Heated Tobacco Products: Philip Morris International

This page was last edited on at

Image 1: PMI’s IQOS and HEETS tobacco sticks (Source: Screengrab from uk.iqos.com, 15 June 2021)

PMI’s flagship heated tobacco product (HTP), called IQOS, was first trialled in Milan (Italy), and then Nagoya (Japan) in 2014.1

What is IQOS?

IQOS is a battery-operated device that heats tobacco sticks, originally called HEETS, and later sold under a range of brand names, including TEREA, SENTIA and DELIA.2 The sticks have been sold under cigarette brands Marlboro and Parliament in some countries.3 Sticks are available in several flavours.

IQOS heats the tobacco up to 350°C, compared to 600°C in cigarettes, and therefore, according to PMI there is no “combustion, fire, ash, or smoke” and “the levels of harmful chemicals are significantly reduced compared to cigarette smoke”.4 However, these claims are widely debated within the public health community. Independent reviews of PMI’s data indicate that while IQOS may expose users to lower levels of some harmful chemicals, it also exposes users to higher levels of other potentially harmful chemicals and the impact of IQOS on health remains unknown.5678 One peer reviewed review of PMI’s clinical data concluded that IQOS was “not detectably different” from cigarettes, in terms of potential harmful effects.9 PMI publishes its own evidence on IQOS on its PMI Science website.

PMI also sells e-cigarettes (also known as an electronic nicotine delivery systems, or ENDS) under the IQOS brand, called IQOS VEEV (formally IQOS MESH).1011 There is evidence that the company has conflated the two products.12 For details see PMI’s IQOS: Use, “switching” and “quitting”.

- For more information on IQOS VEEV and earlier products see E-cigarettes: Philip Morris International

Product Innovation

Since launching the IQOS brand in 2014, PMI has developed and marketed several iterations of IQOS. Between 2014 and 2018, IQOS models were numbered 2.2, 2.4 or 3.1314

In 2019, PMI launched brand extensions IQOS Multi and IQOS Duo (see image 1).3

PMI had a second HTP product under development, called TEEPS, which uses a carbon heat source to heat the tobacco sticks.15 The company alleged that this product wass closer to the look and feel of a conventional cigarette than IQOS. 16 PMI conducted a “small scale city test” of TEEPS in the Dominican Republic in December 2017, and intended to “consumer test” the product in late 2020.1718 In its 2021 annual report, PMI stated it had discontinued the current TEEPS technology following feedback from consumer testing in late 2021.19

In February 2021, PMI announced to investors that it planned to launch another device later in the year called IQOS ILUMA.320 IQOS ILUMA launched in Japan Duty Free later that year, followed by Switzerland and Dubai duty free launches in 2022.21

In November 2022, PMI launched a bladeless HTP under the IQOS brand: Bonds by IQOS. Compatible with Blends tobacco sticks, it was reported as being test marketed in the Philippines, with the company expressing intentions to expand commercialisation in the near future.22

- For more information, including other companies’ HTPs, see Heated Tobacco Products.

In September 2023, PMI announced that it had developed a “non-tobacco” stick for IQOS devices called LEVIA.2 For details see Newer Nicotine and Tobacco Products: Philip Morris International

Markets and Launches

After first launching in 2014, by 2016 IQOS accounted for 99% of the global HTP market, according to Euromonitor data.23 Although competition increased in subsequent years, IQOS continued to hold by far the largest share.52324

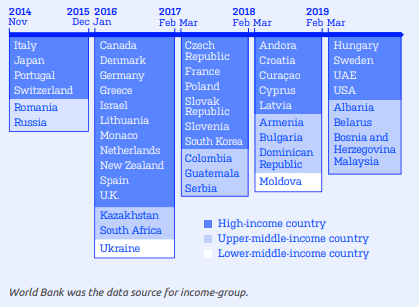

Image 2: IQOS launches by year (Source: STOP report February 2020)5

Market authorisation in the US

By the end of 2019 IQOS was available in at least 47 markets, including the United States (US).5 This followed authorisation from the US Food and Drug Administration (FDA) to launch the product on the US market, which PMI had applied for in 2017.25 26 PMI launched IQOS in the US in 2019, initially in Atlanta, Georgia.27 In July 2020, it was reported that Altria was also selling IQOS in Richmond (Virginia) and Charlotte (North Carolina), with plans to roll out to four more US cities in the following 18 months.28

Through its exclusive licensing agreement with Altria, PMI launched IQOS in the US in 2019, initially in Atlanta, Georgia.29 By May 2021, Altria was also selling IQOS in Richmond (Virginia), Charlotte (North Carolina) and Charleston (South Carolina).30 Due to patent disputes raised by R.J. Reynolds (US subsidiary of British American Tobacco), Altria was unable to sell IQOS in the US after 29th November 2021.31 In October 2022, PMI and Altria announced they would be ending their agreement with PMI paying $2.7 billion to Altria for full commercialisation rights for IQOS in the US from May 2024.31

- For more information on global market shares see Heated Tobacco Products.

Marketed in lower income countries

PMI has mainly sold IQOS in high income countries. However, it is also increasingly marketing its products in lower income countries (see Image 2). Although not officially launched, there is evidence that IQOS was available in 2018 in Vietnam, Indonesia and the Philippines, described by PMI as “key markets”. 53233 PMI indicated that it intended to formally launch IQOS in the Philippines in the second quarter of 2020, subject to meeting “some regulatory and legal requirements”.33

On 17 February 2020, PMI launched the product in Lebanon.34 IQOS had been sold previously in airport duty free stores in both Lebanon and Saudi Arabia.35

In its 2022 third quarter conference presentation, PMI stated that IQOS continued to show “promising growth in Low and Middle-Income markets”, specifically noting progress in Lebanon and Egypt.36 PMI went on to say its latest HTP development “is specifically relevant for low- and middle-income markets”.36 Based on reference to upcoming test market launches in the Philippines,36 it is likely PMI were referring to its new Bonds by IQOS product (see Product Innovation above).

Marketing during Covid-19 pandemic

During 2020, at the height of the Covid-19 pandemic, PMI’s IQOS launches continued. In July 2020, it launched in Georgia.37 In the Philippines, the product first went on sale online and in some independent retail outlets in April 2020, with IQOS stores opening in Manila in September and October.383940 In October, PMI also announced that it had launched in Jordan, although the precise timing and nature of the launch was unclear.3841 In 2020, Jordan had the world’s highest smoking rates, and was reported to have experienced a large amount of tobacco industry interference, including by PMI.42 For more information see the Eastern Mediterranean Region page.

PMI formally launched IQOS in Costa Rica in October.43 PMI said that this took their total number of IQOS markets to 61, “of which half are outside the OECD”.38 IQOS was already available in Mexico, although, after considerable lobbying, the company failed to get the Mexican government to approve its import or promotion there.4445

The Australian government also continued to reject the product, as well as e-cigarettes. For more information see Heated Tobacco Products

According to PMI, by the end of 2020, IQOS was “commercialised” in 64 markets.346 IQOS is not yet on sale in Indonesia, PMI’s largest market for cigarettes.35383 In 2023, PMI referred to a “lack of readiness” for the product in the country.2

Closed IQOS Stores In the UK

In the UK, where the overall market for HTPs is small, Philip Morris Ltd (PML) opened specialist IQOS stores in London, Bristol, Manchester and Cardiff.35 However by June 2021, most of them were permanently closed, likely due to the impact of the Covid-19 pandemic.347 PML appeared to shift its retail focus to independent grocery retailers and other potential stockists, reportedly doubling the size of its UK sales force.4849

IQOS users

PMI releases frequently updated estimates of the number of smokers who it says have stopped smoking and switched to IQOS.5051 However, it is not clear how it arrives at these estimates, as PMI does not release all of its data, and so they can not be independently verified. PMI conducted some user studies (which it submitted to the FDA),52 but these were run over periods of only 4-6 weeks which limits the ability to generalise the findings as a reflection of sustained behavioural change. The FDA’s 2020 decision on IQOS (see below) states that PMI must conduct post market surveillance studies in the US, which may provide a more accurate picture of conversion rates.52

PMI also estimates the number of users in the process of “conversion” to using IQOS.5051. However, these are based on a seven day assessment only,50 which limits the ability to generalise the findings as a reflection of sustained behavioural change. It is likely that the number of people who use IQOS exclusively is lower than PMI’s estimates.553

In 2020, PMI stated that over 10 million smokers had “switched” to IQOS, with another 4 million “in conversion”.5154 As of October 2022, PMI stated that there are approximately 19.5 million IQOS users, of which 13.5 million had “switched” from smoking to IQOS.55 PMI has previously stated that its “aspiration” is for the number of smokers switching to IQOS to exceed 40 million by 2025.56

For definitions of ‘cessation’, more details on PMI’s user estimates, the evidence on dual use, and its attempts to promote IQOS as a cessation tool, see PMI’s IQOS: Use, “Quitting” and “Switching”.

Promoting IQOS and “Smoke-Free”

Although it does not disclose its marketing spend, PMI has allocated a large amount to advertising and promoting IQOS.505 As well as retail websites and distribution deals, it has established dedicated ‘concept’ stores around the world to promote its products direct to its customers, with multiple stores in some cities.35 It has developed sophisticated, multi-platform advertising campaigns, using traditional and social media. (For examples see images from Stanford University’s research into the impact of tobacco advertising and work by the Campaign for Tobacco Free Kids). It has also promoted its products at music festivals and cultural events in glamourous locations around the world.53557 PMI has been accused of marketing IQOS and other newer nicotine and tobacco products to youth, including through the use of paid social media influencers.535575859

PMI’s promotion of IQOS is inextricably linked to its “Smoke-Free” public relations strategy, and campaigns such as “Hold My Light” and “UnSmoke Your World”. Research published in February 2020 by Stanford University shows how PMI’s promotional activities not only replicate advertising strategies used in the past to promote cigarettes, but also help to “normalize” the company and its heated tobacco products in the eyes of the consumer.55760 This normalization increases pressure on policy makers to regulate these products in ways that benefit the industry, particularly in lower income countries.

- For more information on PMI’s “Smoke-Free” Campaigns see Philip Morris International

Submitted Modified Risk Application to FDA

In December 2016 PMI submitted an application to the FDA to approve IQOS as a “Modified Risk Tobacco Product” (MRTP).6162 In 2018, the US Tobacco Products Advisory Committee (TPSAC) recommended against approving PMI’s application to market IQOS as a reduced risk product.63

On 7 July 2020, the FDA partially authorised PMI’s MRTP application. While it concluded that the data PMI submitted showed that IQOS may reduce exposure to harmful substances, it did not agree that IQOS reduces the risk of disease and death, compared to smoking cigarettes, and so had failed to meet the higher standard of “risk modification”. PMI used the US-specific MRTP order granted by the FDA to further promote IQOS and push for its approval, or deregulation, in multiple countries around the world. For more background see Heated Tobacco Products. For details and examples see PMI Promotion of IQOS Using FDA MRTP Order.

PMI submitted a new MRTP for IQOS 3 in 2021. On 11th March 2022, the FDA repeated its previous decision, granting PMI a modified exposure order, but not a modified risk order for the IQOS 3.64

- For information on PMI’s newer nicotine and tobacco products, its collaborations, and how it uses its products to undermine public health, see Newer Nicotine and Tobacco Products: Philip Morris International

TobaccoTactics Resources

- Philip Morris International

- Newer Nicotine and Tobacco Products: Philip Morris International

- PMI’s IQOS: Use, “Quitting” and “Switching”

- PMI Promotion of IQOS Using FDA MRTP Order

- Heated Tobacco Products

- Harm Reduction

- Tobacco Industry Product Terminology

Relevant links

TCRG Research

- Critical appraisal of interventional clinical trials assessing heated tobacco products: a systematic review, Braznell S, Van Den Akker A, Metcalfe C, G.M.J. Taylor, J. Hartman-Boyce, Tobacco Control, Published Online First: 08 November 2022, doi: 10.1136/tc-2022-057522

- Tobacco industry messaging around harm: Narrative framing in PMI and BAT press releases and annual reports 2011 to 2021, I. Fitzpatrick, S. Dance, K. Silver, M. Violini, T.R. Hird, Frontiers in Public Health, 18 October 2022. doi:10.3389/fpubh.2022.958354

- US regulator adds to confusion around heated tobacco products, A.B. Gilmore, S. Braznell, BMJ, 2020;370:m3528. doi:10.1136/bmj.m3528

- Understanding the emergence of the tobacco industry’s use of the term tobacco harm reduction in order to inform public health policy, S. Peeters, A.B. Gilmore, Tobacco Control, 2015; 24:182-189. doi:10.1136/tobaccocontrol-2013-051502

For a comprehensive list of all TCRG publications, including research that evaluates the impact of public health policy, go to the Bath TCRG’s list of publications.