Tobacco Company Investments in Pharmaceutical & NRT Products

This page was last edited on at

Key points

- Historic interests in Nicotine Replacement Therapy – lozenges and gums, early inhalers

- Addition of Swedish snus-style nicotine pouches in to product ranges – “modern oral”

- Acquisitions of pharmaceutical and biotech companies developing “inhaled therapeutics” e.g. inhalers for chronic obstructive pulmonary disease (COPD)

- Investments in cannabis industry with focus on inhalers, CBD and (potentially) drug delivery – “botanical therapeutics”

- Investments are part of a trend in tobacco industry “Pharmaceuticalisation”: shifting business practices to mirror those of pharmaceutical companies either by acquiring pharma companies or presenting a pharma-like public image, despite tobacco sales.

Background

Research conducted using tobacco industry documents, published in 2017, explores the history of tobacco industry interests in Nicotine Replacement Therapy (NRT) type products.1 Tobacco companies first developed nicotine replacement products in the 1950s, but the threat of regulation by the US Food and Drug Administration (FDA) meant that they stopped. After that medical NRT was produced by pharmaceutical companies, initially available on prescription, and later increasingly available over-the-counter.1 In the 1980s, the tobacco industry actively opposed NRT but, once the threat of FDA regulation had passed (with the regulation of tobacco products beginning in the US in 2009) tobacco companies re-entered the nicotine market.1 The authors note that:

Although the tobacco industry initially viewed NRT as a threat, it found that smokers often combined NRT with smoking rather than using it as a replacement and began marketing their own NRT products.1

The UK’s Royal College of Physicians (RCP) states that: “Nicotine replacement therapy (NRT) is most effective in helping people to stop smoking when used together with health professional input and support, but much less so when used on its own.”2

Alongside interests in NRT, a 2005 review of historic tobacco industry documents found that the tobacco industry was investigating nicotine analogues: molecules structurally similar to nicotine that that could be used “to create more ‘desirable’ products and to circumvent anticipated nicotine regulation”. There were also “potential pharmaceutical applications for analogues such as treatments for neurological disorders”.3

Research from the US shows how tobacco companies continue to develop and market oral nicotine products such as gums and lozenges, which may not support cessation long term, and risk take-up by non-smokers.4

More recently, transnational tobacco companies have invested in products such as non-electronic inhalers for nicotine and cannabis and, most controversially, for the delivery of medicines to treat lung disease (see PMI’s acquisition of Vectura). These interests are detailed below, by tobacco company.

For information on tobacco company investments in e-cigarettes (also known as electronic nicotine delivery systems, or ENDS), heated tobacco products (HTPs) and oral tobacco products such as snus and nicotine pouches, see Newer Nicotine and Tobacco Products.

British American Tobacco

Image 1: Slide from BAT presentation to investors (Source: British American Tobacco, Deutsche Bank Global Consumer Conference, 9 June 2021)

BAT had an interest in a nicotine inhaler, before it was abandoned in favour of its e-cigarettes, HTPs and, more recently, oral nicotine products. In a presentation to investors in June 2021, BAT said that it was “building an ecosystem beyond nicotine” and its target areas included “health and wellness” and developing products to help consumers “focus, energize and relax”.5 BAT subsequently launched a dedicated website for its Btomorrow Ventures investment arm.6 In July 2021, the website listed investments in cannabis and CBD products, meditation drinks, and other “wellness” products, including technology marketed at healthcare professionals.7

BAT investment in inhalers

Voke Inhaler

In 2010, British American Tobacco (BAT) acquired the licence to commercialise a nicotine inhaler called Voke, developed by a UK company called Kind Consumer. This product was approved for medical use in 2014, making it potentially available as a cessation product on prescription in the UK. However, BAT decided instead to invest in e-cigarettes, and handed the license back in 2017. Kind Consumer did not successfully re-launch the product and at the end of 2020 the company closed down.

- For details see Kind Consumer

BAT investments in oral nicotine products

Zonnic gum & Revel lozenge

BAT own a nicotine gum called Zonnic, which it gained from its acquisition of US company Reynolds in 2017. Reynolds had acquired this product with the Swedish company Niconovum in 2008, and marketed it from 2014, suggesting it could be used alongside cigarettes. 1 In Sweden, BAT’s nicotine pouches (see below) are also sold under the Zonnic brand.89

BAT also gained Reynold’s Revel nicotine lozenge. In 2020, Revel was rebranded as Velo, the same name as BAT’s nicotine pouches.10114 In August 2020 BAT/Reynolds filed an application to the FDA for pre-market approval for Velo lozenges in the US.1213

In 2021, the UK Velo website did not mention Revel or Velo lozenges.14

The Niconovum website states that it also “manufactures a private lable NRT product for a major retailer in the UK”, but does not give further details.15

Lyft & Velo nicotine pouches

BAT has marketed its most recently developed products, snus-type nicotine pouches, in multiple countries, including Pakistan and Kenya, mostly under the Lyft and Velo brands. In 2020, BAT acquired US nicotine pouch Dryft via its US subsidiary Reynolds (RAI), which was subsequently rebranded as Velo.

BAT positions its nicotine pouches, alongside the nicotine gum and lozenge, as “modern oral” products.16 and has submitted PMPTAs in the US for velo pouches.12

BAT (Reynolds) stated that:

“Velo is an award-winning brand bringing consistently innovative products to adult tobacco users, and a potential marketing order for PMTA submission would help to ensure adult tobacco consumers have access to FDA-regulated, consumer-acceptable product alternatives to combustible tobacco”.12

In 2023, the Canadian government authorized the marketing of BAT’s Zonnic nicotine pouch as a natural health product.17

- For details see Nicotine Pouches

BAT pharmaceuticals

Reynold’s American Inc. (RAI) acquired Kentucky Bioprocessing (KBP), a biotech company developing anti-ebola drugs, in 2014.18 BAT acquired Reynolds American Inc. (RAI), and KBP, in 2017. According to the biotech company, its business approach:

“uniquely positions KBP – and ultimately the RAI Group and BAT – to capitalize on enormous markets and create value and new revenue streams with strong, global growth potentials.”18

In 2020 KBP began developing a COVID-19 vaccine produced using tobacco plants, a move that BAT has used to promote its tobacco business. BAT director of Scientific Research David O’Reilly said that the vaccine “reflects our efforts to accelerate the development of our emerging biologicals portfolio.”19

In January 2022, BAT announced the creation of biotech investment company KBio Holdings Limited (KBio) to “leverage the existing and extensive plant-based technology capabilities of BAT and Kentucky BioProcessing Inc”.20 David O’Reilly is listed as a KBio director at Companies House.21

Philip Morris International

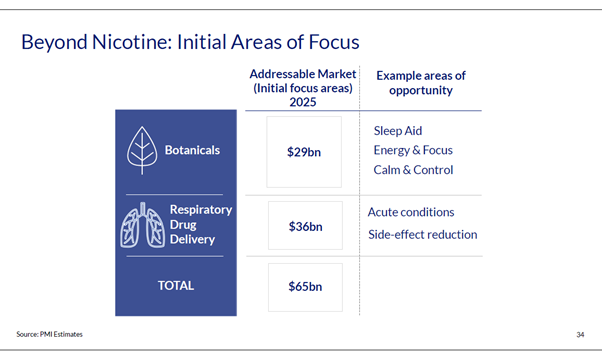

Image 2: Slide from PMI presentation to investors, 10 February 2021. (Source PMI website)

In a presentation to investors in February 2021, Philip Morris International (PMI) stated that it planned to go “beyond nicotine” into “botanicals” and “respiratory drug delivery” (image 2).22

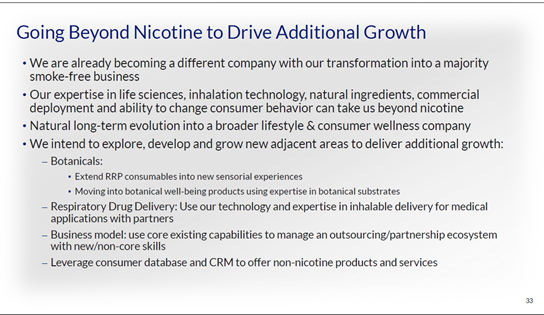

Image 3 Slide from PMI presentation to investors, 10 February 2021. (Source PMI website)

The company said that this was part of its “long term evolution into a broader lifestyle & consumer wellness company” (image 3).22 However the short-term goal was “additional growth”.22

PMI investments in inhaler devices

Syqe Medical

In 2016, PMI bought an Israeli company, Syqe Medical, which was developing a cannabis inhaler.23 PMI did not publicise this acquisition.

- For more information see Cannabis

In July 2021, PMI announced its intended acquisition of Vectura, a UK company specialising in inhaler products to deliver medicines .24 25

The acquisition was especially controversial because this type of inhaler is used to treat lung conditions often caused, or made worse by, smoking.2627 There was strong criticism of the deal, in particular from health charities and the World Health Organization (WHO).282930

Vectura, along with Fertin Pharma (see below), is now a subsidiary of Vectura Fertin Pharma, a company established by PMI in 2022 to oversee the commercial development of its pharmaceutical acquisitions.31 PMI’s Chief Life Science’s Officer, Jorge Insuasty, was appointed President of Vectura Fertin Pharma in December 2022.32 According to its website, Vectura Fertin Pharma brings together “Vectura’s expertise in inhalation and Fertin Pharma’s leadership in oral and intra-oral delivery systems”.31

- For more on Vectura, PMI’s acquisition and subsequent events, see Vectura

Oti-Topic

In August 2021, PMI announced its intended acquisition of another pharmaceutical company Oti-Topic, which is based in the US and produces respiratory inhalers.3334 Notably, it was in the final stages of developing an inhalable treatment for acute myocardial infarction (heart attack). Branded ASPRIHALE, FDA approval for the product was expected in 2022.34

PMI stated that:

“This acquisition is part of PMI’s strategic plan to leverage its expertise, scientific know-how, and capabilities in inhalation to grow a pipeline of inhaled therapeutics and respiratory drug delivery Beyond Nicotine.”34

One market analyst estimated that the market for inhalation delivery could be worth US$18 billion by 2027.35

PMI investments in oral nicotine products

In 2021 PMI acquired manufacturers of snus type nicotine pouches, and other oral nicotine products.

In July 2021, PMI announced that it was acquiring Fertin Pharma for around US$820 million. PMI described the company as “a leading developer and manufacturer of innovative pharmaceutical and well-being products based on oral and intra-oral delivery systems”.363738 In a press release PMI CEO Jacek Olczak listed products made by Fertin, including: “gums, pouches, liquefiable tablets, and other solid oral systems for the delivery of active ingredients, including nicotine” stating that the company was a “leading producer of Nicotine Replacement Therapy (NRT) solutions”.36

Fertin Pharma describes itself on its website as a global developer and manufacturer of “oral and intra oral delivery systems”,39 these include gum, tablets, lozenges and pouch powders.40 Fertin’s website states that it sells 3 billion units annually.39 It supplies these generic delivery systems to a range of global nicotine brands including products traditionally thought of as pharmaceutical nicotine replacement therapies (NRT) such as Nicotinell.4142 Fertin’s tablet and gum products are also used for the delivery of non-nicotine products including cannabinoids (CBD), pain and allergy medication, sleep aids such as melatonin and vitamins.40

According to market research company Euromonitor, Nicotinell products held a little over 10% of the market share for all NRT products in 2022.43 PMI’s acquisition therefore gives it a foothold in the global supply of NRT products.

PMI said that acquiring Fertin would enable them to develop various “botanicals and other selfcare wellness products”.36 On 15 September 2021, PMI announced that it had closed the deal.44

In 2022, the company became part of Vectura Fertin Pharma (see Vectura above).31

As of June 2023, PMI/Fertin’s ryze nicotine gum was being marketed in India,45 with trademarks registered or pending in multiple countries, including the Philippines, Indonesia, Cambodia, Lao PDR and Bhutan.46

AG Snus & nicotine pouches

In May 2021, PMI acquired Danish snus manufacturer AG Snus, which produces both tobacco leaf products and nicotine pouches.4748

Swedish Match

In 2021, PMI acquired Swedish Match, manufacturers of snus and nicotine pouches, with a large market share in Northern Europe and the US.4950

In 2021, PMI began referring to gums and nicotine pouches as “modern oral” products, as does BAT.36

- For more information see Newer Nicotine and Tobacco Products: Philip Morris International

PMI investment in a COVID-19 vaccine

Medicago

In May 2019, PMI invested CAD$15,975,000 for a 48% stake in Medicago, a Canadian biopharmaceutical company.51 In March 2020, Medicago began developing a COVID-19 vaccine that would be manufactured using tobacco plants.52 GlaxoSmithKline partnered with Medicago to assist in manufacture of the vaccine in July 2020,53 and in October 2020, the Canadian government invested CA$173 million in Medicago’s vaccine.54

This government investment in a tobacco industry sponsored vaccine was widely criticised for demonstrating a “complete disregard for [Canada’s] treaty obligations under the Framework Convention for Tobacco Control,” according to Tobacco Control experts Joanna Cohen and Simon Chapman.55 PMI’s CEO at the time, André Calantzopoulos, welcomed the Canadian Government’s collaboration with the tobacco industry, saying “Better outcomes can be achieved when governments and companies join efforts to promote shared objectives for the greater good”.56

In February 2022, Health Canada approved Medicago’s Covifenz for distribution.57 At this point PMI held a 25% stake in the company.58 However, the WHO rejected Medicago’s request for emergency global use of its Covifenz vaccine in March 2022, due to Medicago’s ties to PMI.59

Medicago’s majority shareholder, Mitsubishi Tanabe Pharma Corporation, removed PMI as a shareholder in December 2022, following an advocacy campaign led by Action on Smoking and Health (ASH) Canada and Corporate Accountability.60

In February 2023, Mitsubishi shut down Medicago, citing a lack of commercial viability for its Covifenz vaccine.61

- For more information see the COVID-19 monitoring database

Altria

Altria investments in oral nicotine products

Verve

Philip Morris US (an Altria company) had a nicotine lozenge called Verve, which they developed in 2012.162 According to US researchers, Philip Morris believed it could avoid the use of warning labels, because Verve was made with nicotine extract, not tobacco.

- For more information on TobaccoTactics see Altria: Funding Scientists

From 2016 the Verve lozenge only appeared to be on sale in Virginia.1 and by 2019 it was discontinued.63 In October 2021, the FDA gave approval to Altria to market new mint flavoured ‘discs’ and ‘chews’ in the US under the Verve brand.636465

However it is not clear if Altria intends to sell these gum and lozenge type products. The company stated that it had: “applied learnings from this successful application to our On submissions, which remain under review by FDA.”63 (see below)

On! nicotine pouch

In 2019, Altria acquired On! nicotine pouches from a Swiss tobacco company. In 2020, it submitted 35 applications to the FDA for authorisation to market these products in the US.

- For details see Nicotine Pouches

On its website, Altria positions nicotine pouches alongside smokeless tobacco, heated tobacco products, and e-cigarettes, all of which it describes as “smoke-free”.66

Altria & BAT Interests in Lexaria Bioscience

Altria and BAT have connections with Canadian company Lexaria Bioscience, relating to its drug delivery technology ‘DehydraTECH’.67

It was reported that DehydraTECH allows oils, including cannabidiol (CBD), to be dehydrated, mixed with other ingredients and added to food, drinks and creams, enabling faster delivery into the bloodstream.6869 Altria acquired a nearly 17% share of Lexaria Bioscience subsidiary Lexaria Nicotine, gaining a seat on its board, and funded its research and development (R&D) programme in 2019 “to evaluate oral nicotine delivery performance”. 70 Altria also acquired non-exclusive licence rights to use DehydraTech.70 In 2020, BAT signed an R&D agreement with Lexaria Bioscience, which excluded the US (where Altria operates)).70

This appears to relate to the production of nicotine pouches and cannabis or CBD products.

Japan Tobacco

Japan Tobacco international (JTI) owns the Nordic Spirit brand of oral nicotine pouches.

Japan Tobacco has a pharmaceutical division, which has developed drugs designed to treat medical conditions, including heart disease and lung cancer.717273

In July 2021, JT’s clinical trial list included a new drug (a PDHK inhibitor) to treat heart failure and “improve cardiac function”.74

Imperial Brands

Imperial owns nicotine pouch brands Skruf and zoneX.

- For details see Nicotine Pouches

Tobacco Tactics Resources

Newer Nicotine and Tobacco Products

Nicotine Pouches

Cannabis

Harm Reduction

Vectura

TCRG Research

- Tobacco industry messaging around harm: Narrative framing in PMI and BAT press releases and annual reports 2011 to 2021, I. Fitzpatrick, S. Dance, K. Silver, M. Violini, T.R. Hird, Frontiers in Public Health, 18 October 2022, doi:10.3389/fpubh.2022.958354

For a comprehensive list of all TCRG publications, including TCRG research that evaluates the impact of public health policy, go to the Bath TCRG’s list of publications.