill” and “fresh mint” was announced (Figure 3).47 These cards impart a menthol flavour into factory made cigarettes or RYO tobacco if inserted into product packs.48 Imperial stated it was selling 900,000 packs of flavour cards a week by mid-2021.49

The point of sale display ban exempts tobacco accessories (including branding) in England and Wales but in Scotland accessories must be hidden like other tobacco products.50 Imperial have made use of the exemption in England and Wales to recommend that flavour infusion cards are promoted in point of sale displays.4851 Imperial reported selling 900,000 a week in July 2021.52 Swan, an accessories manufacturer had also launched flavour cards by mid-2021.52 In July 2021, the UK tobacco accessories market was reported to be worth UK£314 million.52

Menthol and other flavour sprays, stones and drops have been developed for soaking filters or cards, and are on sale in the EU,1153 and the UK 5455

Exploiting the term ‘characterising flavours’

The TPD regulations state that:3

“characterising flavour” means a smell or taste other than one of tobacco which—

(a) is clearly noticeable before or during consumption of the product; and

(b) results from an additive or a combination of additives, including, but not limited to, fruit, spice, herbs, alcohol, candy, menthol or vanilla”

In November 2020, The Bureau of Investigative Journalism, working with the Organised Crime and Corruption Reporting Project (OCCRP) reported uncertainty and confusion in multiple European countries as to the level of menthol flavouring present in cigarettes that could be considered to be characterising.2156 They presented evidence that the term ‘characterising’ was used after lobbying from the tobacco industry.21 Public health NGO Comité National Contre le Tabagisme (CNTC) accuses tobacco companies of exploiting the ambiguity around the definition of the term ‘characterising’.11

Determining whether a product has a characterising flavour is difficult. The EU took nearly five years to put a methodology in place; a combination of sensory panels and chemical analyses.756 Slow development of testing, and a lack of firm action, has left a regulatory vacuum for the tobacco industry to exploit. JTI launched products which, when challenged, it claimed did not have a characterising flavour.56 The company later changed direction, saying it was able to sell these products because there was no way at the time to test for a characterising flavour.56 Other tobacco companies and health campaigners have claimed that these new products do have flavours that would be characterising.57 The Direction Générale de la Santé (DGS, the French ministry of health) was reported to be investigating over 300 products suspected of containing prohibited flavours.11 Sweden referred 21 JTI cigarette varieties to the European Commission to test for characterising flavour in June 2020. In late 2021, the Office for Health Improvement and Disparities (the successor to Public Health England) was reported to be testing products from several manufacturers.56

UK

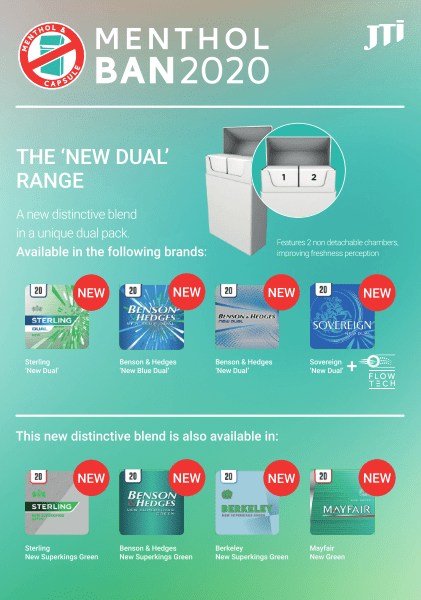

In the UK products began to be released at an early stage. In late March 2020, JTI promoted new ‘dual’ cigarette products with new blends, filters and two sections of 10 cigarettes, to appeal to menthol smokers looking for new products.5859 However it was unclear what these new ‘blends’ entailed.

JTI also developed a range of “Green” and “Blue” product variations under the same brand names as their menthol cigarettes.60 The Sun newspaper reported that these products tasted and smelled like menthol, without containing the substance.60 Scottish Local Retailer published a dedicated publication for UK retailers in conjunction in conjunction with JTI, called “Making A Mint”, which detailed alternative products including cigarettes made with “distinctive blends” of tobacco but did not mention helping smokers quit; it did recommend selling cigarettes at low prices.(Figure 4 )61 These new cigarettes were promoted under the logo “menthol reimagined”, alongside JTI’s newer nicotine and tobacco products (so called “Next Generation Products”).61 (Imperial Tobacco promoted its e-cigarette blu in this publication.61 See below for more on tobacco companies promoting newer products as menthol alternatives). JTI also ran an online training course for retailers, which featured their new cigarettes as direct replacements for existing menthol brands.60

Figure 4: Page from retail publication showing JTI’s alternative cigarettes post-ban.(Source: Scottish Local Retailer/Japan Tobacco International, Making a Mint 2020, PDF supplied by Action on Smoking and Health)

A week before the May ban, Imperial Tobacco announced the launch of new “smooth” variants of their non-menthol brands, called “Bright” and “Green Filter”. The company said this was to “help retailers cater for their menthol and crushball customers when the ban comes into effect, by offering them new innovations from their brands of choice”.62 Imperial also said its research showed that 82% of menthol and crushball smokers would continue to smoke their usual cigarette brand despite reduced levels of menthol, and 70% percent were “expected to switch to a smooth or full flavour variant”.62

Better Retailing reported that, according to information from UK wholesalers, tobacco companies had between them created 29 new product lines to replace menthol products due to be banned, which was confusing for customers.63 While colour and branding can be used to promote products to retailers, cigarettes can only be sold in plain packs, and so the only noticeable difference for the customer with these new products would be a slight change of brand variant name.

Ireland

The Irish Times reported that JTI were selling a “green” version of their Silk Cut cigarette brand. JTI argued that this product complied with the ban, even though the company admitted that it used menthol flavouring in its manufacture.64 According to the newspaper, JTI stated that they: “conduct robust internal testing processes to determine that the use of flavourings in our products does not produce a clearly noticeable smell or taste other than one of tobacco.”64 BAT accused JTI of using the same tactic in France, with new versions of its Camel and Winston brands, to which JTI issued a similar denial.65

The Irish Times also reported that PML was advertising a new cigarette in the retail press. Called “Marlboro Bright“, it was described by PMI as a “the Marlboro menthol blend – without methylation”.6466 PMI later said that this advertisement was a “mistake” and it should have used the phrase “without menthol” rather than “methylation”.66 The company insisted that it had “delisted all menthol cigarettes in the UK and Ireland – all of our cigarettes remaining on the market, including our latest variant Marlboro Bright, do not have any menthol in them and are in full compliance with the law”.67

BAT also developed new variations under its Pall Mall, Vogue and Rothmans brands which included new blends and changes to filters “providing meaningful differentiation for adult smokers who previously preferred menthol.”686970 A representative of BAT (P.J.Carroll) in Ireland said that it was “not launching any cigarette brands or accessories with menthol-type properties”.64

These attempts to adapt products were criticised by the Irish government with a spokesperson stating that the Health Minister believed the issue “should be dealt with at EU level”.64

Similar tactics from BAT, PMI and JTI have been noted in the following EU member states: France, Germany, Belgium, Spain, Denmark and Ireland 11, Austria, Czech Republic, Estonia, Hungary, Italy, Latvia, Lithuania, Luxembourg, the Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden 57

In 2020, JTI’s brands in France,11 and Ireland 71 had high sales, suggesting this has been a successful strategy for the tobacco industry.

New ‘cig-alike’ cigarillos

The only part of standardised packs legislation applicable to cigars and cigarillos was a larger health warning; legislation on branding, minimum pack size, and flavourings does not apply. Tobacco companies developed new product variations and promoted these products in the retail press.25 From 2020, JTI and/or Landwyck cigarette-like cigarillos were launched in France, Germany, Belgium, Spain, Denmark, Ireland, Romania, Netherlands, Poland and the UK.11

Figure 5: JTI’s Sterling Dual menthol cigarillo (Source: talkingretail.com)72

Japan Tobacco International

Stirling Dual Capsules are cigarette-like cigarillos with mentholated tobacco launched in the UK by JTI in early 2020 (figure 5).72 The product contains a capsule filter which releases a peppermint flavour on crushing.73 Stirling is one of JTI’s most popular cigarette brands, which already included capsule options. The cigarillos were legally allowed to be sold in 10 packs making them approximately half the price of the cheapest cigarette packs on the UK market. Marketing to retailers framed them as an option to circumvent the menthol ban.1935 Action on Smoking and Health (ASH) described this as a “cynical” move on the part of JTI, saying that its new cigarillo was essentially “a cigarette wrapped in tobacco leaf”.36 JTI, quoted in retail magazine The Scottish Grocer, said that it was “committed to providing retailers with as much choice as possible by launching innovative new products that respond to current trends”.74

These cigarillos won retail industry awards and were described as having “a strong performance” and JTI released a 20 stick version in early 2021.73 In the second half of 2020, over 45% of cigar sales recorded by the Retail Data Partnership were Sterling Dual Capsule cigarillos.56

Scandinavian Tobacco Group

The Scandinavian Tobacco Group, a cigar specialist, launched Signature Dual in February 2020.4275 This is a menthol capsule cigarillo, similar to JTI’s Sterling Dual Capsule.

Imperial Brands

In August 2020, Imperial Brands (previously Imperial Tobacco) added a 10-pack of menthol crushball cigarillos to its JPS Players range, with a price comparable to JTI’s product. Imperial’s UK market manager said that this product would: “help bridge the gap left by the ban”.7677

Impact of new cigarillo variants

According to Euromonitor data, the UK cigarillo market was in decline until the TPD came into force in 2016, but it is now growing. Euromonitor forecasts sales of cigarillos will carry on rising, whereas cigar sales will remain in long term decline.7879

Promoted newer products through menthol ban websites

Tobacco companies used harm reduction as a strategy to achieve their business objectives. In advance of the menthol ban in the UK, they promoted their newer nicotine and tobacco products (heated tobacco products, e-cigarettes and nicotine pouches).

As the UK does not allow open promotion and display of tobacco products, tobacco companies created websites and pages specifically to provide information about the ban to retailers and consumers, in addition to articles in the retail press.29307980 Although they are apparently set up to provide information, these websites also help companies to capitalise on the upcoming ban by promoting their newer products.59 These include heated tobacco products (HTPs) such as PMI’s IQOS and its HEETS tobacco sticks, to which the ban did not apply.4231

- For details, see: Promotion of Newer Products Around The UK Menthol Ban

What Next for Menthol in Europe?

Despite industry efforts to boost menthol sales, the upcoming ban appeared to be having an impact on UK smokers’ buying habits, as sales of menthol cigarettes fell in the months before it came into effect. For details see Flavoured and Menthol Tobacco – Do Bans Work.

UK: arguments for retrenchment

Since the EU 2016 TPD came into force, the UK has left the EU (known as Brexit). Twitter activity and some media reports suggested Brexit could be an opportunity to repeal the menthol ban. 8182 It is not clear whether the tobacco industry intends to lobby to roll back this legislation after the transition period. However, traditionally the UK has gone beyond EU requirements regarding tobacco control, so repealing would require a change in political consensus.83 In July 2020, the Secretary of State for Health and Social Care confirmed that “As the ban is part of United Kingdom legislation, it will remain in place when the UK exits the transition period with the European Union”.84

The UK did not replicate the 2023 EU ban on flavoured heated tobacco products (see below).

Finland: going beyond the TPD

Finland aims to end the use of tobacco and other nicotine products by 2030. Policy makers have interpreted the 2016 TPD flavour ban as also applying to e-cigarette liquids.85 There have been court cases in Finland as shops have been selling flavourings labelled for food use, but which have not been tested for possible toxicity when heated and inhaled. These flavourings are labelled for use with e-cigarettes (vaping) in other countries. Finnish researchers have called for the EU to reconsider regulation, product notification and prohibition of e-cigarette flavours.85

Revision of the 2014 TPD

The TPD is under revision, in both the EU and the UK, as scheduled in the legislation. Tobacco industry activity implies that current regulation should be tightened to:86

- remove the loopholes around characterising flavour by banning menthol as an ingredient;

- extend the ban to all tobacco products, especially cigarillos and other products that are mimicking or replacing cigarettes; and

- consider whether to broaden regulations to include heated tobacco sticks, e-liquids and other new products

As essentially a cigarette wrapped in brown leaf rather than white paper, cigarillos are likely to be very attractive to the tobacco industry; not only are they currently exempt from EU and UK standardised packs legislation, but they are also subject to lower taxes.2519 It has also been recommended that the ban is extended to waterpipe where flavours are a key attraction and young people, and some European populations have a particularly high level of use.87

Extending the ban to accessories could be more difficult given their variety, but there are already a bans on their display at point of sale in Denmark and Scotland.8889 Some accessories such as cigarette filters, where the tobacco industry has made false health claims, could themselves be banned completely.37

Tobacco industry strategies during revision development

Reinskje Talhoot from the National Institute for Public Health and the Environment, (Rijksinstituut voor Volksgezondheid en Milieu, RIVM) in the Netherlands stated that the tobacco industry has been focussing on the toxicity of tobacco additives like menthol. There is little evidence of toxicity and this helps draws attention away from studies that show that menthol encourages young smokers to continue smoking.6

From May 2020, manufacturers were required to disclose additives in tobacco products and additional information about the harmful and addictive effects of 15 priority additives including menthol. The EU Commission asked an independent group of experts, called WP9 and led by RIVM, to assess the research reports.6 WP9 concluded that there was strong independent evidence that low amounts of menthol (which would be insufficient to make a characterising flavour) still facilitates smoke inhalation making smoking easier for novice (new) smokers.6 WP9 noted that tobacco industry reports did not come to the same conclusion because they left out some independent studies. There were also limitations in the research methods and statistical analyses.6 WP9 therefore concluded that the industry reports were unreliable and should not be used to guide EU member states’ policies. WP9 instead advises that menthol in cigarettes should be banned completely.6

EU ban on flavoured heated tobacco products

Heated tobacco products (HTPs) were exempted from the flavour ban. However, the Commission published a report in June 2022 which found that the sales of HTPs had increased by more than 10% (by volume) in 10 member countries, and were making up over 3% of total tobacco product sales.90

This was classified as a “substantial change of circumstances” enabling the Commission to propose a ban on flavoured HTPs, as part of Europe’s Beating Cancer Plan.9192 93 The Commissioner for Health and Food Safety, Stella Kyriakides, said:

“With nine out of ten lung cancers caused by tobacco, we want to make smoking as unattractive as possible to protect the health of our citizens and save lives. Stronger actions to reduce tobacco consumption, stricter enforcement and keeping pace with new developments to address the endless flow of new products entering the market – particularly important to protect younger people – is key for this. Prevention will always be better than cure.”91

After a period of scrutiny, a Delegated Directive was published in November 2022 and entered into force the same month, which banned HTPs with a characterising flavour in any of their components (referring to components closes a potential loophole for flavoured accessories).9495 EU member countries were required to adopt national laws by 23 July 2023, and enact the ban 3 months later, by 23 October.92 Germany was the first country to pass the ban into law,96

Extended transition period in Italy

The directive included a 3 month transitional period.94 Market analysts Tobacco Intelligence reported that Italy allowed an extended transition period to sell existing stocks of flavoured products: 95

“…manufacturers can supply these to tax warehouses until 31st December 2023, tax warehouses can provide them to retailers until 1st March 2024, and retailers can sell existing stocks.”95

Tobacco industry response

Legal challenges

In January 2023, BAT was granted permission to challenge the ban in the Irish high court (as the Republic of Ireland is part of the EU).9798 BAT stated that the ban would undermine its investment in “products with a reduced-risk profile” and have implications for public health policy.97 In March, Philip Morris Group was given permission to join the legal challenge. Philip Morris did not market HTPs in Ireland at the time, but said it intended to do so.99 In October 2023, media reported that the case had been referred to the European Court of Justice, with the tobacco companies accusing the EU of regulatory ‘overreach’.100101102

Promoted purchases in countries where flavoured HTP sticks continued to be legal

On its website PMI stated that Northern Ireland was affected by the ban, but not the rest of the UK.103 It noted that as the ban was on sales, not use, “[a]dult users may still be able to buy heated tobacco products with a characterising flavour abroad and use them in the EU.”104

Tobacco industry journal Tobacco Journal International also highlighted the potential for cross-border purchasing of flavoured products from neighbouring countries without a ban in place.105

Launched new nicotine sticks

In the months before the ban came into force, PMI and BAT launched flavoured sticks for using in HTP devices that do not contain tobacco. Instead, the sticks contain nicotine infused leaves (including rooibos tea) apparently developed in order to circumvent the HTP flavour ban.106107

For details see:

- Newer Nicotine and Tobacco Products: Philip Morris International

- Newer Nicotine and Tobacco Products: British American Tobacco.

TobaccoTactics Resources

- Flavoured and Menthol Tobacco

- Promotion of Newer Products Around The UK Menthol Ban

- EU Tobacco Products Directive Revision

- Flavoured and Menthol Tobacco in LMICs

- Product Innovation

- Newer Nicotine and Tobacco Products

Relevant Links

- STOP statement on the delayed US menthol ban and NGO-instigated legal action

- Menthol tobacco companies are exploiting loopholes in the UK’s characterising flavours ban, S. Dance & K. Evans-Reeve, Tobacco Control blog, May 2021

TCRG Research

- Effects of and challenges to bans on menthol and other flavors in tobacco products, K. Przewoźniak, C. Kyriakos, R. Hiscock et al, Tobacco Prevention & Cessation, 2021; 7 (November): 68, doi: 10.18332/tpc/143072

- Tobacco industry tactics to circumvent and undermine the menthol cigarette ban in the UK, R. Hiscock, K. Silver, M. Zatonski, A. Gilmore, Tobacco Control, 18 May 2020, doi:10.1136/tobaccocontrol-2020-055769

- Cigarette-like cigarillo introduced to bypass taxation, standardised packaging, minimum pack sizes, and menthol ban in the UK, J. Branston J, R. Hiscock, K. Silver, D. Arnott, A. Gilmore, Tobacco Control, Online First, 26 August 2020, doi: 10.1136/tobaccocontrol-2020-055700

- A prospective longitudinal study of tobacco company adaptation to standardised packaging in the UK: identifying circumventions and closing loopholes, K. Evans-Reeves, R. Hiscock, K. Lauber K, J. Branston, A. Gilmore, BMJ Open, 2019;9:e028506, doi:10.1136/bmjopen-2018-028506

- Standardised packaging, Minimum Excise Tax, and RYO focussed tax rise implications for UK tobacco pricing, R. Hiscock, N. Augustin, J. Branston, A. Gilmore, PloS one, February 2020, doi:10.1371/journal.pone.0228069

For a comprehensive list of all TCRG publications, including research that evaluates the impact of public health policy, go to the Bath TCRG’s list of publications.