Nicotine Pouches

This page was last edited on at

As the harms from conventional products have become better understood, and tobacco control measures have been put in place, the cigarette market – from which tobacco companies make most of their profits – has started to shrink. To secure the industry’s longer-term future, transnational tobacco companies (TTCs) have invested in, developed and marketed various newer nicotine and tobacco products, including in low and middle-income countries (LMICs).1

Since the early 2000s TTCs have developed interests in e-cigarettes (also known as electronic delivery systems, or ENDS), heated tobacco products (HTPs), snus and nicotine pouches. Companies have referred to these types of products as ‘next generation products’ (NGPs) although terminology changes over time.

- See the product terminology page for more details, including terms favoured by the industry.

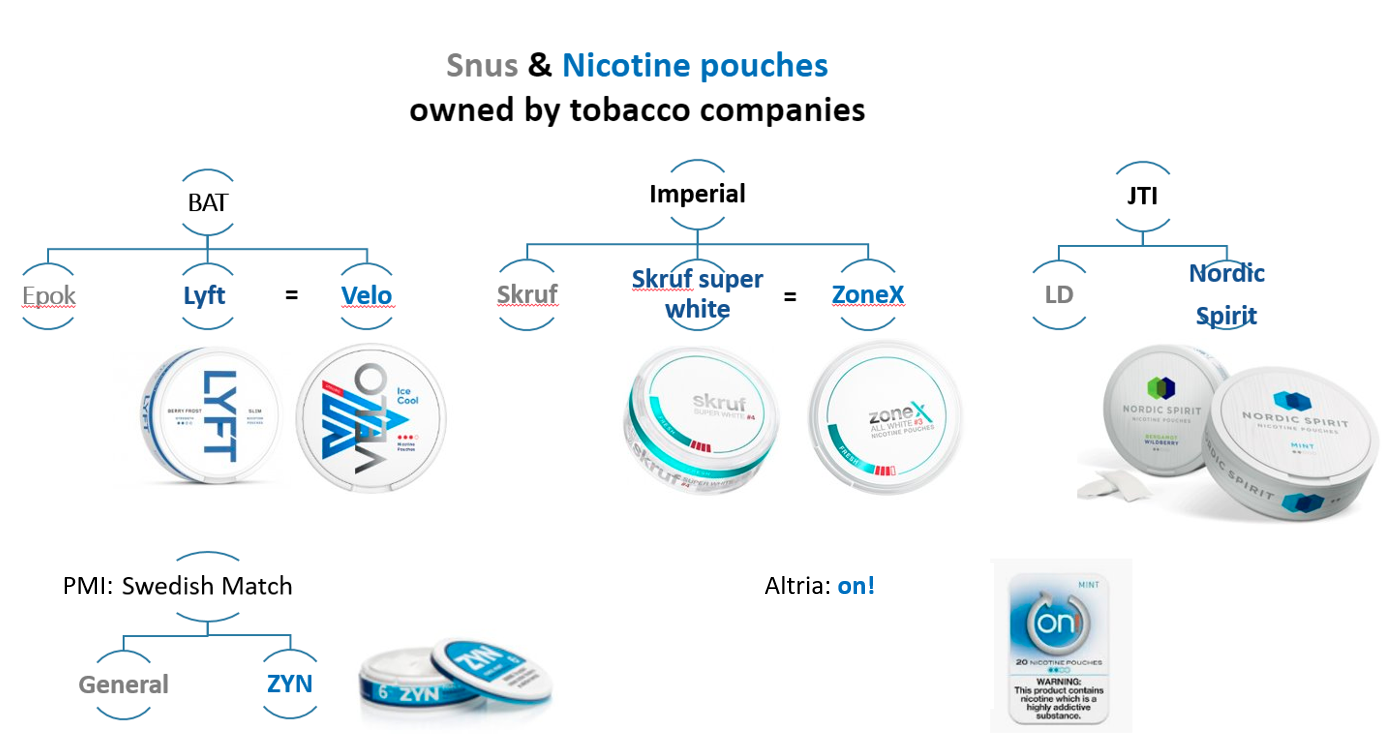

All of the ‘big four’ TTCs (PMI, BAT, JTI, Imperial Brands) have invested in Swedish-style snus and related products called nicotine pouches, which they have promoted as part of their harm reduction strategies.

Background

Nicotine pouches are similar to snus pouches as they are made to be placed between the lip and gum, and do not require spitting. However, nicotine pouches do not contain fresh tobacco leaf but a form of dehydrated nicotine that does not need to be kept cold.2 The pouches also generally contain plant fibres, flavourings and sweeteners.3 Nicotine is absorbed into the bloodstream via the mucous membranes in the mouth.23 They are not new products and similar oral pouches with contents other than nicotine have been available in Sweden for many years, regulated as food.3

TTCs have identified opportunities to market these products in countries where there is either an existing market for snus, or conversely in markets where tobacco snus is currently banned.2

Researchers have cautioned that nicotine pouches in particular may appeal to youth and non-smokers, as they are often sold in a variety of fruit flavours, in attractive packaging, and can be used discreetly (more so than e-cigarettes).24 They can also contain high levels of nicotine where unregulated.4

“Tobacco Free”

It appears that some nicotine pouches, may use synthetic, or “tobacco-free”, nicotine (rather than nicotine derived from tobacco leaf), creating confusion and uncertainty as to how best to regulate these products.2567

In its 2022 annual report, BAT states that its “current portfolio contains no synthetic nicotine”.8 PMI states that its pouches contain “nicotine derived from tobacco”.9 JTI and Imperial Brands do not refer to synthetic nicotine and describe their pouches as “tobacco-free”.10111213

In 2022, the UK independent scientific Committee on Toxicity (COT) noted in a discussion paper:

“the apparent variation in how manufacturers present nicotine content and strength across different products, which may be confusing for the consumer. In addition, use of the description ‘tobacco-free’ may be misleading as the nicotine may be derived from tobacco, which raises concerns regarding carry over of toxicologically relevant contaminants (e.g., metals and nitrosamines).”14

COT also raised concerns around the lack of specific regulations for nicotine pouches in the UK, and the absence of data other than that produced by the industry.14 COT planned to produce a full report for the UK government in autumn 2023.14

See below for more on regulation.

Figure 1: Images of nicotine pouch brands owned by the largest tobacco companies as of 2023. (Source: TCRG. Product images from company websites)

Cigarette Companies Investing in Nicotine Pouches

The interests of the four main TTCs are summarised below, as well as those of Altria which also sells nicotine pouches outside the US. PMI was the last to acquire this product through its purchase of Swedish Match in 2022.

British American Tobacco

In 2019, BAT introduced nicotine pouches to its portfolio, marketing them as Lyft in the UK and Velo in the US.151617 A July 2019 news report suggested that BAT’s nicotine pouches were also on sale in Sweden, Italy and Tanzania.18 BAT started promoting Lyft /Velo in “emerging markets” in LMICs (see below).

In November 2020, BAT announced that it had acquired US-based nicotine pouch company Dryft Sciences, via its subsidiary Reynolds American Inc. (RAI), with the pouches to be sold under the Velo brand.19 According to BAT this would give them a combined share in the US nicotine pouches market of around 10%.19

BAT distinguished Epok, Lyft and Velo from traditional snus and allocated them to a new product category, which it called “modern oral products”.15 In November 2019, it announced that it would consolidate its NGPs under fewer brand names, and all its “modern oral” products would be sold as Velo.20 It continues to market the product as Lyft in Sweden and Denmark.21 It also sells nicotine pouches under its Niconovum brand Zonnic in Sweden.22

BAT reported that it had sold 4 billion pouches worldwide in 2022, and held 69% of the market in Europe, although sales in the US had declined since 2021.823 It also referred to an estimate that the global nicotine pouch market would grow by 500% by 2026, and referred to the launch of new products ranges called Velo Mini and Velo Max.8 In 2023, BAT said that Velo was leading the market outside of the US and contributing to revenue growth.

In 2024 BAT reported that it had opened a new “innovation centre” in Southampton, UK, to focus on the development of nicotine pouches.

- For information on BAT’s other nicotine products see Newer Nicotine and Tobacco Products: British American Tobacco

Japan Tobacco International

Japan Tobacco International sells its Nordic Spirit brand of nicotine pouches, mainly in Europe.2425 In its 2020 integrated report Japan Tobacco stated that the pouch was sold in nine countries, and that it held 70% of the UK market.2627 In 2021, it said that it “prioritized Sweden, Switzerland and the UK”.28 In 2022, JTI announced that it had test-launched Nordic Spirit in the Philippines and was planning to launch a new “formula” in the UK.11 In 2023, new strong and extra strong spearmint flavoured pouches went on sale in the UK, to meet the “demand for stronger variants”.29 According to the Nordic Spirit website its extra strong pouches contain 11mg per pouch (17mg per gram).30

JTI also refers to its nicotine pouches as “modern oral” products.

- For information on JTI’s other nicotine products see Newer Nicotine and Tobacco Products: Japan Tobacco International

Imperial Brands

In May 2018, Imperial Brands announced that it had launched a version of its snus brand Skruf without tobacco leaf, called Skruf Super White, intended for sale in Sweden and Norway.31 This product appears to have been rebranded as zoneX for the UK market in August 2019, however its direct sale in the UK was later discontinued.323334 35 In 2022 Imperial’s website stated that in 2021, ZoneX had “first launched in Sweden and Austria”, further launched in “Norway, Denmark and Estonia” in 2022 and finally made available in “Iceland and duty-free Middle East” in 2023.1213

In 2020, IMB had previously published an article on its Imperial Science website exploring what it described as “The Tobacco-Free Nicotine Pouch Opportunity”.36They later said they had launched a “cutting edge bamboo fibre based product”.37

Imperial’s website describes ZoneX users as:

“young adult nicotine users, typically 25+, urban and open-minded. They’re making lifestyle changes and favour a discreet way to enjoy nicotine.”13

In 2023, Imperial acquired several nicotine pouch brands from Canadian company TJP Labs, to market in the US.38

Altria

In 2019 Altria announced that it was acquiring an 80% share in oral nicotine pouch on! from Swiss tobacco company Burger Sohne.3940 It set up a new subsidiary Helix Innovations, through which it would manufacture and market the product.3940 Altria stated that, as on! was already on sale across the US before August 2016, it did not require pre-market authorisation from the US Food and Drug Administration (FDA).39 However, by mid-2020 it had submitted 35 Pre-Market Tobacco Product Applications (PMTA) for on!, it was sold in 40,000 US stores, and Helix was increasing manufacturing capacity.41 According to Altria, by the end of 2020 the number of stores selling on! had nearly doubled.42 A 2020 investor transcript reported that the product was “attracting female tobacco consumers due to its spitless, white and compact format” and accounted for 30% of this type of oral nicotine product.43

In 2021, Altria acquired the remaining 20% of on!.44 In 2022, it stated that it held over 20% of the UK nicotine pouch market, although the category was “increasingly competitive”.45 It also stated that Helix operates internationally, although most of its oral products are sold in the US.45 As of February 2023, the FDA had not issued marketing order decisions for any on! products.45

Philip Morris International

At the beginning of 2021, PMI did not have a nicotine pouch product on the market. However, in a presentation to investors in February that year, the company noted the “attractive economics” of this small, but growing, product category.46 CEO Andre Calantzopoulos said PMI was planning to develop a product through a “combination of partnerships and internal development”.47

In May 2021, PMI acquired Danish snus manufacturer AG Snus, manufacturer of Shiro nicotine pouches.4849 For more details see Cigarette Companies investing in Snus.

In July 2021, PMI announced that it had acquired Fertin Pharma, a company specialising in nicotine replacement therapy (NRT) type products.50 At this time, PMI also began referring to gums and nicotine pouches as “modern oral” products, as BAT and JTI do.50

- For more information see: Tobacco Company Investments in Pharmaceutical & NRT Products

At this time, PMI began referring to gums and nicotine pouches as “modern oral” products (as does BAT).50

In 2022, PMI acquired Swedish Match.51 Swedish Match specialises in snus and nicotine pouches, and does not sell cigarettes. By 2023, Shiro nicotine pouches were presented on the PMI website, along with snus, as “oral smokeless products”.52 Its nicotine pouch Zyn has been sold mainly in Sweden and some other European countries, as well as the US (since 2015).53 It also sells the Volt Pearls product in Denmark, Iceland and Sweden.9

- For more information see Newer Nicotine and Tobacco Products: Philip Morris International and Swedish Match

In its 2022 annual report, PMI stated that the Zyn trademark had an “indefinite life due to the fast growth and the leading position of the brand in the market”.9

The Global Market

According to a Tobacco Reporter article published in 2024, Euromonitor International values the global market at over US$10 billion and projects it to reach US$15 billion by 2027.54 Nearly 15 billion units were sold in 2023, but they remain a small part of the market.54

In 2023, Euromonitor analysts noted that in the US, there were over US$8.5 billion of retail sales and nearly 3% of the population uses pouches. However, the most rapid increase in sales in 2023 was in Pakistan where BAT markets Velo (see below), and they expect most growth going forward to be in Asia Pacific and Eastern Europe.54 They also noted that most pouches were sold in the US in 2023, the other top five markets (Sweden, Denmark, Pakistan and Austria) between them sold less than a third of the units sold in the US market.54 Other nicotine pouch markets include UK, Germany, Poland, Czech Republic, Uzbekistan, Ukraine and Indonesia.5455

PMI’s purchase of Swedish Match immediately gave it a 60% share of the global market in 2022, a jump from almost zero in 2021. BAT held around a sixth of the global market, and Altria and Swisher (a US-based tobacco company which also sells cigars, snus and snuff, and other nicotine products)56 each held around a twelfth share.57 The global market shares of other companies, including JTI and Imperial Brands, were negligible.

- For information on TTC interests in tobacco leaf snus see Cigarette Companies Investing in Snus.

Regulation of Nicotine Pouches

Nicotine pouches are subject to a variety of regulations around the world, from outright bans to partial or selective regulation, depending on how they are defined and classified by governments. In many cases no regulation is in place. The Institute for Global Tobacco Control (IGTC) tracks and reports regulatory approaches around the world (see below).58 Although not all countries contribute to its Policy Scans for nicotine pouches, the most up to date information available on the IGTC database at the time of writing is referenced below.

In the UK, as of 2023, nicotine pouches are regulated under general consumer product safety regulations, not as tobacco products. They are widely available in shops and online.145859 Concerns have been raised over their availability to youth, and social media marketing.146061 The UK Department of Health and Social Care stated that it was aware of concerns, but as the use of pouches was low (in England) it did not plan to introduce further regulation at this time.61

European Union

While there is an EU-wide ban on tobacco snus, nicotine pouches are not covered by current tobacco product regulations. This is subject to review in the next revision of the Tobacco Products Directive.6263 It is however important to note that individual member countries are diverging in the way they regulate these products.

Sweden has an exemption from the EU ban on snus.63 In Sweden, pouches containing products other than tobacco and nicotine have long been regulated as food items.3 Zonnic oral pouches (owned by RAI from 2009,64 and BAT from 2017) were registered as an over-the-counter (non-prescription) drug in 2013, but only available from pharmacies and other regulated outlets.65 There are a range of nicotine replacement therapies (NRT) products registered under the same brand name (see below). In 2019, the Swedish National Food Administration advised that nicotine pouches should now not be regulated as food, as they were intended to be spat out and the contents were mostly absorbed through the mouth, not the stomach.3

Elsewhere in Europe regulation varies widely. In France nicotine is classified as a poisonous substance, subject to regulation, but pouches can be regulated as a medicine for cessation purposes.58 In Finland nicotine pouches are no longer classified as medicines, unless marketed as such.66 In Norway (not in the EU but a member of the European Economic Area) a total ban on nicotine pouches and other newer products was lifted in July 2021, and replaced by a market approval scheme.6768 Both tobacco-derived and synthetic nicotine pouches are regulated, but advertising and sponsorship are banned.58

In contrast, in March 2023, Belgium announced a total ban on nicotine pouches, by royal decree.6970 BAT were reported to be petitioning the courts to annul the decree.71 The Netherlands announced a ban a month later.7273

In 2021, the German Office of Consumer Protection and Food Safety (BVL) stated that nicotine pouches were not regulated under either the tobacco legislation or as foodstuffs and so could not be legally sold.74 BAT removed its nicotine pouches from the German market that year.74 Some federal states have withdrawn pouches, and some products have been classified as a health hazard due to high levels of nicotine.58

North America

In the US, nicotine pouches are regulated by the FDA and subject to age restrictions, a nicotine health warning and pre-market assessment .63 There are also regulations specific to synthetic nicotine.75 Nicotine pouches are freely available to consumers.53 US researchers have noted a “loophole”: as nicotine pouches were not included in the smokeless tobacco regulation, companies are able to advertise nicotine pouches on radio, TV and other media.76

Initially the Canadian government did not authorise the sale of nicotine pouches, and issued an alert, stating that as they had not been assessed by “safety, efficacy and quality” they might contain high levels of nicotine and be harmful to health.77 These products are now regulated, either classified as a ‘Natural Health Product’ or as a prescription drug, depending on the level of nicotine.58 In July 2023, Health Canada authorized the marketing of BAT’s Zonnic nicotine pouch (with 4mg of nicotine) as a natural health product.78798081 Physicians for a Smoke-Free Canada reported that this product contains the same ingredients as BAT’s Velo,80 and noted that:

“BAT will face very few restrictions on how it can market ZONNIC nicotine pouches in Canada, other than with respect to how it represents the therapeutic benefits of the product.”80

Australia & New Zealand

As with e-cigarettes and heated tobacco products, nicotine pouches are banned from sale in Australia, and only available on prescription.58

In New Zealand, oral tobacco products (including snus) and nicotine pouches are banned, unless approved as medicines.58 (E-cigarettes are regulated, but not banned)

New and emerging markets

In some low and middle-income countries, including Argentina, Bangladesh, Georgia, Indonesia, India, and Nigeria, only tobacco-derived products are regulated as tobacco products, but not those derived from synthetic nicotine.58 In others, including Brazil, Brunei Darussalam, Iran, and Thailand, both are regulated as tobacco products.58 In Ukraine there are no specific regulations in place, but synthetic nicotine pouches are regulated as a food product.58 Mauritius bans both,58 whereas in Uruguay, nicotine pouches are categorised as a form of nicotine replacement therapy (see below).58

At the time of writing, July 2023, nicotine pouches remain unregulated in most countries.58

As researchers from Norway, among others, have pointed out:

“The boundaries between various tobacco and nicotine products are getting less clear, making it possible for the tobacco and nicotine industries to take advantage of the discrepancies in regulation.”4

- The Policy Scan Project, by the Institute for Global Tobacco Control (at Johns Hopkins University), which tracks and reports regulatory approaches to nicotine pouches around the world.

- For information on tobacco regulation more broadly, see the Tobacco Control Laws website, published by the Campaign for Tobacco Free Kids (CTFK).

- For countries that are parties to the WHO Framework Convention on Tobacco Control (FCTC) progress towards implementation of relevant articles, including newer products, is detailed in the FCTC implementation database.82

BAT Promoting Nicotine Pouches in LMICs

BAT began marketing Lyft in Kenya in 2019, and Pakistan in 2020. In 2021, BAT said that it was also test marketing its product in Bangladesh and Indonesia.83 and “consumers are familiar with other similar oral products”.84 The company has identified an opportunity to market these products in countries where electronic devices are less popular, affordable, or available due to regulatory restrictions. It also referred to markets where there is was a “pre-existing ritual of oral product consumption”.8384

Kenya

After announcing its intention to sell nicotine pouches in Kenya, BAT launched Lyft in the country in December 2019.188586 In February 2020, the company announced that it was planning to build a new factory in Nairobi to produce nicotine pouches, and for Kenya to become a regional export hub for the product.87 BAT Kenya (BATK) managing director, Beverley Spencer-Obatoyinbo said that “Given the high incidence of oral stimulant use among smokers, we believe that this new product category will provide a viable alternative to smoking”, although she presented no evidence at the time to support this statement.87

In response to concerns about the potential impact on tobacco farmers, Business Daily Africa reported that BATK’s head of legal and external affairs stated that the company was “using proceeds from the tobacco portfolio to invest in the new categories. When the time comes, we will help them (farmers) transition to sustainable crops,” although this was “not a change that can happen overnight”.88 Spencer-Obatyoinbo confirmed that BAT switching to “non-combustibles” was “not an immediate thing”.88 Nevertheless, in September 2020, BAT was reported to be lobbying the Kenyan Revenue Authority (KRA) for a tax break for the product, citing its large investment and potential exports.89 (According to BAT the nicotine for its pouches is currently manufactured in Switzerland.)89 The Chief Executive of the International Institute for Legislative Affairs argued that this would be a “huge setback for tobacco control interventions in Kenya”.90 For more information see the Kenya country profile page.

Nicotine pouches were initially registered as a pharmaceutical product by the Kenya poisons board.91 This designation was challenged by local advocates.91 Health Cabinet Secretary Mutahi Kagwe wrote to the poisons board, arguing that the product had been wrongly designated, and stated that it was being distributed via vending machines in contravention of the law.9192 Although Lyft was de-registered and effectively banned, there was a reported lack of enforcement and the product was found to still be on sale in December 2020.9293 In February 2021, the Kenyan government said that it was intending to classify nicotine pouches as a tobacco product under the Tobacco Control Act, making the product subject to similar marketing restrictions as cigarettes and other tobacco products.92 Concerns have been raised in Kenya over potential use by children (see below).

In February 2021, BAT told investors that “In Kenya, we have temporarily suspended sales due to local regulatory challenges and continue to engage with the local authorities.”83 In March it told the Kenyan media that it was planning to spend Kenya Sh1 billion (US $10 million) on marketing Lyft once the product was approved.94 This included plans to set up distribution networks across 21 countries in the Common Market for Eastern and Southern Africa (COMESA).94

In 2022, BAT’s nicotine pouch was back on the market in Kenya, as Velo.95 In its annual report, BAT stated it had “reintroduced Velo to a limited retail universe with positive early momentum, as we focus on driving guided trial.”8

The introduction of Velo has not been without controversy, and politicians in Kenya are again asking for the product to be banned. Letters between BAT and the Kenyan Ministry of Health reveal that BAT had lobbied to reduce the size of warning labels on the product.96

BAT has also lobbied against increased taxes on these products.979899

Pakistan

Velo was launched by BAT in Pakistan in December 2019, with a campaign run by Ogilvy Pakistan “positioned towards affluent adult consumers”.100101102

A Freedom of Information Request submitted by Bath TCRG revealed that UK High Commission staff in Pakistan had attended a “social event” for Velo in February 2020. The FOI stated that “They were invited by the event coordinator and did not meet any Velo representatives at the event.”103

- British diplomats have previously been associated with lobbying by BAT in Pakistan, and other LMICs. See the page on UK Diplomats Lobbying on Behalf of BAT

BAT said it was “particularly proud of Velo’s performance in Pakistan”. 23 In its 2022 annual report, BAT stated that Pakistan was its third largest market for nicotine pouches. It said that the market was “enabled by powerful, consumer-centric digital activations”, and that it was selling over 40 million units a month.8 These sales figures, and rapid growth, are roughly consistent with Euromonitor’s estimates.57

South Africa

Unlike NRT products, nicotine pouches are not on the South African Health Products Regulatory Authority’s list of approved medicines, for which it would be subject to clinical trials and regular monitoring updates. Nicotine pouches are also not regulated as tobacco products because the nicotine is synthetic and does not fall under the definition of tobacco products in the Tobacco Products Control Act (2018). This means that they can be sold without health warnings and can be sold to those under the age of 18.104

South Africa is also one of the target markets for PMI’s ZYN nicotine pouches. 105

Indonesia

In February 2021, BAT referred to the test marketing of its nicotine pouches in Indonesia. BAT reported “encouraging results”.83 External statistics suggest the market remained small.57

Concerns Around Use by Youth

Researchers in the US have identified the risk of nicotine pouches appealing to non-smokers and in particular youth, as some products come in a range of fruit flavours and are more discreet than e-cigarettes.2106 As of 2024, PMI was facing a lawsuit for ZYN in the US on the basis of the product being addictive and harmful to young people. The lawsuit states that PMI is benefiting from the promotion of the brand on social media. 107The FDA has also issued warning letters and penalty charges to a number of retailers for the underage sale of flavoured ZYN nicotine pouches. As of April 2024, the FDA has not authorised the sale of ZYN products in the United States. 108109

Although they can only legally be sold to adults in the UK, concerns have been raised over potential use by children.14110

In 2020, there were reports that Lyft was being used by children in Kenya.87111 Children were also reported to be using the products in schools in Scotland.112

In February 2021, journalists from the Bureau of Investigative Journalism published an article describing how BAT used social media influencers to promote its nicotine pouches in multiple countries, including Australia, Kenya and Pakistan. The authors argued that this was part of a campaign targeted at young people, rather than older adults trying to quit smoking.113114115

An investigation by The Guardian newspaper in 2023 identified further promotion in the UK via social media and music events, as well as prize draws and the provision of free samples.61

BAT also promotes Velo through motorsport sponsorship.116117

- See Snus: Marketing to Youth for information on earlier tobacco company marketing of the tobacco leaf product.

Industry Alliance Lobbying in the EU

The ‘Nordic Nicotine Pouches Alliance’ (NNPA) was established in Belgium in 2020.118 As of March 2024, BAT and JTI are the only partners listed on the NNPA website.118

The NNPA webpage states “We engage, inform, and increase knowledge about nicotine pouches”.119 However, on the EU transparency register, its stated goal is to “focus on regulation concerning nicotine pouches within the European Union”, specifically the Tobacco Products Directive and the Tobacco Taxation Directive.120121 Jonas Lundqvist, NNPA CEO, is listed as the accredited lobbyist on the EU register.122120121 In 2022, the estimated cost of NNPA lobbying activities was listed as €400,000-499, 999, four times the amount listed in 2021.120121

NNPA also runs the online news platform ‘Pouchforum’.123 Articles published on the platform have accused the European Commission of misrepresenting the risk of nicotine pouches,124 and suggested that the Commission does not act in a transparent manner.125 The site editor is Robert Casinge, also ‘Senior Partner’ in the NNPA, and previously listed as a lobbyist on the EU register.121126

Framing Nicotine Pouches as NRT

TTCs appear to be framing their nicotine pouches as a nicotine replacement therapy (NRT), which is designed to help smokers quit.127128129 However, they are also marketing them as consumer products, including for use when it is not possible to smoke or use e-cigarettes, for example on a plane. 130131132

In 2016, researchers in the US pointed to the implications for both product regulation and smoking cessation,64 and the:

“blurring of the lines between cessation products and novel tobacco products and potentially confusion and misuse by consumers which may result in initiation or situational and dual use of tobacco products.”64

All four of the main transnational tobacco companies have conducted their own research on nicotine pouches, published on their science websites.

BAT markets Niconovum NRT products, in the US and Sweden under the brand name Zonnic; in Sweden, Zonnic products include nicotine pouches.22133134 In 2020, BAT also rebranded its Revel nicotine lozenge as Velo – the same brand as its nicotine pouch – in the US (and submitted it for pre-market approval). 135136

In its 2022 annual report, BAT stated that “[t]he weight of evidence suggest Modern Oral nicotine pouches have a profile that is comparable to nicotine replacement therapy products”. It cited BAT’s 2021 research on Velo, which compared snus, nicotine pouches and NRTs.8137 However, the 2022 report then went on to acknowledge “low levels of average daily consumption and high poly-usage”, leading BAT to submit a further PMTA for a “superior” product.8 As of February 2023, no Velo products had received pre-market approval in the US.8 At the time of writing, it was not yet clear how BAT planned to promote its Zonnic nicotine pouch after it was approved for sale over-the-counter in Canada in July 2023.787981

BAT’s science website presents its research on nicotine pouches, as well as a summary of the ‘Snus and the Swedish Experience’.138 For more background on this topic see The Swedish Experience.

PMI acquired Fertin Pharma in 2021, stating that Fertin was a “leading producer of Nicotine Replacement Therapy (NRT) solutions”.50 PMI has also referred to the “medical” or “pharmaceutical” grade nicotine in its products.9139 (Read more about on PMI’s acquisition of pharmaceutical companies.)

PMI’s science website presents its research on nicotine pouches.139 It does not refer to its snus products on these pages.139140141

Imperial Brand’s science website has cited evidence on tobacco-leaf snus and other next generation products (NGP)s to support its statement that “these products are more satisfying – and acceptable – to adult smokers than traditional nicotine replacement products (NRTs) like patches, lozenges, and gums”.36 However, the evidence it cites pre-dates the widespread sale of nicotine pouches by TTCs: the 2016 report from the Royal College of Physicians (RCP) refers only to Zonnic and does not discuss satisfaction of acceptability of the product.129

Imperial refers to its use of “high purity pharmaceutical grade nicotine”.36142 In May 2021, Imperial published its “comprehensive scientific assessment” of its nicotine pouches, in comparison to cigarettes.143

Japan Tobacco‘s science website does not feature nicotine pouches, although it includes its research on these products.144

Environmental Impact

The impact of cigarette filters on the environment is well documented. More recently, the impact of single use, or ‘disposable’, e-cigarettes has been highlighted

As the nicotine pouch market grows the disposal of these single use products is an emerging concern.145146

On its website, BAT states that the Velo plastic cans are being upgraded to use single polymer plastics in order to “align with the group’s ESG ambitions”. 147

TobaccoTactics Resources

TCRG Research

- S. Peeters, A. Gilmore, Understanding the emergence of the tobacco industry’s use of the term tobacco harm reduction in order to inform public health policy, Tobacco Control, 2015,24(2):182-189

For a comprehensive list of all TCRG publications, including TCRG research that evaluates the impact of public health policy, go to the Bath TCRG’s list of publications.