E-cigarettes: Imperial Brands

This page was last edited on at

Imperial Brands (previously Imperial Tobacco) set up a subsidiary Fontem Ventures in 2012, through which it has developed and sold its e-cigarettes (also known as electronic nicotine delivery systems, or ENDS) since 2014.1

Note: Imperial Tobacco changed its name to Imperial Brands in 2016. Here we use ‘Imperial’ for both. Fontem Ventures is a wholly owned subsidiary, so we refer here to the parent company (Imperial), except where it is helpful to specify Fontem Venture’s role (for example where the subsidiary initiated legal action, or lobbying activity). Renaming companies and setting up subsidiaries not only performs a business function, but can help tobacco companies to distance elements of their business from their core activity of selling tobacco.23

Initially Imperial’s e-cigarette markets were the United States (US), the United Kingdom (UK), France and Italy. It began expanding into multiple new markets in 2018 with its flagship e-cigarette brand, blu.4 In 2021 Imperial was focusing on blu’s most profitable markets: the US, the UK and France.5 See below for more information.

Imperial also has had some interests in heated tobacco products (HTPs), snus and nicotine pouches. Like other companies, it has referred to its newer nicotine and tobacco products as ‘next generation products’ (NGPs), although its product terminology changes over time.

Acquisitions and Interests: E-cigarette Companies

Dragonite (2013)

In August 2013, Imperial paid US$75 million to acquire Hon Lik’s e-cigarette company Dragonite, including its Research & Development facility in Beijing.67 Lik, a Chinese pharmacist, is credited with inventing the first e-cigarette in 2003.8

The first e-cigarette launched in 2014 by Imperial in the UK was Puritane, a result of its collaboration with Hon Lik.910 Sold in Boots pharmacies this product was initially submitted for licensing as a medical device in the UK (see below).11 Puritane was later discontinued in favour of Imperial’s flagship e-cigarette brand, blu.

Lorillard’s blu (2014)

The company acquired the blu brand when US tobacco company Reynolds American Inc. (RAI) purchased another US tobacco company, Lorillard, in July 2014. Amidst antitrust concerns that the merger would give Reynolds an unfair advantage over the US nicotine market, Reynolds sold blu (along with cigarette brands Kool, Salem and Winston, and a manufacturing plant) to Imperial for US$7.1 billion. When speaking of the company’s new acquisition, at-the-time Imperial’s chief executive Alison Cooper said:

“This is a great opportunity to transform our U.S. business and secure a significant presence in the world’s largest accessible profit pool.”1213

Von Erl (2017)

Imperial bought the Austrian e-cigarette company Von Erl in June 2017, for GB£26.7 million (around US$34.4 million). This deal included Von Erl’s US subsidiaries.14 The My VonErl e-cigarette was reportedly relaunched as myblu in 2018.15161718

Blu became Imperial’s flagship brand in 2018 which was described as a “transformative year” by Imperial.19

- For more product information see e-cigarettes: Imperial’s Blu

Acquisitions and Interests: E-Liquid Companies

Nerudia (2017)

Acquired by Imperial in November 2017.20 The owners of Nerudia had sold a previous company CN Creative to British American Tobacco in 2012. 16

Cosmic Fog (2018)

In March 2018, Imperial acquired a stake in this US e-liquid business. According to market research company Euromonitor International, Cosmic Fog was selling its products in 60 countries, including 5,000 e-cigarette stores in the US.211819 Imperial did not disclose the size of the share.

Patent Cases

In March 2014, Imperial launched legal proceedings (as Fontem Ventures) over patents in California against nine of its American e-cigarette rival companies, including the top three: Lorillard‘s Blu (now owned by Imperial), NJOY, and Logic (acquired by Japan Tobacco International in July 2015).2223 The lawsuits alleged patent infringement, citing four intellectual property patents that were purchased as a part of its Dragonite acquisition. The majority of the cases were settled out of court in 2015 and 2016.2425

Fontem Ventures also sued Altria subsidiary Nu Mark in 2016, over its MarkTen and GreenSmoke e-cigarettes, a case which was settled out of court in 2017.2526 In October 2018, Fontem settled four lawsuits for patent infringement it had instigated against RJ Reynolds vapor (BAT).2627

Product Innovation

From Medical Device to Lifestyle Product

Imperial’s first brand of e-cigarettes, Puritane was initially marketed as a healthcare product. Imperial closed a deal with Boots pharmacies to sell the Puritane brand throughout its pharmacies in the UK.28 Imperial (through Fontem Ventures) applied to the UK Medicines and Healthcare products Regulatory Agency (MHRA) in 2014 to have Puritane licenced as a medical device.29 If successful, this would have allowed the company to market the product with reduced risk claims. In April 2017, in response to a Freedom of Information request by the University of Bath’s Tobacco Control Research Group, the MHRA confirmed that:

“according to our licencing records there are no currently granted licences for any product named ‘Puritane’, nor are there any licences held by Fontem Ventures”.30

Therefore it is reasonable to assume that if Fontem Ventures had lodged an application for Puritane in 2014, the application was unsuccessful or had expired.

A second e-cigarette called JAI was launched in France and Italy in March 2015.313233 Unlike Puritane, Imperial positioned JAI as a lifestyle product, marketing it through tobacconists.34 PR company Aspect Consulting helped launch the e-cigarette in France through a mix of “online, traditional media and trade communication activities”.35 Like Puritane, JAI was also discontinued.3637

Since 2016, Imperial’s strategy has been to focus on blu, marketing it as a lifestyle product.3819

Multiple Flavours

Similar to cigarettes, flavour is an important product innovation tool to boost e-cigarettes sales. In 2021, Imperial marketed a variety of flavoured e-liquids, including: Peach Passion, Vanilla Creme, Mint Chocolate, Tropic Tonic, Berry Swirl, and Caramel Café (see image 1).39 Like other companies, Imperial has been accused of using e-cigarette flavours that are attractive to children and young people.

Image 1. A selection of fruity blu e-cigarette flavours (screengrab from UK website taken in November 2019, www.blu.com)

Evidence shows that fruit and menthol-flavoured e-cigarettes are more appealing to young people than tobacco flavoured e-cigarettes.40 In a 2015 submission to the Australian Senate inquiry into ‘Personal choice and community impacts’, Imperial (as Fontem Ventures) declared that:

“flavours that clearly appeal primarily to minors (e.g. candy flavours, bubblegum, milkshake) should not be marketed”.41

In line with its policy, Imperial (Fontem) does not market these particular flavours, but it does market fruit and menthol flavours.

After a rapid increase in the numbers of children and young people using e-cigarettes in the US, in 2018 the FDA sent warning letters and penalties to retailers found to have sold e-cigarette products to children.42 In September 2018, the FDA wrote to Fontem Ventures giving the company 60 days to provide a written plan to “address the rate of youth use of Blu products” (Similar letters were sent to JUUL Labs, Altria, Reynolds American Inc. (RAI) and JTI).4344

While Imperial subsequently announced plans to raise minimum age requirements on its US websites (to 21), and encourage retailers to use age verification systems, it continued to market a range of flavours such as “honeymoon”, “neon dream” and “melon time”.45 The company denied that fruit flavours attracted children to e-cigarettes and blamed other companies, in particular JUUL Labs for the rise in youth use.4546 Imperial also said to be taking the issue “very seriously”, and that it was developing technological solutions such as child locks and geofencing. 45 As of April 2021 it was not clear which, if any, of these new measures had been put in place. Imperial published a pre-emptive statement on the Fontem Ventures’ website, before the FDA had concluded its investigations or issued its guidance, saying that:

“…we believe the forthcoming FDA Guidance restricting the sale of flavoured e-vapour products will have unintended consequences. These include deterring adult smokers from trying vaping, potentially encouraging adult vapers to return to smoking, growth in DIY or illicit flavour-making, and the potential development of an illicit trade in flavoured e-liquids or flavour agents.”47

No supporting evidence was given for these claims in the statement. Claims of ‘unintended consequences’ are made repeatedly by tobacco companies when lobbying against regulation, including that the regulations will not work, or that they will lead to an increase in illicit trade.

Nicotine Levels

Blu e-liquid products are available in different nicotine concentrations in different countries, according to national regulations. In the European Union (EU), the highest permissible level of nicotine in e-cigarettes is 20mg/ml (20%). Imperial states on the UK blu website that its e-liquids come in a choice of nicotine level of 9 or 18 mg/ml.48

In July 2018 Imperial launched a range of “Intense” tobacco and menthol flavoured e-liquid capsules for use in myblu.49 This range of e-liquids contain nicotine salts (see Image 2), which are created when ‘freebase’ nicotine is dissolved in acid.50 This process can make a higher dose of nicotine more palatable, and so allow higher doses of more concentrated nicotine to be consumed. On blu’s UK website, the Intense capsules all contain 18mg of nicotine. 38 At the same time, Imperial launched another range of e-liquids in the US, called “Salt of the Earth”, for use in refillable devices. Although this range was on sale at independent US online retailers (in 24 and 48 mg/ml strengths), in April 2021 they were not available on blu’s US website.515253

Image 2: Imperial’s ‘intense’ nicotine salt e-cigarette (Source: Imperial Brands, ‘Building blu’ presentation, 2018)

In Japan the sale of nicotine liquids is banned. In June 2018, Imperial launched a version of myblu in Japan, using flavoured liquids without nicotine. 5455 According to Euromonitor, Imperial consequently captured 90% of the (relatively small) Japanese market, 5456 although it withdrew this product in 2022, as it was not profitable.57

- For more information on Imperial’s HTPs see Newer Nicotine and Tobacco Products: Imperial Brands.

FDA Marketing Denial Order for myblu

The US Food and Drug Administration (FDA) requires companies to submit a Premarket Tobacco Product Application (PMTA) for any new e-cigarettes they wish to sell.58 As a large number of products were coming onto the market without approval, the FDA required that companies needed to submit applications for those already on the market as of 8 August 2016. As long as a PMTA was submitted within ten months, the products could remain on sale.59

When Imperial launched myblu in the US in 2018, a spokesperson from Fontem Ventures said that as it was a version of a similar e-cigarette (My VonErl) sold by a company they had acquired a year earlier, it therefore complied with FDA rules.59 However, Reuters reported that company advertising indicated that the new myblu e-cigarette contained a higher concentration of nicotine than the VonErl product, at least 40 mg/mL. FDA defines such products with higher concentrations of nicotine as new products, which are therefore subject to FDA review.5960

Imperial submitted a PMTA for myblu in April 2020.61 Two years later, the FDA rejected the PMTA, issuing a marketing denial order for several myblu products. Imperial appealed the order, stating that:

“we expect the FDA will not seek to enforce the MDOs while this appeal remains ongoing, and we therefore expect the products to remain in the market during this period.”62

Key Markets

Between 2014 and 2017, Imperial’s e-cigarettes were sold in four main markets: US, UK, France and Italy. 541 By 2016, Imperial reported that blu was the second largest e-cigarette brand in the US and UK markets.631

Imperial expanded to Russia, Bulgaria and Canada in 2018,5415 and Spain in 2019.64 By November 2019 the company reported that myblu was available in 16 markets, although it did not detail which.4

In February 2021, Imperial’s newly appointed CEO, Stefan Bomhard presented a new five-year strategy for the company, which included a renewed plan for blu: focusing efforts on key countries (the US, UK and France) while withdrawing from less profitable markets.5 Imperial withdrew blu from Canada in 2020,65 and Russia and Japan in 2021.57

In 2022 Imperial reported that it was trialling a “refreshed marketing proposition for blu into new territories”.57

- See below for more on Imperial’s market share.

Marketing Strategies

Marketing strategies used by the industry to promote tobacco products and tobacco use have been banned under Article 13 of the World Health Organization Framework Convention on Tobacco Control (WHO FCTC).66 They are however being used to promote e-cigarettes, by targeting individuals with promotional material; using product displays and branding at social venues like shopping centres; and offering free samples and taste testing. In 2015, Euromonitor labelled Imperial’s blu as “one of the most marketed vapour product brands in the UK”, referring to the brand’s strong presence on British television and point-of-sales displays in small retailers and supermarkets.67

As e-cigarette advertising has become more restricted, in Europe and elsewhere, tobacco companies have become more creative.68 Since 2015, Imperial (Fontem) has worked with advertising agencies to develop new marketing campaigns for its e-cigarettes, including paid promotional content in magazines. Like other tobacco companies, it is increasingly using social activities (including established music events and pop-ups), and paid influencers, called “brand ambassadors”, to promote its products on social media.69

Consequently Imperial has also been criticised for targeting young people, an accusation which Imperial has denied. 697071

It has also used campaigns that mimic public health approaches to behaviour change and harm reduction, as detailed below.

Fake Warning Labels (US, 2017)

In 2018 researchers in the US exposed an advertising campaign used ahead of the introduction of new nicotine warning labels on packets. Imperial had run an advertising campaign for blu in popular magazines in 2017, titled “Something Better”, which used fake warning labels.72 Statements such as ‘IMPORTANT: Vaping blu smells good’, ‘IMPORTANT: contains flavour’, and ‘IMPORTANT: Less harmful to your wallet’ were printed in boxes next to images of people vaping, mimicked both the proposed nicotine warning labels (now mandatory in the US) and the language of harm reduction.73 A study conducted by researchers at Ohio State University, using these advertisements, concluded that “Adolescents viewing an advertisement with a fake warning were less likely to recall the advertisement’s actual warning or health risks”.73 The company was accused of potentially desensitising consumers to the real risks associated with nicotine.7274

“Pledge World” (Global, 2018)

In December 2018, blu created an Instagram page for a site called ‘Pledge World’ containing attractive and inspirational images and encouraging people to “make a pledge” to fulfil a “lifelong ambition” and “#OWNIT.75 The Instagram page did not make it clear that it was a brand campaign for blu. However, a link in the bio led to the main website, which was identifiable as relating to e-cigarettes.76

When it was launched in April 2019 the website urged visitors to make a pledge to make a change:

“This is it. The beginning of a potentially life-changing journey. Tell us your pledge, your dream, your goal; and we could help you #OWNIT. Are you ready?” 76

Pledging is a known method used to support lasting behaviour change, including in stop smoking services.7778 It is not clear how blu intended to make lasting change in peoples’ lives. It did, however, appear to collect participants’ personal data, including names, addresses, phone numbers and birthdays, as well as Instagram handles. 75

The last post on the Instagram page appeared to be at the end of May, and the number of followers had reached just under 5,500 (a small figure in terms of Instagram campaigns), by which time the main website stated that it was no longer accepting entries.79 In October 2019 the UK version of the website simply contained a “coming soon” holding page, and it was not clear if this campaign was still active.80

“Blutopia” at Festivals (UK, 2019)

In 2019, Imperial used its contracted advertising agency (MSQ Partners) and a ‘brand experience’ company (Hyperactive) to create “an immersive, hedonistic, vaping nirvana experience” at big summer music festivals in the UK.818283

According to Campaign Magazine:

“‘Blutopia’ is described as an ‘immersive brand world’ where visitors can explore Blu flavours. Guests will be invited into secret multi-sensory flavour rooms that enhance their flavour experiences using sound, light and scents. The rooms will include flavours such as apple and cherry crush.” 84

Blu’s brand planning manager in the UK, Pete Blackman, said that when people were socialising and smoking outside in the warm weather, the company wanted to “take over those social moments and put Blu in front of mind”. 84

Promoting the blu ‘club’ (Europe, 2019)

In the UK and Ireland in 2019, a widespread campaign for myblu was launched using billboards, taxis and buses, with graphic images and phrases including “I blu do you?” and “you blu too? who knew?” As well as outdoor advertising, the product was promoted on social media, in pop up shops and at events, with the strategy being to “normalise vaping at social occasions”. 8283

Blackman, blu’s brand planning manager, said that the idea was to create the feeling of a club:

“Vaping culture has grown rapidly in the UK, with many vapers considering themselves to almost be in the know on something new and different and as a result, part of a special club…This campaign plays on that idea by creating a unique language and identity that resonates with vapers, while making the club open to everyone looking to switch” 82

The company also said it had set up ‘partnerships’ with entertainment venues in London to allow vaping. 8284

In September 2019, perhaps in response to increasing public and government concern over the use of e-cigarettes by young people (see below), Imperial launched a more information-based marketing campaign in the US. This promoted myblu to “help existing adult smokers understand that they now have a choice about how they consume nicotine”.85

- For examples of Imperial’s earlier advertising campaigns see E-cigarettes: Marketing Blu.

Price Promotions

Aggressive price promotions are also used as an incentive for current, or potential, customers, for example coupons enclosed with a product purchased, or discounted products. In 2019, a blu promotion was offering e-cigarette devices for US$1, instead of the usual retail prices of US$19.99.86

- For more background information on e-cigarette promotion and marketing, go to E-cigarettes: Marketing and E-cigarettes: Marketing Rules.

Science

Imperial uses scientific arguments rooted in a harm reduction narrative to promote its e-cigarettes as a safer alternative to cigarettes.87

In April 2021, Imperial’s head of Tobacco Harm Reduction Science also stated that e-cigarettes have “harm reduction potential relative to continued smoking”88 At the beginning of the 2021 Tobacco Products Directive (TPD) review, the main piece of European legislation covering tobacco products and newer products, Imperial submitted a piece to the EU public consultation casting doubt over the independent group’s assessment on the safety of e-cigarettes. It pushed for the policy group to consider “relative” harms of e-cigarettes rather than their absolute harms, attempting to limit future coverage of EU Tobacco Control to e-cigarettes.89

- For more information on the debate on e-cigarettes’s role in public health, see the page: E-cigarettes.

Lobbying Decision Makers for Fewer Restrictions

In 2019, when the safety of e-cigarettes was being widely debated, Imperial said that they to supported e-cigarette regulation.90 Richard Hill, CEO Fontem Ventures, stated in October: “We’re up for it… we believe that we can demonstrate that our products can operate in the interest of national health.”60

However, in a report published on its website in 2018, the company had stated:

“As vapour products do not contain tobacco, they should be excluded from all existing and future tobacco legislation, including excise”.91

Since the first e-cigarette products hit the market, tobacco companies have lobbied for more favourable marketing and tax regulations than cigarettes.92 Imperial has lobbied decision makers, through Fontem Ventures, in the UK and internationally (including where it does not yet sell its products) to oppose tougher regulations on e-cigarettes. As well as lobbying decision makers directly, it has also lobbied through trade organisations, and contracted public relations (PR) companies including: Instinctif Partners (see lobbing section below); Aspect Consulting; FTI Consulting,9394 and Bell Pottinger.94

Direct Lobbying

New Zealand: Smoking Ban In Cars (2019)

Imperial made a submission to the New Zealand Government’s Health Select Committee in August 2019, over a proposed ban on smoking in cars. Imperial’s Head of Corporate and Legal Affairs, Kirsten Daggar-Nickson, argued that it was not appropriate to include e-cigarettes in the bill, as they don’t produce smoke. She said that the company’s e-cigarettes were aimed at “people who have tried absolutely everything and cannot quit”, and not at new smokers. However, when challenged by the Committee as to what happens to their business if their existing customers quit (or die), she went on to say that their intention was to “transition them to next-generation products” and therefore switch, rather than quit.95 Imperial have made it clear to investors that e-cigarettes are ‘additive’ to their business. (See below for more on Imperial’s business strategy)

Norway: Consultation on the Implementation of the European Union Tobacco Products Directive (TPD, 2016)

Despite not selling its e-cigarettes in Norway, Imperial (as Fontem) responded to a consultation by the Norwegian Department of Health on the national implementation of the TPD. In its submission, the company asserted that e-cigarettes offered a “huge public health benefit”, and that pharmaceutical-type restrictions will unintentionally make smokers continue to use tobacco, or see them turn to illegal e-cigarettes.96

Wales: Public Health Bill (2015)

Imperial lobbied the Welsh government against the inclusion of e-cigarettes in existing smoke-free regulations, arguing that it would force e-cigarette users to use their e-cigarette in designated smoking areas where they would be exposed to second-hand smoke. It argued that the proposed Bill was based entirely on “precautionary impulse and not scientific evidence”.97

Australia: Senate Inquiry (2015)

Imperial told an Australian Senate inquiry that “E-cigarettes do not contain tobacco, do not emit smoke and do not involve any combustion. It is therefore unfair and inappropriate to conflate them with tobacco products.41

Indirect Lobbying

International: COP 8 (2018)

Imperial is a member of the UK Vaping Industry Association (UKVIA), along with other tobacco companies, and its Senior UK Government Affairs Manager has a seat on the board.9899 UKVIA lobbied against e-cigarette regulation at the 8th WHO FCTC Conference of the Parties (COP 8) in 2018. For more details see UKVIA

Scotland: Members of Scottish Parliament (2017-2019)

In 2017, public relations company Aspect Consulting, contacted Scottish Members of Parliament (MSPs) to promote the alleged health benefits of e-cigarettes.100 Although the company disclosed that it acted on behalf of Fontem Ventures, it failed to mention that Fontem was a subsidiary of Imperial. Despite lack of conclusive evidence, Aspect Consulting claimed that e-cigarettes acted as a barrier to tobacco use.100

Imperial lobbyist Lindsay Mennell Keating made multiple approaches to MSPs in 2018, including Richard Lyle, and nine further meetings were registered in 2019.101 All these instances of lobbying were recorded as being in relation to e-cigarettes.

Astroturfing Campaign: EU Citizens’ Initiative

As newer nicotine and tobacco products have come onto the market, new tobacco industry tactics are emerging that challenge tobacco control regulations. In February 2019, a campaign was launched under the European Union (EU) Commission’s “Citizen’s Initiative” called “Let’s demand smarter vaping regulation!”102 Imperial launched and part-funded this campaign which proposed revoking article 20 of the Tobacco Products Directive (TPD), which “requires EU Member States to introduce restrictions on the advertising of electronic cigarettes”.103

The accompanying website, promoted by Imperial Brands, portrayed it as a “grassroots” campaign to support a change in regulation, by differentiating e-cigarettes from traditional tobacco products.104

This is a clear example of ‘astroturfing’, a well-known tactic used by the tobacco industry to interfere with tobacco control legislation.105106

- For details see: Imperial Brands Use of the EU Citizens’ Initiative.

Pricing, Profitability and Market Share

In 2016, Imperial indicated that it would seek to get e-cigarette bottom-line profitability mainly via a pricing strategy. Arthur van Benthem, then Fontem Ventures’ CEO, was quoted as saying:

“The average consumer in the UK spends about £2 on his habit on a daily basis, versus £5 on cigarettes. The opportunity for pricing, even with excise coming in, is quite significant.”1

Van Benthem also indicated that the company would seek to reduce retailer margins on e-cigarettes and achieve cost reduction through economies of scale and focusing on online sales.

According to Euromonitor, Imperial’s share of the global e-cigarette market (by value) fell from 4.7% in 2015 to 2.8% in 2019. 54 Over the same period the market had more than doubled in value from US$8.3 billion in 2014 to over US$20 billion in 2019.107 Imperial’s share of the US market fell dramatically from 10.7% in 2015, to 3.1% in 2019. Like the other international tobacco companies, Imperial lost significant market share to JUUL Labs which rose to hold 53.5% of the US market by 2019.

In the UK market, Euromonitor data shows that, after falling to 1.4% in 2015, Imperial’s share increased to 5.2% in 2019.54Tobacco company sales figures, published in investor reports and presentations, tend to be higher than those reported by market research companies. Imperial reported its share of UK sales as 16% in 2016.63 Similar figures produced by British American Tobacco (BAT) in 2018, put Imperial at the same share (16%), although in second place behind BAT (at 41%).

2019 figures from Euromonitor put Imperial’s share between 3 and 4% in France, Italy, and Bulgaria.54 It held less than 1% of the Russian e-cigarette market, which was dominated by JTI brand Logic.54108

In its 2018 annual report, Imperial credited blu with increasing the net revenue from its newer products business “substantially to £200m or 2.6 per cent of tobacco & NGP net revenue”.15 However, investment in blu was having a negative impact on its operating profits, which had fallen by 4.4%.”15

E-cigarettes “Additive” To Tobacco Business

Like British American Tobacco Imperial has described e-cigarettes as adding to the company’s revenue, rather than replacing cigarettes. 19109 In 2020, traditional tobacco products contributed more than 97% of Imperial’s total revenue while NGPs contributed less than 3%.110

Imperial ex-Chief Executive Alison Cooper stated on several occasions that the company’s e-cigarette products are an “additive business on top of that of tobacco delivery”.109111112

Imperial continues to develop tobacco products to appeal to both non-smokers, and those who smoke and vape (‘dual’ or ‘poly’ users). In October 2018, it launched its Riverstone brand of rolling tobacco in the UK which, according to Talking Retail, it described as:

“a high-quality, easy-to-roll blend of tobacco at an affordable price, designed to appeal to new smokers as well as dualists”.113 114115

In May 2019, the company reported that Riverstone’s share of the market had grown.116 The product was relaunched in November 2019, promoted to retailers as the UK’s first ‘combi-pack’ (containing cigarette papers and filters). 113117

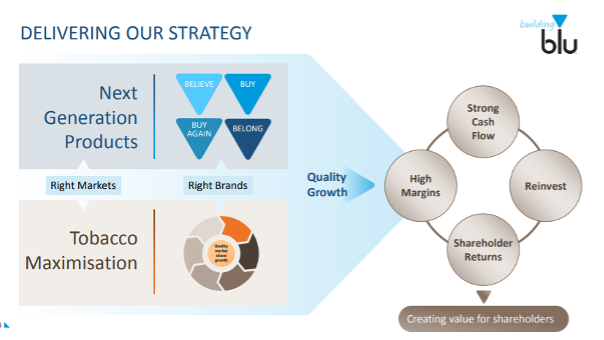

Tobacco remains central to Imperial’s business model. The main goals remain maximising growth and delivering returns to shareholders, irrespective of product or any public health gains (see image 3).419

Image 3: Imperial’s goal is creating growth and shareholder value (Source: Imperial Brands, ‘Building blu’ presentation, 2018).

A “fast follower” approach

In November 2019, Imperial announced that it would be changing strategy and “improving growth in NGP with greater discipline and a more tightly focused business model.”4 In February 2021, Imperial launched this new strategy, redesigning its approach owing to “below expectations” performance.5 Imperial’s new strategy was considered to have a “very clear focus” on cigarettes, as the “biggest contributor to value creation” for the company.5118

Recognising its role as the smallest of the four transnational tobacco companies, Imperial has described itself as a “fast follower” and “challenger business” approach,57 Imperial launched its blu bar disposable for the UK market in November 2022 to “meet the rapidly growing demand in this category”, only a few months after PMI and BAT had launched theirs.119

TobaccoTactics Resources

- Fontem Ventures

- Newer Nicotine and Tobacco Products: Imperial Brands

- E-cigarettes: Imperial’s Blu

- E-cigarettes: Marketing Blu

- E-cigarettes

- E-cigarettes: Altria

- E-cigarettes: Philip Morris International

- E-cigarettes: British American Tobacco

- E-cigarettes: Japan Tobacco International

- E-cigarettes: Tobacco Company Interests in Single Use Products

- JUUL Labs