Newer Nicotine and Tobacco Products: British American Tobacco

This page was last edited on at

Since the early 2000s transnational tobacco companies (TTCs) have developed interests in newer nicotine and tobacco products, including e-cigarettes (also known as electronic delivery systems, or ENDS), heated tobacco products (HTPs), snus and nicotine pouches.

Companies have referred to these types of product as ‘next generation products’ (NGPs) although terminology changes over time.

As the harms from conventional products have become better understood, and tobacco control measures have been put in place, the cigarette market – from which tobacco companies make most of their profits – has started to shrink. To secure the industry’s longer-term future, TTCs have invested in, developed and marketed various newer products, including in low and middle-income countries.1 They are often publicly linked to tobacco companies’ harm reduction strategies and labelled ‘reduced risk’ or ‘modified risk’ products.

There is ongoing scientific and policy debate about the role of these products in tobacco control, with concerns around long term health effects, marketing to youth, and how this diversification may help the industry to build credibility and influence policy makers.12

It is important to note that, despite increasing investment in these products, the core of the global tobacco industry’s business remains unchanged. Newer products form a small proportion of their revenue, compared to conventional products, and will do so for the foreseeable future.

Background

Like its competitors, British American Tobacco (BAT) has been investing in newer nicotine and tobacco products that, unlike cigarettes, have potential for growth in developed markets. 3 BAT’s NGPs include snus, nicotine pouches, e-cigarettes, and heated tobacco products (HTPs).

BAT has promoted its investment in newer products under the phrase “transforming tobacco” and the slogan “creating a better tomorrow”, stating that these investments are a testimony to the company’s commitment to offer “…an unrivalled suite of potentially reduced-risk products that address the varied preferences of today’s consumers”.456

In 2018, BAT stated that it had invested more than US$1 billion since 2012 in “building a whole new area of the business focused exclusively on Next Generation Products”.7 The company added: “These new products offer us another opportunity to further grow our business, while also having the potential to reduce smoking-related disease because they are considered to be less risky than normal cigarettes”.7

Yet the company’s 2018 annual report indicated that cigarettes remain at the heart of the company’s business:

“As we develop new and potentially reduced-risk product categories, our conventional cigarette business remains strong and continues to grow. This enables us to invest in the development of better and more innovative products, while continuing to deliver strong results and dividends to our shareholders.”5

This is particularly true for low and middle-income countries (LMICs). In 2020, during the COVID-19 pandemic, BAT reported that volume of its sales of cigarettes and other conventional tobacco products grew in Brazil, Bangladesh and Turkey, while, according to BAT, sales in developed markets remained “resilient”.8 In June 2021, BAT reassured investors that it had a profitable business “able to drive value from Combustibles” which remained key to growing its revenue.9

Snus

Snus is a smokeless tobacco product, traditional to Sweden, and is sold as a paste or in a tiny pouch that is placed between the gum and upper lip for a period of time.

In 2005 BAT started its snus activities with limited trial markets in South Africa, Scandinavia, Canada, and Japan.10

Three years later the company acquired Swedish snus manufacturer Fiedler & Lundgren.11

In 2011, BAT “scaled back” its snus activities to Scandinavia only, “to review our [BAT’s] approach to developing new reduced risk product categories”.12

However, in 2017 BAT’s snus activity once again picked up. Following its acquisition of Reynolds American Inc. (RAI) in the United States (US), the company gained ownership of Camel snus in the US. In Europe, that same year, BAT acquired Swedish snus company Winnington AB, adding Epok to its portfolio.1314

- For more information see: Cigarette Companies Investing in Snus

Nicotine pouches

In late 2018, BAT introduced snus-style nicotine pouches (which do not contain tobacco leaf) to its portfolio, marketing them as Lyft in the United Kingdom (UK) and Sweden (see image 1), and Velo in the US.151617 Media reports and the company’s social media posts indicate that these nicotine pouches were being promoted in lower and middle-income countries, including Ukraine,18 Belarus,19 Kazakhstan,20 Tanzania,2122 and Kenya.212324

In 2019, BAT started reframing its language around its pouch products, creating a distinction between its older tobacco leaf brands and new brands like Epok. Up to March 2021 it referred to both Epok white tobacco snus and nicotine pouches as “modern oral products”.25 After this, Epok was no longer mentioned on BAT’s main website.26

A BAT presentation from March 2019 pointed to a potential global market for these products: the “large existing base of oral products consumers around the world”.27 While describing its nicotine pouch market share in Russia, in December 2019, BAT finance director, Tadeu Marroco, also said that “Everything is doing well in Russia. We have a strong portfolio of combustibles there”.28 Once again BAT’s statements underline the continuing importance of conventional tobacco products to its business.

- For more details see Nicotine Pouches

In August 2020, BAT (Reynolds) rebranded its nicotine lozenge Revel as VELO and stated that it had submitted it to the US Food and Drug Administration (FDA) for pre-market approval.293031

E-cigarettes

After its snus acquisitions, BAT briefly dabbled in a regulatory-approved nicotine inhaler, and then turned its focus on e-cigarettes.32

- Read more about what an e-cigarette is here.

Invested in Licensed Medical Products

In 2010 BAT set up a company called Nicoventures to focus entirely on the “development and commercialisation of regulatory-approved [TobaccoTactics emphasis] nicotine products”.33 The company’s media release said that this move was a “natural extension of British American Tobacco’s approach to tobacco harm reduction…”34 Soon after, Nicoventures entered into a distribution agreement with entrepreneurial healthcare company Kind Consumer Limited to commercialise the latter’s non-electronic nicotine inhaler, Voke. After a lengthy application process the product was licensed as a medicine. For details see Kind Consumer

However, in early 2017 BAT pulled out of the partnership. BAT’s Scientific Director David O’Reilly conceded that BAT was never fully committed to ensuring that its products were compliant with medical grade safety standards:

“We were never really interested in prescription products. At that time, the medicinal route was the only route to market, but smokers do not see themselves as patients. Now there are additional routes to market, and we are devoting significant time and resources to extending consumer choice and delivering even better next-generation tobacco and nicotine products”.35

One of the so-called “additional routes to market” referred to by O’Reilly was e-cigarettes.

Acquired and Developed E-cigarettes

BAT was one of the first tobacco companies to enter the e-cigarette market (after RJ Reynolds and Altria, see: E-cigarettes: Industry Timeline) with the launch of its Vype e-cigarette on the UK market on 30 July 2013.36 The e-cigarette was developed by a company called CN Creative, which had been acquired by BAT the year before.3738

From 2015 to 2019, BAT bought several other small e-cigarette manufacturers (CHIC, Ten Motives, VIP, and Twisp), and in 2017 inherited the popular Vuse e-cigarette when it acquired tobacco conglomerate Reynolds American Inc. (RAI). In 2019, BAT/Reynolds acquired a share of e-liquid manufacturer VapeWild, although it was subsequently closed down.8 In January the same year BAT also acquired a minority share of Ayr Ltd, a UK manufacturer and retailer.[British American Tobacco, Annual Report and Form 20-F 2019, accessed July 2021[/ref]

Vype and Vuse were BAT’s flagship brands, both marketed in various formats (see image 2 for Vype brand extensions). BAT began consolidating its e-cigarettes under one global brand, Vuse.3239 See below for more details.

To date, the e-cigarette is BAT’s most widely sold newer product, albeit not with the biggest profit margin (see below).32 “Key markets” for BAT were initially the UK, France, Germany, Canada and Mexico (where it launched in February 2019).40 It added the US to this list in 2020.8 In addition, BAT has sold its e-cigarettes in the US, Guatemala, Colombia, Germany, Ireland, Poland, Hungary, Kuwait, Bahrain, Greece, Italy and New Zealand.414243

Read more detailed information on BAT’s e-cigarettes business here:

- E-cigarettes: British American Tobacco;

- E-cigarettes: BAT’s Vype and Vuse; and

- other companies involved in BAT’s e-cigarette business: Nicoventures and CN Creative.

See also Cannabis below.

Launched ‘Vape Explained’ website

In December 2020, BAT launched a website vapeexplained.com.4445 This was described as “a digital information hub providing adult smokers and vapers with factual answers to the questions most commonly searched for online.”45

BAT stated that the site would help people make informed decisions and “separate fact from fiction”, and that it was “not operated for advertising or marketing purposes”.46

In February 2022, the company was promoting a similar site it had set up in Canada, called clearthesmoke.com.47

Heated Tobacco Products

Due to its focus on e-cigarettes, BAT entered the HTP market later than its competitors Philip Morris International (PMI) and Japan Tobacco International (JTI).

i-Fuse

In 2015, BAT launched its first HTP product, iFuse, a hybrid product that heated an e-liquid to around 30°C, to create a vapour that is passed through a tobacco pod (similar to JTI’s PloomTech).48 iFuse is no longer available and was superseded by glo.

Glo

Glo is BAT’s flagship HTP. It was first test marketed in Sendai, Japan, in December 2016.4950 In 2017, the product was rolled out nationally in Japan and also introduced in other countries. 51 Glo uses a battery operated device to heat tobacco sticks to around 240-280°C.52 BAT’s sticks are called Neostiks and sold under its cigarette brand Kent and new brand Neo.53

BAT claimed that glo was “a real game changer for consumers”,50 and “a simpler and more practical alternative to IQOS.”54 In 2019, glo was available in three versions (image 3): the glo Pro, glo Nano, and the glo Sens. The Sens was a hybrid like the iFuse, although by 2021 it appeared to have been withdrawn.8 Glo is not as widely distributed as BAT’s e-cigarettes, although it said it aimed for glo to be the “fastest growing THP brand”, challenging PMI’s dominant product IQOS. In 2020 BAT launched glo Hyper, with “induction heating”, first in Japan, the Russia and Ukraine.8

BAT’s key markets for glo remain Japan and South Korea (together forming the bulk of the global market for HTPs)55 ]52 although Russia, Italy and Romania appear to be of increasing significance to the company.52 BAT has also reported trial marketing in Kazakhstan, Serbia, Croatia, the Czech Republic, Poland, Greece, Canada, Bulgaria, and Switzerland.4256 In late 2019, BAT said it was “getting more and more traction in glo across Eastern Europe”.28 In March 2020, The Guardian reported that BAT was advertising glo on Facebook in Poland and Romania, in contravention of the platform’s policy.57 (It was also promoting its e-cigarettes through its social media accounts, after a clamp-down on the use of social media influencers.57 For more information see E-cigarettes: British American Tobacco.)

As of April 2022, BAT stated that glo was available in 25 markets, “driven by the innovative glo hyper model in Japan and across our Europe and North Africa (ENA) region”.58

In July 2022, BAT launched BAT announced the launch of its Glo Hyper X2 device, initially in Japan.59 In February 2023 it launched the product in South Korea, in direct competition with PMI’s IQOS and KT&G’s lil heated tobacco products, which dominate the market.6061 It was reported in local media that the company was promoting the new product with “a wide range of experiential marketing, from alcoholic beverages … to pop-up stores”.[translated from Korean]62

Eclipse/ Neocore

In mid-2018, BAT had appeared to be intending to launch a HTP called Eclipse in the US.63 This was the brand name of a carbon-tipped product originally developed by Reynolds American Inc. (RAI) in 2014 (later renamed Revo), which the company had shelved in 2015.64 In 2017, BAT said it had received a “substantial equivalence” clearance from the FDA for Eclipse, which would enable it to launch the product in the US without a Pre-Market Tobacco Application (PMTA), on the basis that it was essentially the same as RAI’s previously commercialised product.6364 BAT had previously said it was going to submit a PMTA to the FDA for glo.65 (PMI was granted such permission in April 2019 for its IQOS.) 66 In 2018, BAT received FDA approval for Eclipse, now renamed Neocore.676869

It is unclear what BAT’s plans are for either glo or Neocore in the US. Bowles indicated that he was in no rush to put glo on the US market, with e-cigarettes being the dominant newer product, and “oral tobacco” (presumably Velo) having “a very big potential in the US”.70

According to the Financial Times, in 2019 BAT had “ambitions to build its global heated tobacco share from 10 per cent to 25-35 per cent by 2024”.71 Although BAT appeared to gain some market share from PMI between 2017 and 2018, by 2019 PMI was regaining lost ground.5572 In 2021, BAT remained below its target, holding 15.3% of the market.73 For more on the global HTP market and company shares see: Heated Tobacco Products

Non-tobacco product to circumvent regulation

In October 2023, BAT announced that it had launched a new non-tobacco stick for glo, called veo. Made with Rooibos tea leaves, and infused with nicotine and flavours, it was launched first in the Czech Republic, then other EU countries.74 75 It appeared that this product was developed in order to circumvent regulations which apply to heat sticks containing tobacco, specifically potential bans on flavours.7576 BAT declined a request from Reuters to comment on the implications for health of inhaling this product.76

Cannabis

In February 2020, BAT announced that they were researching CBD and THC flavourings for their e-cigarettes.77 In January 2021 BAT said that it had begun test sales of a CBD products called the “VUSE CBD Zone” in Manchester, UK, with a potential roll-out later in 2021.78

For more information see: Cannabis

Changed Risk Statements

BAT has reframed the language and health claims it has made for its newer products over time. In 2014, BAT stated on its website that smoking its e-cigarettes was “substantially less risky than smoking tobacco”.79 By April 2016 it had started to refer to its e-cigarettes as “vapour products” which, along with its HTPs, it now deemed “less risky alternatives” to conventional cigarettes. 80 By mid-2018, BAT had begun using the term “Potentially Reduced Risk Products” (PRRPs).5428182 It defined these in 2019 as products which:

“have been shown to be reduced-risk; are likely to be reduced-risk; or may have the potential to be reduced-risk, in each case if switched to exclusively as compared to continuing to smoke cigarettes.”83

A disclaimer adds that no such claims are made in the US without clearance from the Food and Drug Administration, the FDA.83 However in 2021, BAT dropped the word “potentially”, and referred to these products as “reduced-risk products”, citing “the weight of evidence and assuming a complete switch from cigarette smoking”, in addition to the US disclaimer.8485

NGPs: An “Additive” Opportunity for BAT?

Irrespective of the product or claims of harm reduction motives, BAT’s primary goal remains the same: growing its market share and revenue in order to deliver profits and returns to shareholders.

Global Nicotine Market Growing?

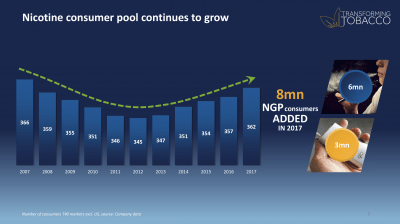

At the company’s Investor Day in March 2019, BAT’s Chief Marketing Officer Kingsley Wheaton reported that BAT estimates showed that the number of tobacco and nicotine consumers had grown since 2013.6 A few months earlier, in October 2018, BAT’s then-CEO Nicandro Durante had hosted a briefing session for industry analysts, sharing BAT data that showed an increase in nicotine users from 345 million in 2012 to 362 million in 2017 in its markets outside the US (see image 4).42 The increase reversed a decline in nicotine use from 2007, as people gave up smoking cigarettes, indicating that newer products were at least partially responsible for the growth in the number of people in the “nicotine consumer pool” since then.

New “Entrants”

At the 2019 BAT Investor Day, BAT’s Director New Categories, Paul Lageweg, showed investors that BAT “was back in the growth business” and that category growth was “driven by entrants”.56 BAT defined “entrants” as people aged 18 and older who are entering the “nicotine category”,56 in other words, those who previously did not smoke or use other nicotine products such as e-cigarettes or snus. According to Lageweg, three million new nicotine users entered these “new categories” globally in 2018.56 The share of new entrants was particularly high in the US.56 This may have been due to the popularity of a product of one of its competitors, JUUL Labs, amongst US teenagers.

Of the various products in the NGP category, Lageweg suggested that a higher proportion of increased sales of e-cigarettes (58%) could be attributed to new entrants, compared to the proportion for HTPs (11%) (see image 5).56 Lageweg added that although growth in HTPs was driven by switchers (those that switch from smoking cigarettes), its proportion of new entrants was still growing. According to Lageweg, 50% of the increase in the snus market was due to new nicotine users.56

Dual Use and “New Consumption Moments”

Emerging industry evidence suggest that a significant number of smokers may not be necessarily switching to newer nicotine and tobacco products, but use these products alongside cigarettes (known as dual, or poly use).

In a presentation to investors in September 2019, CEO Jack Bowles and Finance Director Tadeu Marroco reported “evidence of poly-usage across the categories”.40 In his March 2019 presentation, Lageweg had been more specific and showed investors a graph that suggested that 65% of e-cigarette users were dual users, as opposed to 55% of HTP users.56 The year before, then-CEO Durante said that dual use had become “the key consumer dynamic”, with dual use growing from 13% to 23% in less than one year.42 In its 2021 annual report, BAT stated its own research suggested “a high percentage of modern oral users are already poly-users of other categories”.52

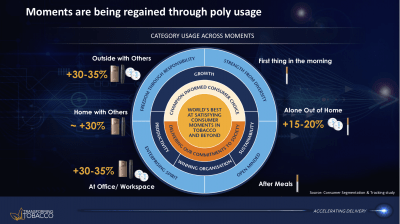

BAT has also told investors that due to dual use, “moments are being regained” (see image 6).56 By that, the company means that smokers now have other products to use when smoking is not allowed or socially unacceptable, such as in a shared office, at home with family, or in public social spaces. Another BAT presentation identified the most popular “new occasions” for e-cigarette users were “when I can’t smoke cigarettes” (86%), “In the car” (62%) and “Inside pubs and restaurants”(47%).42

Expectations Going Up in Smoke?

Like its competitors, BAT has been ambitious in setting targets for its newer nicotine and tobacco products.

In 2019, the company said that it was going to double its revenue from these products by 2023/24 to UK£5 billion.32 It also claimed that this part of the business was more profitable than cigarettes, which had a 65% profit margin. HTPs were described as the most profitable (81%), with double the profit margin of e-cigarettes (42%). Snus was also more profitable (78%), while the newer nicotine pouches were less so (66%).6 However the profit margin on HTPs had fallen by 2% the previous year, while it had increased on every other product, with the margin on e-cigarettes nearly doubling.6

In September 2019 the company announced that it was going to cut 2,300 jobs globally, allegedly so that it could continue to invest in its newer products.86 One month later, the company appeared to be lowering investor expectations regarding sales.87 In late November 2019, BAT announced that it was “simplifying” its portfolio to focus on three flagship brands only: e-cigarettes would be branded as Vuse, “modern oral” products as Velo, and HTPs as glo.88 As of 2021, this rebranding was ongoing.889

In its 2020 and 2021 annual reports, BAT reiterated the UK£5 billion goal, through a “step change in New Categories”, but with the target year pushed back to 2025.852 In 2021 BAT told investors that its “new category” products were still on a “pathway to profitability”.990

Rebranded Using New Products Slogan

In March, 2020 BAT rebranded its website, with a new logo and the prominent strapline ‘A Better Tomorrow’.91 This phrase had originally been trademarked by subsidiary Nicoventures in July 2019 and had been used to promote its newer products, notably in motorsports. It was also registered to cover conventional tobacco products.92

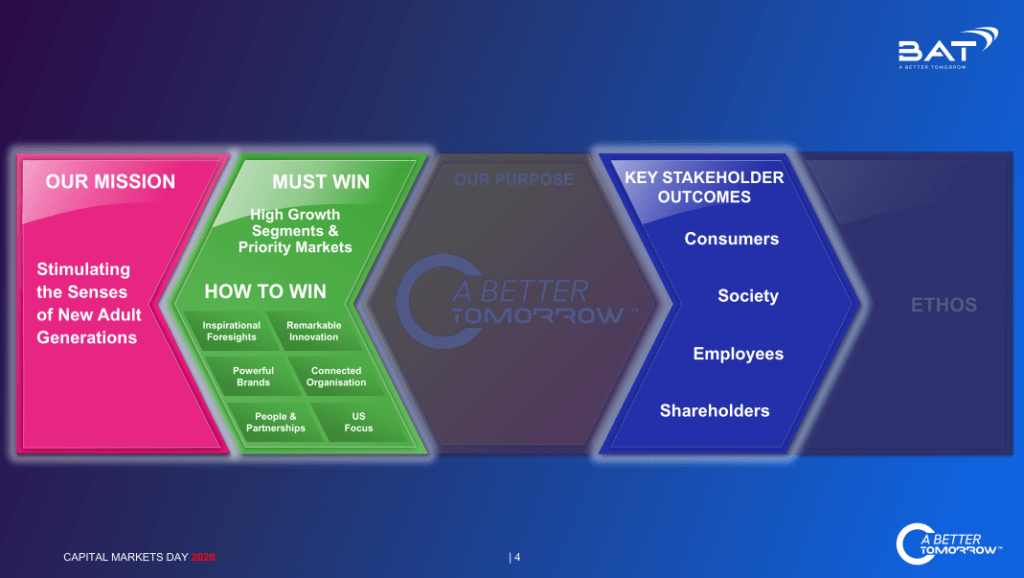

The ‘About Us’ web page placed this slogan at the centre of BAT’s strategy (see Image 7):93

“Our purpose is to build a better tomorrow by reducing the health impact of our business through offering a greater choice of enjoyable and less risky products for our consumers.”93

Tobacco products remain “at the core” of its business and key to growth, and the company only expresses an “aim to generate an increasingly greater proportion of our revenue from products other than cigarettes” in order to reduce health impacts.

BAT stated that its new mission was about “stimulating the senses of New Adult Generations”. According to its investor presentation in March 2020, this includes stimulating senses through the use, not just of newer products, but also of conventional cigarettes and roll your own tobacco (RYO) (Image 8).93

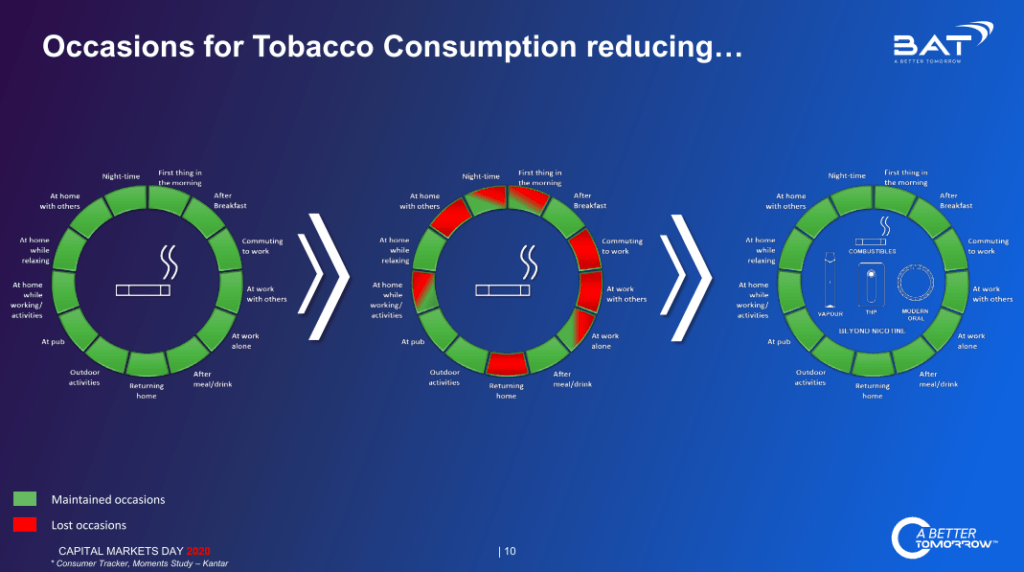

It developed the idea of “regaining moments”. It termed the times when smoking is restricted due to regulations, or social norms, as “lost occasions”, and that these were all occasions that could be “maintained” around the clock through the use of BAT’s newer products (Image 9).93

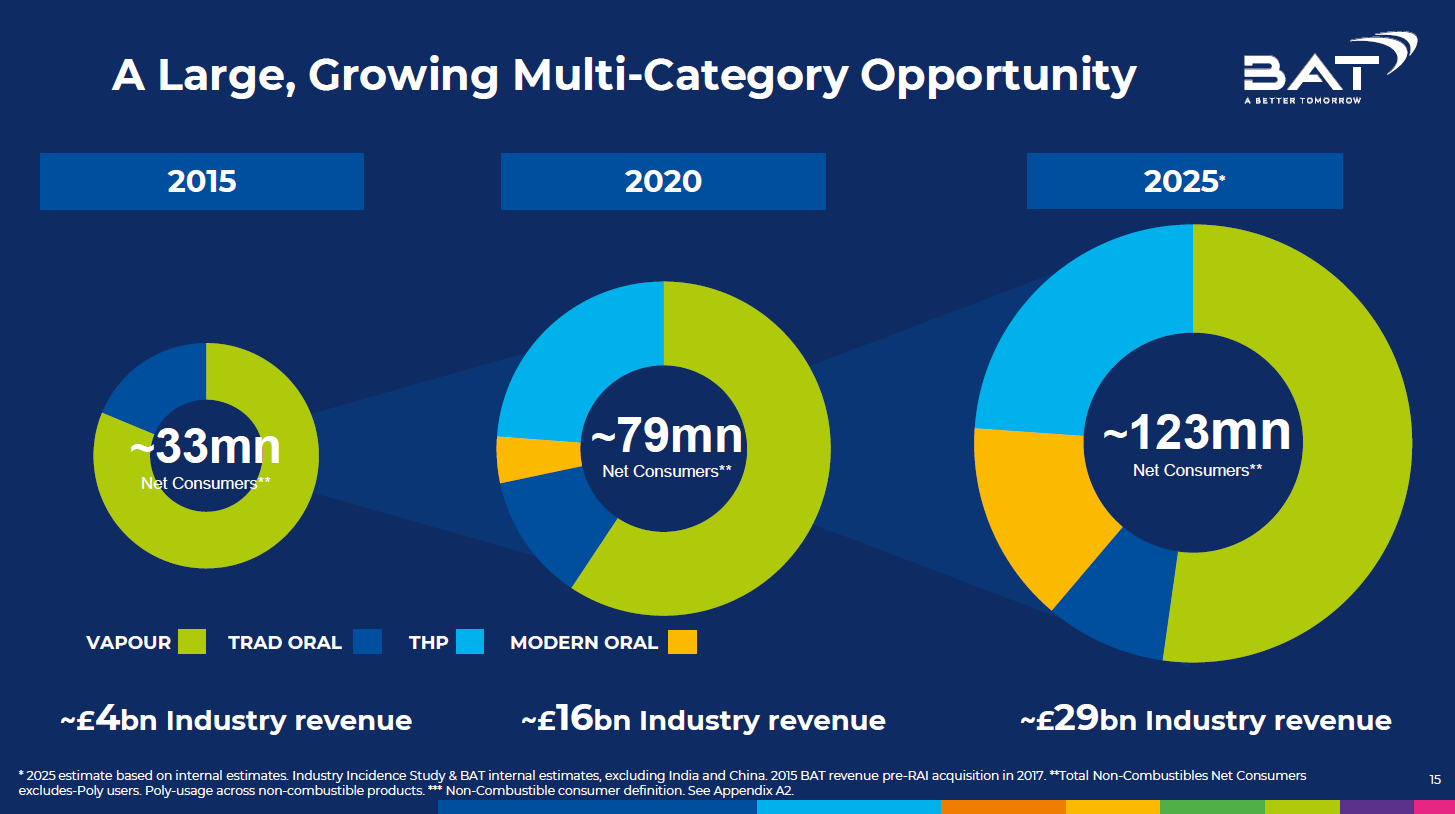

Image 10: The Market Opportunity (Source: British American Tobacco, Deutsche Bank Global Consumer Conference, 9 June 2021)

BAT’s 2020 Annual Report continued the theme, with reference to “the evolving and varied needs of today’s consumer who seeks sensorial enjoyment for different moods and moments”.8 In 2021 BAT also referred to “On The Go Wellbeing & Stimulation” in a presentation to investors, while predicting further growth in the nicotine consumer pool (image 10).94

In 2021, BAT claimed “15 million users of our non-combustible products” (which would include snus and heated tobacco) and that it aimed to reach 50 million by 2030.990 It did not specify how many of those consumers are in LMICs, but BAT noted that its target markets vary according to consumer preference and regulatory restrictions:9

“If you think about New Categories, generally they are working in the sort of northern hemisphere markets on a sort of swath from America, through Canada, West Europe that’s the sort of Vapour heartland. Then through into Southern and Central Europe and the CIS and Northern Asia, where it becomes progressively more tobacco heating.”

There are also demographic differences which impact on the markets BAT chooses to target. For example, in Canada there is much higher proportion of teenage and young adult customers (many of whom have never smoked) compared to the UK, where most customers are older and former smokers.95 Differing regulation, including country-specific rules governing nicotine levels and flavours, is also a factor.9596 According to the NGO Physicians for a Smoke-Free Canada, BAT sells the most high-nicotine products there.96

See the page on Harm Reduction for an explanation of how the tobacco industry makes use of the language of public health to advance its commercial objectives.

BAT is one among several tobacco companies that have invested in therapeutic products such as nicotine lozenges, gum and inhalers. More information can be found on this page:

TobaccoTactics Resources

- British American Tobacco

- E-cigarettes: British American Tobacco

- Heated Tobacco Products

- Cigarette Companies Investing in Snus

- Nicotine Pouches

- Tobacco Company Investments in Pharmaceutical & NRT Products

- Newer Nicotine and Tobacco Products

- Harm Reduction

- Product Terminology

- Industry Approaches to Science on Newer Products

Relevant links

- BAT website

- British American Tobacco’s ‘resilience’ does not herald a ‘Better Tomorrow’, Action on Smoking and Health (ASH) blog by Andy Rowell, TobaccoTactics, April 2020

TCRG Research

Tobacco industry messaging around harm: Narrative framing in PMI and BAT press releases and annual reports 2011 to 2021, I. Fitzpatrick, S. Dance, K. Silver, M. Violini, T.R. Hird, Frontiers in Public Health, 18 October 2022, doi:10.3389/fpubh.2022.958354

Transnational tobacco company interests in smokeless tobacco in Europe: Analysis of internal industry documents and contemporary industry materials, S. Peeters, A. Gilmore, PLoS Medicine, 2013,10(9):1001506

Understanding the emergence of the tobacco industry’s use of the term tobacco harm reduction in order to inform public health policy, S. Peeters, A.B. Gilmore, Tobacco Control, 2015; 24:182-189, doi:10.1136/tobaccocontrol-2013-051502

For a comprehensive list of all TCRG publications, including TCRG research that evaluates the impact of public health policy, go to the Bath TCRG’s list of publications.