Promotion of Newer Products Around The UK Menthol Ban

This page was last edited on at

Tobacco companies used harm reduction as a strategy to achieve their business objectives. In advance of the menthol ban in the UK, they promoted their newer nicotine and tobacco products: heated tobacco products (HTPs), e-cigarettes (electronic nicotine delivery systems, ENDS) and nicotine pouches.

- For more background, and other types of interference in the run up to the ban, see Menthol Cigarettes: Industry Interference in the EU and UK.

Philip Morris

A leaked Philip Morris International (PMI) document from 2014 indicated that it opposed flavour bans and identified the European menthol ban as a threat to its business.1 However, in a presentation in February 2020, it stated that the ban was “not expected to have [a] significant impact”.12 CEO Andre Calantzopoulos said that, while menthol accounted for 10% of consumption in the region, this was in fact an “opportunity” for PMI’s heated tobacco product IQOS, as its tobacco sticks (HEETs) were not covered by the ban.3 In early 2020, Philip Morris actively promoted IQOS as an alternative to menthol cigarettes, to retailers and to consumers.4567 IQOS is more profitable for PMI than its cigarettes.8

Philip Morris has only a small market share of the UK cigarette market. Nevertheless, Philip Morris Ltd (PML) set up two websites: menthol-ban-retail.co.uk (aimed at retailers) and menthol-ban.co.uk (aimed at consumers). The consumer-facing website advocated three options for current menthol smokers: to “quit”, “heat” or “vape”.9 It also contained market research data, commissioned by PML, stating that, while 15% of smokers would try to quit in response to the ban, over 50% would consider switching to HTPs “once made aware of this option”. While this site mentioned the NHS stop smoking service, and provided a web link, this appeared as a small “disclaimer” at the bottom of the page.9 From Philip Morris’ communications with retailers, it appears that the HTPs it referred to were PMI’s own product IQOS, and that its survey participants were shown the device.710

Market research conducted in the UK in 2020 found very different figures from PML. A survey by HIM & MCA, reported in retail publication Convenience Store in May 2020, found that only 6% of menthol smokers said they would switch to menthol HTPs, with 16% likely to opt for e-cigarettes.11 Another survey by e-cigarette retailer Vape Club produced similar results to HIM/MCA; 39% of UK menthol smokers intended to stop using tobacco products, with 18% planning to switch to e-cigarettes, and 15% saying they would quit use Nicotine Replacement Therapy (NRT) or no product. Assuming no other products, this would mean that only 6% intended switch to HTPs, the same figure arrived at in the HIM & MCA survey.1112 Both organisations surveyed 1,000 UK menthol smokers, but as of May 2020 no public health survey data was available to confirm these figures. The 2016 ITC survey found that just over 15% of menthol smokers in the UK intended to quit in response to the ban, close to the EU average of 16%.13

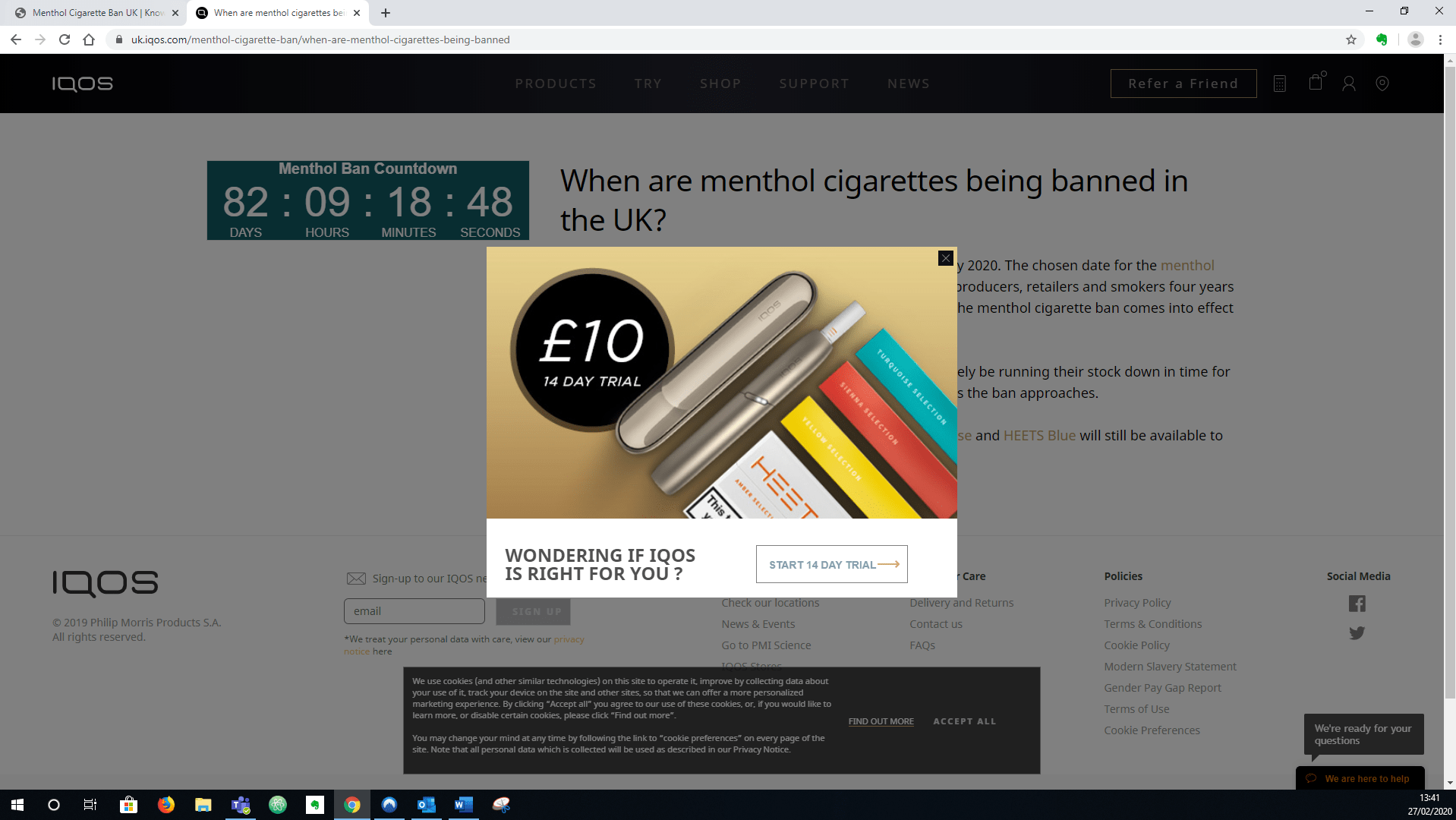

Figure 1: Screenshot of UK IQOS website, February 2020.14

Philip Morris also set up a page on its UK IQOS website, containing information about the ban, including a link to an EU trade factsheet.1415 The page features a “Menthol Ban Countdown” clock; tells customers that “small retailers like corner shops and news agents will likely be running their stock down in time for the ban, so it may become harder to find menthol cigarettes”; and provides links to buy two HEETS menthol products directly from its website.14 In February 2019, a pop-up offered a trial of IQOS (see figure 1).14 Retailers were also given material on IQOS to hand out to customers.11

In PML’s communications with retailers, it appears that the HTPs it referred to were its own product, IQOS, and that survey participants were shown the device.716

In an article published in the trade magazine Talking Retail in mid-March 2020, representatives of PML warned shop owners that they would lose customers and money due to the ban, pointing to a “financial impact calculator” on their menthol ban retail website. An average figure of £13,500 per year was quoted, representing loss of cigarettes sales plus the value of other “basket” items bought at the same time. No evidence was provided in this article to explain how PML had reached this estimate. At the same time the company promoted IQOS starter kits, saying that this was “a massive opportunity for retailers to say to smokers there’s still a product that’s closer in experience to cigarettes”.7 PML suggested that retailers could register on its website to access these kits, and that this was where they would be able to find information about the company’s buy-back scheme for unsold menthol cigarettes.717

Retailers were also offered a series of financial incentives to stock IQOS, through its “Heetwave Open” programme. An e-mail sent from PML to retailers in early May 2020, encourage them to “Sign up and earn £170+”.18 In addition to free HEETs products and money for registering sales of IQOS kits, they were offered money for completing quizzes, watching promotional videos, and uploading images of point of sale material.18 According to the Bureau of Investigative Journalism, PML also hired sales representatives to promote IQOS directly to convenience stores, as part of its efforts to reach a target of a 400% increase in sales of IQOS and HEETS in 2020.19 PML continued to promote IQOS as an alternative to menthol cigarettes after the ban.20 In 2021, it combined menthol with other flavourings in its Mauve HEETS variant, which PML described as “a crisp menthol blend with a taste of dark forest fruits”.21

Since the menthol ban PMI have withdrawn their Nicocigs and IQOS Mesh e-cigarettes from sale in the UK, along with Veev liquids. For more on PMI’s newer IQOS VEEV e-cigarette, yet to be launched in the UK as of November 2021, see E-cigarettes: Philip Morris International

Japan Tobacco International

Japan Tobacco International (JTI) set up a menthol ban section on its retailers’ website (jtiadvance.co.uk), which was promoted in the retail press.222324

This trade website also contained information for consumers, recommending JTI’s newer nicotine products, with links to websites selling its Logic e-cigarettes and Nordic Spirit nicotine pouches.2224 It also warned consumers against turning to illicit tobacco.24

Imperial Brands

Imperial Brands, while not setting up specific web pages, offered advice to retailers in the UK trade press.25 Imperial’s Corporate Affairs Director, Duncan Cunningham, in Talking Retail, linked the ban to potential sales of roll-your-own (RYO) products:2526

“As a result of the forthcoming changes, we may see some menthol smokers shift into buying RYO products, especially given the arrival of recent product innovations, such as Rizla Polar Blast crushball tips, that will help them continue with their flavour of choice.”

Cunningham also suggested that retailers should increase their stock of the company’s blu e-cigarette, including its nicotine salt e-liquids to “help heavy smokers switch”.2526

British American Tobacco

British American Tobacco (BAT) promoted its e-cigarette Vype in the retail press before the ban, and launched new mint e-liquid flavours.272829

European websites

Similar dedicated menthol web pages appeared in France for IQOS from PMI, Vuse from BAT and Logic from JTI. CNTC suggests these were marketing sites rather than information sites.30

TobaccoTactics Resources

- Menthol Cigarettes: Industry Interference in the EU and UK

- Flavoured and Menthol Tobacco

- Product Innovation

- Newer Nicotine and Tobacco Products

Relevant Links

- Menthol tobacco companies are exploiting loopholes in the UK’s characterising flavours ban, S. Dance & K. Evans-Reeve, Tobacco Control blog, May 2021

TCRG Research

- Tobacco industry tactics to circumvent and undermine the menthol cigarette ban in the UK, R. Hiscock, K. Silver, M. Zatonski, A. Gilmore, Tobacco Control, 18 May 2020, doi:10.1136/tobaccocontrol-2020-055769

For a comprehensive list of all TCRG publications, including research that evaluates the impact of public health policy, go to the Bath TCRG’s list of publications.