E-cigarettes

This page was last edited on at

As the harms from conventional products have become better understood, and tobacco control measures have been put in place, the cigarette market – from which tobacco companies make most of their profits – has started to shrink. To secure the industry’s longer-term future, transnational tobacco companies (TTCs) have invested in, developed and marketed various newer nicotine and tobacco products.1

Since the early 2000s TTCs have developed interests in e-cigarettes (also known as electronic delivery systems, or ENDS), heated tobacco products (HTPs), snus and nicotine pouches. Companies have referred to these types of product as ‘next generation products’ (NGPs) although terminology changes over time.

- See the Product Terminology page for more details, including terms favoured by the industry.

This page gives an overview of TTCs interests in e-cigarettes, which have been acquired, developed and sold by these companies since 2012. Products produced by other companies which do not have links to TTCs are not covered on TobaccoTactics.

We link to further pages giving more detailed information about each company’s products, market share and business strategy, including methods used to promote their products around the world. We also point to examples of lobbying activity conducted by, and on behalf of, tobacco companies, in order to influence regulation around e-cigarettes.

- For answers to some frequently asked questions about e-cigarettes see E-cigarettes: The Basics

There is ongoing scientific and policy debate about the role of these products in tobacco control, with concerns around long term health effects, marketing to youth, and how this diversification may help the industry to build credibility with policy makers.12 Products are often publicly linked to tobacco companies’ harm reduction strategies. However, research updates on, and analysis of, the potential health benefits/risks of e-cigarettes are outside the scope of TobaccoTactics.

Image 1: Transnational tobacco companies’ main tobacco and e-cigarette brands (Images source: IMB, PMI, BAT and JTI corporate websites, accessed October 2022)

Tobacco Companies Enter the E-cigarette Market

Tobacco companies began buying existing e-cigarette brands and developing their own e-cigarette products from 2012. At the time, the global e-cigarette market was highly fragmented and dominated by independent companies, with the Financial Times estimating in June 2013 that the market was worth $3 billion.3

Tobacco companies were well placed to take advantage of this fast growing market, as they had established distribution points and the resources to cover the costs of marketing. They were also in a position to meet the financial and legal demands that would likely come with any future regulation of e-cigarettes (see below).3

In 2012 and 2013 there was a flurry of tobacco company investment in e-cigarettes, both in the United Kingdom (UK) and in the United States (US), a trend which continued in subsequent years.

- For a diagram showing the tobacco industry’s entry into the e-cigarette market see E-cigarettes: Industry Timeline.

By 2018, British American Tobacco (BAT), Imperial Brands, Japan Tobacco International (JTI), and to a lesser degree Philip Morris International (PMI), all had their own ‘flagship’ e-cigarette brands, and were expanding their global markets. In the same year, Altria bought a minority stake in US e-cigarette manufacturer JUUL Labs. Market research company Euromonitor International estimated that the e-cigarette market had quadrupled in value, from under US$5 billion in 2013 to more than US$20 billion in 2019.45

British American Tobacco

British American Tobacco (BAT) launched Vype in July 2013. This e-cigarette was originally developed by CN Creative, a start-up acquired by BAT in December 2012 and later merged into Nicoventures.67 After forming a ‘strategic partnership’ with US tobacco company Reynolds American Inc (RAI) in 2014, BAT acquired the whole company and its Vuse range of e-cigarettes in 2017. For more information, see Reynolds American Inc.

BAT went on to acquire more independent e-cigarette companies, and developed a range of products under the Vype and Vuse brands. In 2020, BAT began consolidating the two brands as Vuse.8910 In 2022 it launched a “disposable” product Vuse Go (see below).

- For detailed information on BAT’s e-cigarettes and tactics see E-cigarettes: British American Tobacco and E-cigarettes: BAT’s Vype and Vuse.

Imperial Brands

Imperial Brands‘ subsidiary Fontem Ventures acquired Dragonite in August 2013, previously owned by Hon Lik, the Chinese pharmacist who claims to have invented the e-cigarette. In July 2014, as part of Reynolds’s acquisition of Lorillard, Imperial bought blu.11

Lorillard was the third largest cigarette manufacturer in the US at the time it acquired the e-cigarette company ‘blu ecigs’ in 2012.12 In 2013, it entered the UK market by taking over ‘Skycig’, a leading independent brand, which was then rebranded as ‘blu ecigs’.1314 When Reynolds acquired Lorillard, blu was sold to Imperial to avoid antitrust concerns.1115

In February 2015, Imperial launched its own e-cigarette ‘Jai’ in Europe.16 However blu became Imperial’s flagship brand.

- For more on Imperial’s e-cigarettes and tactics see E-cigarettes: Imperial Brands.

Japan Tobacco International

Japan Tobacco International (JTI) bought UK e-cigarette brand E-lites in June 2014 from Zandera.171819

After acquiring US e-cigarette company ‘Logic’ in July 2015, E-Lites was rebranded as Logic, and this became JTI’s flagship brand.2021

- For more on JTI’s e-cigarettes and tactics see E-cigarettes: Japan Tobacco International.

Philip Morris International

Philip Morris International (PMI) was the last of the international tobacco companies to enter the e-cigarette market. It announced in December 2013, that it was teaming up with Altria to market electronic cigarettes and other tobacco products it described as “reduced risk”.22 PMI gained the right to exclusively sell Altria’s e-cigarettes outside the United States. In 2014, PMI acquired UK company Nicocigs, the owner of the ‘Nicolites’ brand.2223 After rebranding ‘Nicolites’ as ‘Nicocig’, PMI went on to develop its own e-cigarette IQOS Mesh, which went on sale in the UK in 2018, alongside IQOS Heated Tobacco Products.242526

Mesh was relaunched as VEEV in 2020. In 2022, PMI launched a “disposable” e-cigarette called VEEBA (see below). However, PMI’s interests in e-cigarettes are relatively minor compared to its interests in HTPs.

- For more on PMI’s e-cigarettes see E-cigarettes: Philip Morris International.

Altria

Altria launched ‘MarkTen’, produced by its subsidiary Nu Mark, in the US in 2014.272829 Altria acquired independent US e-cigarette company Green Smoke in 2014.3031

Both brands were discontinued in December 2018 and Altria announced that it had bought a 35% stake in market leader JUUL Labs, at the time a leading player in the US e-cigarette market, for US$12.8 billion. By June 2022, this investment was reported to be worth only US$450 million.32

- For more on Altria’s e-cigarette interests see E-cigarettes: Altria and JUUL Labs.

Patent Claims

In March 2014, Imperial Brands’ Fontem Ventures launched legal proceedings over patents in California against nine of its US rivals including the top three Lorillard‘s Blu Ecigs, NJOY and Logic, and BAT’s Nicoventures. According to the Financial Times the lawsuit showed that “big tobacco” was becoming increasingly aggressive in the battle for the fast-growing e-cigarette market: “patents are expected to play an increasingly crucial role as big tobacco companies vie with smaller rivals to gain market share.”3334

Fontem Ventures also instigated lawsuits against Altria subsidiary Nu Mark, and RJ Reynolds (BAT). Most of these cases had been settled out of court by 2017.35363738

E-cigarette company JUUL Labs filed multiple complaints of patent infringement in the US courts, in October and November 2018, mainly against companies in China and Uruguay.3940 In December 2018, Altria acquired a 35% share in JUUL Labs, who subsequently dropped the infringement claims in April 2019.41

The Global Market

According to Euromonitor International, between 2014 (after the first transnational companies entered the market) and 2018 the value of the global e-cigarette market more than doubled from US$6.8 billion to over US$15.5 billion. By 2021, it had risen to nearly US$22.8 billion.42 (NB all figures quoted here are by current value and rounded)

The biggest markets by far remained the US and Western Europe. In the US the value of the market grew from US$2.6 billion in 2014, to over 9.6 billion in 2019, although it then fell significantly in 2020 to around 7.8 billion in 2021. The Western European market grew from US$2.3 billion to US$6.5 billion by 2021. The UK is the largest of the markets in the region, worth over UK£2.6 billion (US$2.9 billion) in 2021.42

The value of the market in the Asia-Pacific region, a key target of tobacco companies, nearly doubled to US$1.4 billion between 2014 and 2018. After growing rapidly to US$2.2 billion in 2019, it doubled again to US$4.4 billion in 2021, making it the fastest growing regional market in terms of value. Markets grew more slowly in Eastern Europe, and the Middle East. The much smaller market in Latin America rose to $US120 million in 2021, nearly doubling in two years.42

Market size is clearly affected by national laws governing the sale of e-cigarette products. (See below for information on regulation) However, the existence of regulation restricting or banning the sale of e-cigarettes does not necessarily mean that tobacco company products are not available to purchase in a particular country – see for example BAT’s sales of Vype in Mexico.

Euromonitor International puts BAT’s share of the global e-cigarette market (by value) at around 17.5% (in 2016, before its acquisition of RAI, it had been 3.5%). JTI and PMI’s market share fell from 2014 and Imperial’s from 2016.4243 PMI’s overall share remains the lowest of all the transnational companies (0.2%)

Between 2015 and 2019 tobacco companies lost a significant slice of the market to the new competitor JUUL Labs, whose global share rose rapidly to nearly 28% in 2019.4243 In the US the rise of JUUL was even more marked, with the company gaining share from both independent e-cigarette companies, and tobacco companies. By 2019, JUUL held over 50% of the US market. It had gained over 15% of the market in Ukraine, but little across western Europe, where it began withdrawing from markets in 2020.4243 Faced with regulatory challenges, especially in the US, JUUL’s share of the market started to decline in 2020. For more information, see JUUL Labs.

Overall independent (non-TTC) e-cigarette companies have maintained the larger share of the global market. However, this fell from over 80% in 2014 to just over 56% in 2019. The market share of independent companies began rising again in 2021, likely benefiting from the withdrawal of JUUL from some markets. Since 2017, Chinese manufacturer RELX Technology, has held a rapidly increasing share of the global market, nearly doubling each year to 9% in 2021. This gives it the third largest share of any company, after BAT and JUUL.4243

New “Disposables”

In 2021, the company with the next largest share after RELX in 2021, was EVO Brands which held a 1.7% share of the global market. EVO manufactures disposable Puff Bars. These single use products have proved controversial owing to evidence of increasing youth use and concerns around their environmental impact.44454647 Although widely on sale, EVO’s products have not yet received market authorisation in the US and are facing enforcement action by the FDA.4348

JTI has been selling disposable e-cigarettes in the US since acquiring the Logic brand in 2015.2049 However it was not until 2022 that BAT and PMI launched new disposable products, within two months of each other: Vuse go and Veeba.

BAT’s VUSE Go

BAT launched its “disposable” e-cigarette under the VUSE brand in the UK in May 2022. It was marketed in fruit, mint and tobacco flavours, and sold “at a premium price”.50 BAT stated that this was its “fastest concept to market delivery to date.”51

PMI’s VEEBA/ VEEV Now

According to Euromonitor data, US company Kaival Brands held a similar share to EVO in 2021 (1.6%).43 In July 2022, PMI signed a deal with a newly established Kaival subsidiary to develop and market PMI’s VEEBA disposable product outside the US, initially in Canada.52534454 In mid-2023, PMI rebranded VEEBA as VEEV NOW.55

According to market analysis in Tobacco Reporter the value of the global disposable market was estimated to be $6.34 billion in 2022 and projected to triple in the next 10 years.44 It is likely that increased sales of single use e-cigarettes will also impact the market for other nicotine products.4756

Imperial’s blu bar

Imperial launched its blu bar disposable for the UK market in November 2022, only a few months after PMI and BAT launched theirs, to “meet the rapidly growing demand in this category”57

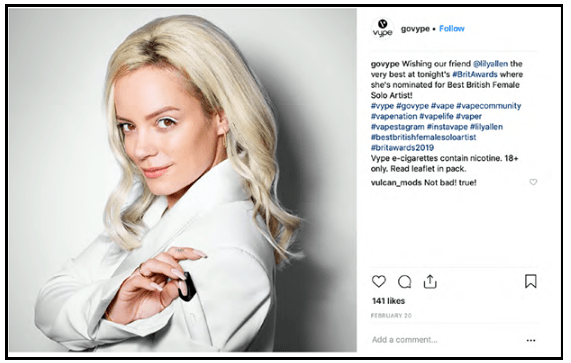

Image 2: UK Singer Lily Allen paid by BAT to promote Vype on social media, triggering complaints to the UK Advertising Standards Authority (Image source: PR Week58)

According to analysis in Tobacco Reporter the value of the global market for single use “disposable” products was estimated to be $6.34 billion in 2022, and projected to triple in the next 10 years.44 It is likely that increased sales of single use e-cigarettes will also impact the market for other nicotine products.4759

- For more information see E-cigarettes: Tobacco Company Interests in Single Use Products

Marketing Strategies

Tobacco companies use a wide range of marketing tactics to promote their products, ranging from traditional media advertising, price promotions and point of sale displays. However, as e-cigarette advertising has become more restricted companies have been forced to become more creative. Pop-up stores and events, music festivals and collaborations with artists (see Image 2) and designers have all been used to help market e-cigarettes, with widespread online promotion via social media, paid celebrities and influencers.5860 This has led to the companies being criticised for targeting young people, rather than adult smokers looking to quit.58616263

The same criticism has been levelled at JUUL Labs. In September 2018, the US Food and Drug Administration (FDA) wrote to JUUL Labs, Fontem Ventures (Imperial), Altria, Reynolds American Inc. (RAI) and JTI, giving the companies 60 days to provide a written plan to “address the rate of youth use” of their products.64

E-cigarette Regulation

Regulation of e-cigarettes varies widely across the world, from full bans (e.g. India); only being available on prescription (e.g. Australia); and to being freely sold as a consumer good (e.g. Europe, US).

The Policy Scan Project, by the Institute for Global Tobacco Control (at Johns Hopkins University) tracks and reports regulatory approaches to e-cigarettes around the world.

The Global Centre for Good Governance in Tobacco Control (GGTC) also publishes information on e-cigarette regulation.65

For detailed, up to date information at country level, see the searchable database on the Tobacco Control Laws website, published by the Campaign for Tobacco Free Kids (CTFK).

For countries that are parties to the WHO Framework Convention on Tobacco Control (FCTC) progress towards implementation of relevant articles, including newer products, is detailed in the FCTC implementation database.66

Information on current e-cigarette regulation can also be found on relevant pages of government websites (see Relevant Links below). See this page for information on the situation in 2014, when there was little regulation in place.

Lobbying Regulators

Article 5.3 of the World Health Organization Framework Convention on Tobacco Control (WHO FCTC), designed to protect public health policies from commercial and other vested interests, applies to the whole tobacco industry irrespective of the type of products they are attempting to sell. Tobacco companies are spending considerable amounts of time, effort and money lobbying decision-makers concerned with laws and regulations around e-cigarettes.67

As with lobbying on tobacco products, tactics include:

- Direct lobbying of politicians and policy makers in formal meetings.6869 See for example the UK All-Party Parliamentary Group for Vaping (E-Cigarettes)

- Submissions to government consultations.70717273

- Meetings and discussions at political and ‘social’ events (sometimes sponsored by tobacco companies).7475

- Employing professional lobbyists.76

- Setting up and joining existing trade associations, to lobby on companies’ behalf.7778 See also The UK Vaping Industry Association (UKVIA) and other E-cigarette Trade Associations with Tobacco Industry Members.

- ‘Astroturfing’ – setting up fake grass roots campaigns.79 See for example Imperial Brands’ use of the EU Citizens’ Initiative.

Can E-cigarettes Help Advance Public Health?

Globally, there is an ongoing debate about whether e-cigarettes are a threat or an opportunity to public health. Some public health experts believe that e-cigarettes are an essential alternative to smoking tobacco that can help smokers quit. Others argue that e-cigarettes could be a route into nicotine addiction and point out that their long-term safety has not yet been proven. There are also those that believe that e-cigarettes may offer public health benefits but that e-cigarettes should be regulated, particularly when it comes to the marketing of such products.

While acknowledging that there are many unknowns about e-cigarettes and that these products are not harmless, many experts in tobacco control and public health will agree that vaping e-cigarettes is less harmful to the health of an individual smoker than smoking cigarettes. For e-cigarettes to have a positive impact on population-level health, a significant number of smokers need to switch completely to e-cigarettes (so not dual-using these products with cigarettes), and the product cannot act as a ‘gateway’ into nicotine addiction for youth and non-smokers, or undermine existing proven tobacco control measures. The difficulty is that a growing share of the global e-cigarette market these days is held by the tobacco industry, which has a history of using newer products to stem the decline in cigarette sales and promote these products to any potential customer.8081

What the Industry Says: It’s All About Harm Reduction

The tobacco industry has long argued that products like e-cigarettes should be made easily available to smokers, to offer them a ‘less harmful’ alternative to smoking.82 In its 2018 “Next Generation Products” report, Imperial wrote that particularly e-cigarettes (or ‘vapour products’ as they refer to it) were creating “…a huge global public health opportunity”.83 BAT, somewhat misleadingly, claimed that there is ‘growing scientific consensus’ on the issue. In its 2018 Sustainability Report, the company stated:

“There is growing consensus among public health bodies and academics that vapour products e-cigarettes can have a significantly reduced risk profile compared to smoking. Public Health England in the UK estimates these products are ‘95% less harmful than smoking’… Other third-party science and research supporting the significantly reduced-risk potential of vapour products continue to grow”.84

A study by researchers from the University of Bath’s Tobacco Control Research Group found that these products, and the associated harm reduction narrative, serve to “…‘renormalize’ an industry that is determined to be seen as a responsible business with a legitimate product…”.82 The study also found that the products and narrative are used as tools to initiate dialogue with scientists, public health experts, politicians and policy makers, re-framing themselves as ‘part of the solution’ rather than being the problem.82 Therefore, the tobacco industry is using e-cigarettes and other newer products as a way to try and re-enter the policy arena from which it has increasingly, and successfully, been excluded in line with Article 5.3 of the WHO Framework Convention on Tobacco Control.

What Industry Documents Show: It’s All About Profit

Despite positioning itself as ‘the solution to the tobacco problem’ it is worth noting that the core of the global tobacco industry’s business remains unchanged. E-cigarettes only form a tiny percentage of their work and will do so for the foreseeable future.4 Tobacco company presentations to investors show that cigarettes remain central to the tobacco business, and the main driver for growth.858687 At its 2019 Annual General Meeting PMI’s CEO Andre Calantzopoulos said that, while stating that newer nicotine and tobacco products are increasingly complementing its cigarette business, the company was “committed to maintaining leadership of the cigarette category” and that it would be “focusing innovation on fewer, more impactful cigarette initiatives that can be deployed swiftly in any market”.88 Similarly, BAT’s CEO Jack Bowles told investors in August 2019: “Our combustible business continues to drive the financial performance of the group and we are performing well”.89 In February 2021, during the Covid 19 pandemic, Bowles’ message was much the same:

“I’m really happy with the resilience demonstrated by our combustible business throughout the year, which has shown its ability to deliver whatever the environment.”90

Profits from e-cigarettes are seen as additional to tobacco companies’ core business, and not simply replacing revenue lost from falling sales of cigarettes.91 In a July 2018 question and answer session, Imperial‘s then CEO Alison Cooper talked about ‘vapour consumption’ and told her audience that “a lot of the time it’s actually also adding to the nicotine consumption in the market. it’s not a question of shifting to NGP, then that comes straight out of the combustible tobacco consumption because we are seeing nicotine market growth in the UK, for example”.92

Similarly, in October 2018, BAT reported that the nicotine consumer pool had started growing in 2013 – when the tobacco industry had started investing in e-cigarettes.93

- See also: E-cigarettes: British American Tobacco.

Imperial continues to develop tobacco products to appeal to both non-smokers, and those who smoke and use e-cigarettes (‘dual’ or ‘poly’ users). It launched its ‘Riverside’ brand of rolling tobacco in the UK in October 2018.9495 According to Talking Retail, Imperial described it as:

“a high-quality, easy-to-roll blend of tobacco at an affordable price, designed to appeal to new smokers as well as dualists”.96

PMI announced that in 2020, during the Covid 19 pandemic, it launched 68 new “combustible” (cigarette) products, an increase on the number launched the previous year. Despite this, it claimed “responsible stewardship” as the “market leader driving the obsolescence of the category”.97

WHO Urges Caution

In March 2019, the Secretariat of the WHO FCTC issued an Information Note which compiled all Conference of the Parties (COP) decisions related to e-cigarettes.

A few months later, the Secretariat released a statement urging governments to remain vigilant, stating that:

“novel and emerging nicotine and tobacco products…are creating another layer of interference by the tobacco industry and related industries, which is still reported by Parties as the most serious barrier to progress in implementing the WHO FCTC”.98

It also reminded Parties of their obligations under Article 5.3 to protect tobacco control policies and activities from all commercial and vested interests.98

TobaccoTactics Resources

- E-cigarettes: The Basics

- E-cigarettes: British American Tobacco

- E-cigarettes: Lorillard

- E-cigarettes: Imperial Brands

- E-cigarettes: Japan Tobacco International

- E-cigarettes: Philip Morris International

- E-cigarettes: Altria

- E-cigarettes: Tobacco Company Interests in Single Use Products

- E-cigarette Trade Organisations With Tobacco Company Members

- Newer Nicotine and Tobacco Products: Tobacco Company Brands

- The list of all pages on e-cigarettes.

- Product Terminology

Relevant Links

- World Health Organisation (WHO): Tobacco – Electronic Nicotine Delivery Systems (ENDS)

- Global Center for Good Governance in Tobacco Control (GGTC): ENDS

- European Commission (EC): Electronic Cigarettes

- United States (US) Federal Drug Administration (FDA): Vaporizers, E-Cigarettes, and other Electronic Nicotine Delivery Systems (ENDS)

- The Institute for Global Tobacco Control: E-cigarette Policy Scan

TCRG Research

- Tobacco industry messaging around harm: Narrative framing in PMI and BAT press releases and annual reports 2011 to 2021, I. Fitzpatrick, S. Dance, K. Silver, M. Violini, T.R. Hird, Frontiers in Public Health, 18 October 2022, doi:10.3389/fpubh.2022.958354

- Understanding the emergence of the tobacco industry’s use of the term tobacco harm reduction in order to inform public health policy, S. Peeters, A.B. Gilmore, Tobacco Control, 2015;24:182-189, doi:10.1136/tobaccocontrol-2013-051502

- E-cigarettes: threat or opportunity?, A.B. Gilmore, G.E. Hartwell, European Journal of Public Health, 2014, 24(4):532-3. doi:10.1093/eurpub/cku085

For a comprehensive list of all TCRG publications, including TCRG research that evaluates the impact of public health policy, go to the Bath TCRG’s list of publications.