E-cigarettes: Philip Morris International

This page was last edited on at

Philip Morris International (PMI) was the last of the transnational tobacco companies (TTCs) to enter the market for e-cigarettes (also known as electronic nicotine delivery systems, or ENDS). In November 2013, the company announced that it was going to produce its own e-cigarette.1 By 2020, PMI had several e-cigarette brands in its product portfolio: Nicocigs, Solaris, IQOS Mesh (later rebranded as VEEV).

PMI routinely describes e-cigarettes as being part of their portfolio of “reduced risk products (RRPs)”, which includes products containing tobacco (see below).23 Up to 2012 PMI referred to these newer nicotine and tobacco products collectively as ‘next generation products’.4 (See Product Terminology)

In a report to shareholders in April 2019, the company stated that it had spent US$6 billion (GB£4.75 billion) on these types of products in the previous decade. This figure included “research, product and commercial development, production capacity, scientific substantiation, and studies on adult smoker understanding”,5 and made up 92% of their “total research and development expense” in 2018.6 By the end of that year they held 4,600 “RRP related patents worldwide” with over 6,000 pending.5

Most of this research and development had been focussed on their heated tobacco products which they “deliberately prioritized”.5 However, in 2019 PMI stated that they had “not been idle on e-vapour products”, had invested “significantly”, and were “ready to introduce them at scale”.5

PMI has also invested in snus and nicotine pouches. See Newer Nicotine and Tobacco Products: Philip Morris International for more information.

Background

Licensing Agreement with Altria

In December 2013, PMI signed a contract including a set of licensing, supply and cooperation agreements with Altria.

Under the agreement, PMI gained the right to exclusively sell Altria’s e-cigarettes outside the United States (US), and in return Altria gained the right to exclusively sell PMI e-cigarettes in the US. They also agreed to collaborate on obtaining regulatory approval.7 Since May 2016 the commercialisation of newer products in the US has been subject to approval by the Food and Drug Administration (FDA).8

When announcing the new licensing contract in 2013, PMI Chief Executive Officer (CEO) Andre Calantzopoulos said:

“PMI firmly believes that reduced-risk tobacco products, as well as e-cigarettes, represent an important step toward achieving the public health goal of harm reduction, a potential paradigm shift for the industry and a significant growth opportunity for the company.”7

Worked with Altria on Research and Development

In July 2015 PMI and Altria announced that they would be expanding their joint working to research and develop new e-cigarettes, 9 and reaffirmed that they would continue to collaborate on “regulatory engagement and approval”.10

- See also: E-cigarettes: Altria

Concentrated on the UK and Irish E-cigarette Markets

Up to 2020, PMI mainly targeted the UK and Irish markets with its e-cigarette brands.

Acquired Nicocigs

In June 2014, it bought an independent UK e-cigarette company Nicocigs, which at the time had an estimated 27% share of the GB£275 million (US$350 million) UK e-cigarette market.11 It also began selling its brands Nicolites and Vivid in the UK.12 In 2016 PMI changed the Nicolites brand name to Nicocig.1314 However by 2019 these products were no longer sold directly; customers were redirected from the Vivid Vapours website to that of an independent retailer, underneath a link to IQOS Mesh (see below).15

After buying Nicocig in 2014 PMI claimed to hold the largest share of the UK e-cigarette market. However, while the market expanded, it appeared that each year after that PMI’s e-cigarette brands held a smaller share. According to Euromonitor International, Nicocig’s brand share fell from 7.5% in 2014, to 0.7% in 2019, and Vivid Vapor’s fell from 4.7% to 0.3%.16 PMI’s total market share in the UK fell from 12.2% (as Nicocigs) in 2014 to 1.2% in 2019.17 Over the same period the UK e-cigarette market grew in value from nearly GB£440 million to over £2.1 billion, an increase nearing 500%.18

In September 2014, Nicocigs registered trademarks for a refillable e-cigarette called VYGO,19 although it did not appear on the market.

While the e-cigarette market was still fragmented, with a large number of independent companies, by 2017 the market leaders in the UK were British American Tobacco (BAT), brands.1720

According to Nicocig’s accounts filed at UK Companies House in 2018, the company made a loss of over GB£4.3 million in 2016 and GB£8.8 million in 2017.21 The accounts also recorded over GB£14.9 million of “amounts owed to group undertakings”, and stated that Nicocigs was a going concern on the assumption of “the continued support of the [sic] its parent company, Philip Morris Holdings B.V.”21 Its 2018 accounts detailed a loss of nearly £2 million, with its revenue having halved to under £4 million, from over £8.5 million the previous year.22

In May 2018, PMI announced a contract with Primeline Group. This gave the Irish marketing company distribution and marketing rights for Nicocig and Vivid in Ireland from December of that year.23

The Vivid website was closed down in 2019 and its products discontinued.24 According to Companies House records, Nicocigs stopped supplying products to the UK market in mid-2020. After reporting further losses the company was due to be closed down in 2021, with its net debts totalling more than UK£14 million.25 The company’s accounts for 2020 cited a “challenging” business environment and competition as “the market becomes saturated with a large number of suppliers”.25 It did not mention that one of the suppliers of competing products was the parent company PMI, with new products Mesh and Veev (see below).

Sold Altria’s E-cigarettes

In 2015 PMI started selling Altria’s MarkTen e-cigarette, rebranded as Solaris, in Spain (in March) and Israel (in December). According to Jacek Olczak, at the time PMI’s Chief Financial Officer, “the Solaris brand name conveys a sense of technology and positive energy”.122627

Altria discontinued MarkTen in the US in 2018. In Spain the brand’s market share fell from 1.7% in 2016 to 0.7% in 2019, and didn’t register in Euromonitor’s figures in Israel.28 By January 2020 Solaris was no longer listed on the ‘leading brands’ page of PMI’s website29 PMI’s focus had already shifted to its own e-cigarette Mesh (see below).

Figure 1: IQOS Mesh on sale on the UK IQOS website (screengrab https://uk.iqos.com, June 2019)

Developed VEEV

Launched as IQOS Mesh

By 2016, PMI had developed an e-cigarette called IQOS Mesh. Confusingly, up to the launch of Mesh, the brand name IQOS was associated exclusively with PMI’s heated tobacco products (see below). Following an all-expenses paid pre-launch event for invited “vape insiders” in Neuchatel, Switzerland,1230 IQOS Mesh was first launched in the UK in 2016, but not widely available.31 After test marketing in London, in July 2018,6 it went on sale in UK supermarkets (including Sainsbury’s) and petrol station forecourts, as well as IQOS stores.32

This e-cigarette was designed to use pre-sealed nicotine cartridges with the brand name VEEV, in three nicotine levels and with a range of “gourmet” flavours including, in 2019, “Tobacco Harmony”, “Summer Garden” and “Passion Fruit Zest”.33 Mesh was sold on the IQOS website alongside the company’s heated tobacco products (see image 1).34 In 2019, the Vivid Vapours website had a prominent redirect to the IQOS site.15

There was no specific reference to IQOS Mesh sales in publicly available company documents in 2018 or early 2019,3536 except that “initial results were promising”.35 According to Euromonitor, PMI launched this product to “take advantage of the fast-growing non-cig-a-like closed system category in the UK”.37 Although it had a 0.2% share in the UK in 2018 and 2019 in the UK, Euromonitor stated that Mesh was “virtually non-existent” in terms of the global e-vapour market.1731

In May 2019, Calantzopoulos revealed, in an interview about IQOS production in Greece, that they planned to roll out sale of IQOS e-cigarettes internationally in 2020, on the back of IQOS heated tobacco products:

“… if we proceed with our entry into the market of conventional vapes, known as electronic cigarettes, under the IQOS trademark – which, by the way, we will start doing gradually at the end of the next year in various international markets – we will be able to do so through our infrastructure and our greater organization that has already been evolved and knows how to do that through IQOS. The initial cost of entry to the market will be much lower for us. So, the profit margins are improved.”38

In February 2020, when presenting its 2019 financial results, Calantzopoulos blamed the slow roll out of Mesh on “consumer confusion around e-vapor in the latter part of 2019” and reiterated that “IQOS MESH 2.0” would be launched in 2020.39 In another presentation also said that it was planning an “accelerated launch in Quarter 3 2020” but under the brand name IQOS VEEV, using the term ‘Mesh’ to refer to the device technology.40 In remarks to industry analystS, Calantzopoulos described VEEV as being “worthy of the IQOS brand”, and as a product suitable for “e-vapor users, adult smokers considering the e-vapor category and dual users of evapor and heated tobacco products”.41

By April 2020 PMI had withdrawn IQOS Mesh from sale in the UK,42 although VEEV liquid capsules remained available,43 and Mesh remained listed on PMI’s website.44

In February 2020 Calantzopoulos was reported as saying to investors that PMI’s “key objective is to achieve sustainable e-vapor category leadership over time”.45 According to Euromonitor data, PMI’s share of the global e-cigarette market was 0.2% in 2019, indicating a continuing fall in market share from the 1.3% it held in 2014.46

Figure 2: IQOS web page for VEEV e-liquid with pop up offer for IQOS menthol tobacco HEETS for HTPs (Source: https://uk.IQOS.com, accessed July 2020)

In April 2020, during the COVID-19 pandemic, PMI said that its plans for IQOS Mesh/VEEV and the licensed KT&G products could be delayed.47 The VEEV e-liquid page of the UK IQOS website featured a pop-up promotional offer for IQOS menthol tobacco HEETS sticks (image 2).48

See below for more on PMI’s heated tobacco products. To read about PMI’s promotion of HEETs in the UK in advance of the ban on menthol cigarettes see: Menthol Cigarettes: Industry Interference in the EU and UK.

Relaunched as IQOS VEEV

After launching in New Zealand in September 2020, PMI announced that it had “started the commercialization of IQOS VEEV, our new evapor product”.4950 It was not clear if IQOS Veev was a new product, an improved version, or simply a relaunched IQOS Mesh. (In November 2020, the PMI website still referred to Mesh devices and Veev liquids.)4151 PMI indicated that further launches were planned in 2020 and 2021, and that the “commercial infrastructure of IQOS will allow us to deploy efficiently and at scale”.50 It also said that it would be “testing age verification technology in select markets”.50

In its 2020 annual report, PMI said that it launched Veev in the Czech Republic in December.52 It also confirmed that it had discontinued its older devices using a “coil and wick”, in favour of the newer mesh product.52 By the end of 2021 PMI reported that Veev, which it now stated was an “improved version of IQOS Mesh” was also on sale in Canada, Corsica, Croatia, Finland, Italy, and Ukraine.53 The company stated that it believed that its:

“differentiated product with IQOS branding and commercial infrastructure will support a higher rate of switching compared to competitive e-vapor products”.53

It also referred to the development of an e-liquid in which flavours and nicotine are extracted directly from tobacco leaves, “without having to add flavoring ingredients”. The product was reported to be available in one unspecified market in December 2021.53 It was also reported that VEEV would be launching in Greece.54

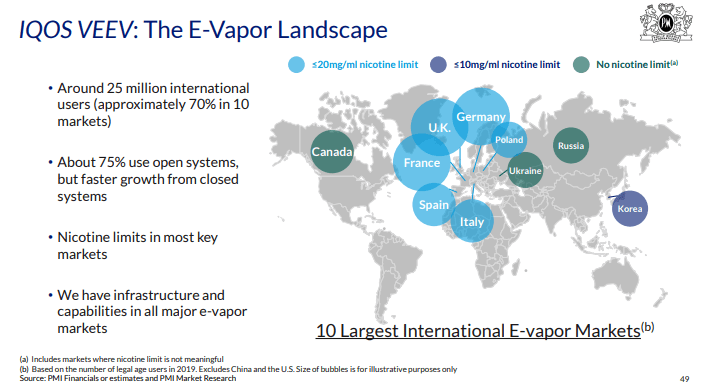

Figure 3: Slide from PMI presentation February 2020 (Source: Philip Morris International, accessed July 2020)

Nicotine Salt Product: STEEM

In 2018 PMI said it was developing a new nicotine salt e-cigarette called STEEM. Apparently “inspired by technology acquired from Duke University” in 2011.5556 This e-cigarette uses a salt created when ‘freebase’ nicotine57 is dissolved in acid. This enables higher doses of more concentrated nicotine to be consumed.58 Euromonitor described STEEM as “virtually non-existent” in the international market in 2018.31

In February 2020, PMI’s presentation to analysts featured a map of the “e-vapour landscape”, indicating different nicotine concentration limits in the 10 largest e-cigarette markets (see figure 3) including the lack of a limit in Canada, Russia and Ukraine.59 However STEEM did not appear to feature in the presentation, or in PMI’s 2020 or 2021 annual reports.5253 The reference to STEEM was removed from PMI’s web page in 2022.6061

New VEEBA ‘Disposable’

In June 2022, PMI reached an agreement with Kaival to manufacture, distribute and market bidi stick and forthcoming “disposable” products outside the US.62636465 VEEBA, launched in Canada in July 2022.6667 It was reported to be the lowest priced disposable product on the market at the time.65

On 21 July, PMI stated that:

“Responsibly marketed disposable e-vapor products can play an important role as a convenient hassle-free entry into the smoke-free category for legal-age smokers.”68

Later in 2022, PMI referred to its plans for plans for further launches of VEEBA but no countries were named.69 VEEBA was officially launched in the UK in March 2023.70

VEEV rebranded

In June 2023, after PMI rebranded its single use product VEEBA as VEEV NOW, and its reusable e-cigarette VEEV as VEEV ONE, PMI’s chief financial officer Emmanuel Babeau stated in a presentation to investors that:

“…with VEEV NOW and VEEV ONE, we have really 2 great products on disposable and closed system (…) let’s go for the market where vaping is a significant market; where there is the hope for minimum regulation today or coming soon.”71

Collaboration with KT&G

In January 2020, PMI announced a “collaboration” with South Korean tobacco company KT&G, to commercialise KT&G’s range of e-cigarettes, heated tobacco and hybrid (vapour and tobacco) products, alongside IQOS.72

- For more information see Next Generation Products: Philip Morris International

E-cigarettes or Heated Tobacco: Where Does PMI’s Interest Lie?

From 2014 it was clear that, in terms of innovation away from conventional cigarettes, PMI believed its future would lie with heated tobacco products (HTPs), rather than e-cigarettes.

PMI claims that HTP devices heat tobacco enough to release flavour and nicotine, but not enough to catch fire and produce smoke. These products give consumers a stronger and faster kick of nicotine, more like a regular cigarette. However, at the time, Calantzopoulos said that “the current generation of e-cigarettes generally has a much slower delivery profile than conventional cigarettes, which, together with a weaker taste, explains limited user satisfaction and reduced adoption rates”.73

In January 2014, PMI announced that it would be investing up to EUR€500 million (US$680 million) in its first “potentially reduced-risk” tobacco products manufacturing facility in Europe, and an associated pilot plant in Italy.7475

Most of this new capacity appeared to be geared towards the production of heated tobacco products (HTPs).

- For more information see Heated Tobacco Products.

Figure 4: PMI’s IQ Vape store in Newmarket, New Zealand (Source: IQOS New Zealand website, accessed March 2021)

Conflation of E-cigarettes and HTPs

As well as marketing Mesh/Veev e-cigarettes under the IQOS brand, PMI has marketed both its e-cigarettes and HTPs in New Zealand under the name “IQ Vape” (see image 5).76 The New Zealand IQOS website described IQ Vape as “the next evolution of IQOS”.77

- For details see IQOS: Use, “switching” and “quitting”

Controversial plan to promote VEEV to pharmacists

In August 2021 the Australian media company News Corp reported that pharmacists were going to be offered payments by PMI, to promote VEEV.7879 In Australia e-cigarettes are only legally available on prescription. Under the planned scheme pharmacists would have received nearly Aus$300 for ordering stock of VEEV, Aus$10 for telling patients about the product, and Aus$5 for dispensing the device or referring patients to a doctor to obtain a prescription.7879

The programme, delivered by PharmPrograms, was stopped after complaints from the medical and pharmacy associations and public health advocates. A spokesperson for the Pharmaceutical Society of Australia was reported as saying:

“Big tobacco’s attempt at financial kickbacks shows absolute contempt for pharmacists.”79

Member of Industry Trade Associations

Between 2017 and 2018, PMI became a member of two European industry associations: the UK Vaping Industry Association (UKVIA) which lobbies the UK government on e-cigarette regulation, and Vape Business Ireland (VBI), which has as similar role in the Republic of Ireland. Nicolites was also listed as a member of Vape Business Ireland until 2021, when the listing changed to IQOS.808182 (VBI no longer appears to list members on its website)

Both UKVIA and VBI were signatories to a document sent to the World Health Organization (WHO) lobbying for the deregulation of e-cigarettes and other electronic nicotine delivery systems (ENDS).83

- For more information see E-cigarette Trade Organisations With Tobacco Company Members and UK Vaping Industry Association (UKVIA)

TobaccoTactics Resources

- E-cigarettes

- E-cigarettes: Altria

- E-cigarettes: British American Tobacco

- E-cigarettes: Japan Tobacco International

- E-cigarettes: Imperial Tobacco

- Newer Nicotine and Tobacco Products: Philip Morris International

- JUUL Labs

- Harm Reduction

- Product Innovation

TCRG Research

- Tobacco industry messaging around harm: Narrative framing in PMI and BAT press releases and annual reports 2011 to 2021, I. Fitzpatrick, S. Dance, K. Silver, M. Violini, T.R. Hird, Frontiers in Public Health, 18 October 2022, doi:10.3389/fpubh.2022.958354

- E-cigarettes: threat or opportunity?, A.B. Gilmore, G.E. Hartwell, European Journal of Public Health, 2014, 24(4):532-3. doi:10.1093/eurpub/cku085

For a comprehensive list of all TCRG publications, including TCRG research that evaluates the impact of public health policy, go to the Bath TCRG’s list of publications.